Oh, Look! Billionaires Have Their Perfect Case to Start the Supreme Court Term.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

This is part of Opening Arguments, Slate’s coverage of the start of the latest Supreme Court term. We’re working to change the way the media covers the Supreme Court. Support our work when you join Slate Plus.

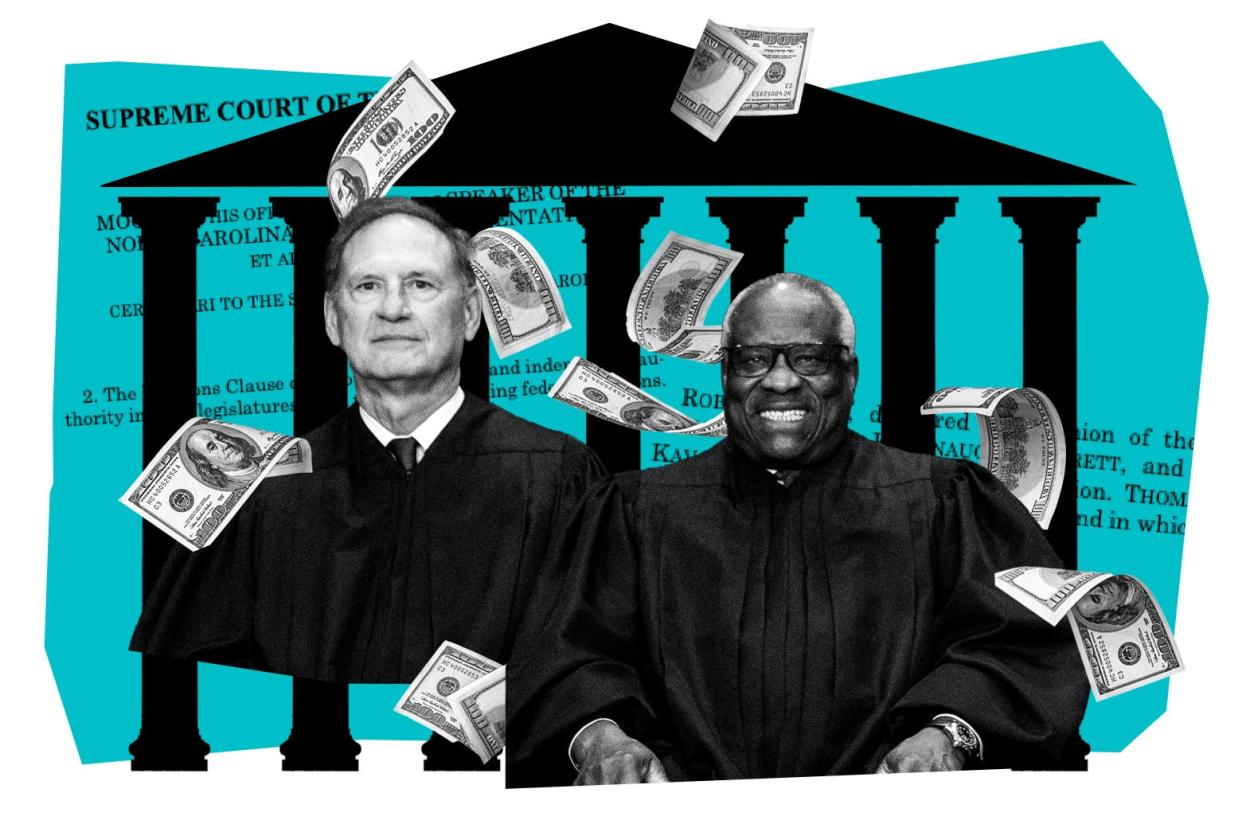

The Supreme Court begins another term this week—its first full term since a wave of corruption scandals properly introduced Americans to the court’s Federalist Society justices and their mind-boggling array of hidden financial, social, and political ties to far-right billionaires and the dark-money juggernauts controlled by political operative Leonard Leo. With this year’s term again presenting a docket that looks like a wish list personally stuffed into Justice Clarence Thomas’ breast pocket by Harlan Crow after a long day of duck hunting, people should be forgiven if they find themselves turning queasy at the first cry of “Oyez, oyez!”

From the volley of billionaire-orchestrated attacks on the government’s ability to regulate corporate excess and exploitation, to a new round of Leo-designed assaults on Black voting and other core civil rights, the term’s docket makes one thing readily apparent: The Federalist Society justices intend to keep slamming the scales of justice on behalf of their oligarch backers while immiserating everyday Americans through antidemocratic judicial fiat.

But even as newsrooms finally begin to take questions of judicial influence and corruption seriously, this term poses a critical test for American legal journalism and public discourse. After the media’s long history of failing to look behind the case pleadings, it’s high time for the mainstream press to confront the long-apparent reality that it’s the Federalist Society and its coterie of billionaires who are driving this court’s agenda.

One of the term’s seemingly less sexy cases, Moore v. United States, serves as a useful barometer. Objectively, it’s hard to understand why the court chose to grant the petition in Moore, a challenge to the constitutionality of the Mandatory Repatriation Tax, a one-time transition tax included in the 2017 Tax Cuts and Jobs Act designed to prevent accumulated earnings from going untaxed permanently. The court only can accept a tiny fraction—about 1 percent—of the petitions it receives to review lower court decisions. Consequently, the court’s rules limit its caseload to those involving only the most consequential issues, usually those requiring resolution of a disagreement among the circuit courts. By that standard, given the lack of any circuit conflict on the MRT’s constitutionality, Moore seems an odd fit.

So, why would the court choose to address a constitutional nonissue that affects a miniscule fraction of taxpayers?

The briefs submitted by the Moores and their fleet of 26 amici curiae help answer that question. Their beef isn’t about the MRT nearly as much as it is about taxes on unrealized gains and on wealth. Currently, no such taxes exist. But as Americans’ outrage over the unprecedented concentration of wealth by the 1 percent has reached a fever pitch, bills have been introduced in Congress to tax both the unrealized gains of the ultrarich and extreme wealth.

Even a glance at the papers in Moore makes it obvious that it’s about much more than the relatively small-potatoes MRT or any taxes levied upon the nominal plaintiffs, Charles and Kathleen Moore, who object to their $15,000 MRT tax bill. Rather than pay the tax in installments over years as the statute permits, the Moores paid their entire liability in 2018, then recruited the ferociously anti-tax Competitive Enterprise Institute to wage a court battle over the constitutionality of the MRT.

Don’t worry—of course the justices’ vacation buddies Harlan Crow and Paul Singer have their fingerprints all over this case, too. Both are closely linked to the Manhattan Institute, one of the eight groups that filed amicus briefs urging the court to take the case. Like the Competitive Enterprise Institute, all eight of those groups also have documented ties to Leonard Leo, who joined Thomas and Justice Samuel Alito on their secret, free vacations and served as billionaire-justice matchmaker.

The billionaires’ reach likely extends well beyond Thomas and Alito. Trump’s three court appointments, Neil Gorsuch, Brett Kavanaugh, and Amy Coney Barrett, all were hand-picked by Leo. And Gorsuch came with his own billionaire sponsor, fellow Coloradan Philip Anschutz. Their relationship dates back to Gorsuch’s days as a young lawyer in private practice, when his representation of Anschutz turbocharged his legal career. In 2006, Anschutz used his influence with the Bush administration to engineer placement of Gorsuch on the U.S. Court of Appeals for the 10th Circuit. Then, in 2016, Anschutz joined forces with Leo to obstruct President Barack Obama’s nomination of then-Judge Merrick Garland to the court following Justice Antonin Scalia’s death, ultimately lobbying Trump to appoint Gorsuch to the seat.

Anschutz, a supporter of the Manhattan Institute and other right-wing groups involved in the Moore case, is no stranger to tax avoidance, having lost a lengthy court battle over his attempt to duck more than $100 million in federal income tax. Gorsuch may well share Anschutz’s disdain for taxation. In 2010, he reportedly gave a speech to Colorado’s political elite at Anschutz’s annual duck hunt, in which he invoked standard anti-tax code language, warning that “nothing is inevitable” and urging “vigilance to all threats to our prosperity.”

Alas, in Moore, the help must have forgotten to stock the billionaires’ pond with its usual abundance of convenient, sympathetic plaintiffs. Hardly some small businessman rubbing pennies together, plaintiff Charles Moore is the son of Thomas Gale Moore, a member of Ronald Reagan’s Council of Economic Advisers and former director of—you guessed it—the Competitive Enterprise Institute, as the Guardian reported last month.

The Moores retained attorney David Rivkin to take their case to the Supreme Court. A ghoulishly pro-billionaire Federalist Society stalwart and partner at the Texas-based law firm BakerHostetler, Rivkin was the first lawyer to file a case challenging the constitutionality of the Affordable Care Act. At going Big Law rates, Rivkin’s legal fees for a single day of work likely exceed the Moores’ entire contested tax bill.

Amid his busy litigation schedule representing oil tycoons and dictators’ henchmen, Rivkin found time to interview Alito in the Wall Street Journal opinion section not once, but twice this summer, as part of a yearslong series. In one interview, Rivkin prompted Alito to opine that Congress lacks the power to pass laws regulating the court. That also happens to be the key legal question underlying Rivkin’s representation of none other than Leo in his defiance of Senate oversight into the Federalist Society boss’s judicial influence scheme. It’s a legal question that could well reach the court. In this case, Alito has already faced—and officially rebuffed—calls for his recusal from Moore based on his conflicts of interest with Rivkin and Singer. Because really, who’s going to stop him?

By all appearances, the court is using Moore as a pretextual vehicle to address the constitutionality of taxes on wealth or unrealized gains of billionaires, rather than waiting until an actual controversy involving such a tax comes before it. With populist economic policy ascendant on both the left and right, the billionaires know it might not be long until the wealth tax they so fear is no longer hypothetical. Better to get that constitutional ruling now, while the court is captured and the going is good.