The Odd Molly International (STO:ODD) Share Price Is Down 91% So Some Shareholders Are Rather Upset

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't wish catastrophic capital loss on anyone. Imagine if you held Odd Molly International AB (publ) (STO:ODD) for half a decade as the share price tanked 91%. We also note that the stock has performed poorly over the last year, with the share price down 75%. Shareholders have had an even rougher run lately, with the share price down 56% in the last 90 days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Odd Molly International

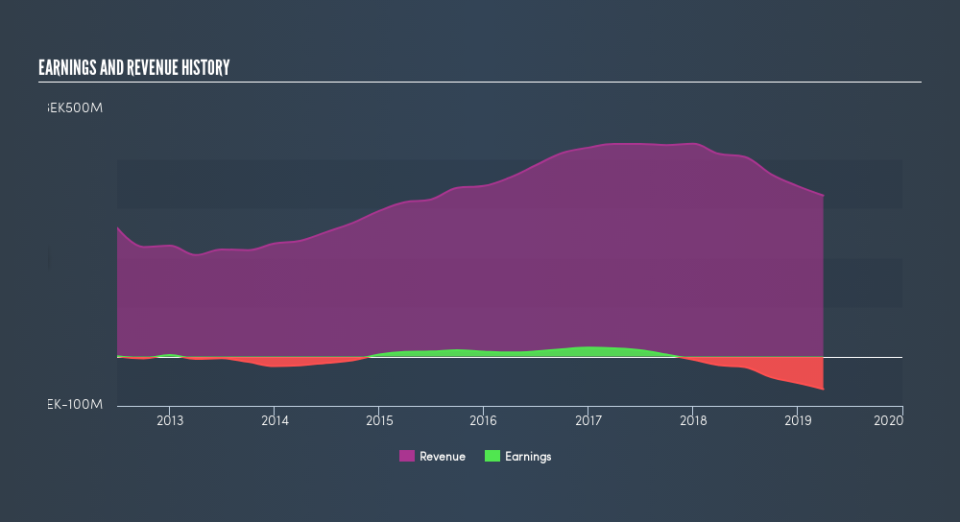

Given that Odd Molly International didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Odd Molly International saw its revenue increase by 7.6% per year. That's a fairly respectable growth rate. So the stock price fall of 38% per year seems pretty steep. The market can be a harsh master when your company is losing money and revenue growth disappoints.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

If you are thinking of buying or selling Odd Molly International stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Odd Molly International's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Odd Molly International's TSR of was a loss of 89% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Investors in Odd Molly International had a tough year, with a total loss of 72%, against a market gain of about 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 36% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You could get a better understanding of Odd Molly International's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.