What Ohio homeowners need to know about their property taxes

When the Franklin County Auditor's office concluded that property values in the county rose 41% over the past three years, homeowners around the county wondered the same thing: What's this mean for my property tax bill?

To answer that, it's necessary to understand how property taxes work. Here are five keys to the process:

Property taxes don't rise the same as property values

Property taxes are based on property values, but a 20% rise in property value doesn't mean taxes will rise 20%. A 1976 state law limits the amount of new taxes that can be collected from a rise in property values. The “effective millage’’ on property taxes decreases to reflect the rise in value, so the actual dollar amount collected doesn't change. Some taxes, called “inside millage,” which amount to less than 10 mills, do, however, increase with rising home values.

To find out how much of your home's levy is "inside millage," type in your address on the "levy estimator" page on the Franklin County Auditor's website.

Property taxes will, however, shift among properties after a reappraisal, as homes that rise more in value than other homes in a taxing district take on more of the tax burden.

To further muddy the waters: Property taxes are based on a property's "taxable value," which is about one-third of its estimated actual value.

Taxes are based on mills

The amount of taxes depends on how many mills are levied on a property. One mill equals $1 collected in taxes for every $1,000 in the property's taxable value. A property with a taxable value of $100,000 and a tax rate of 130 mills, for example, would pay $13,000 a year in taxes.

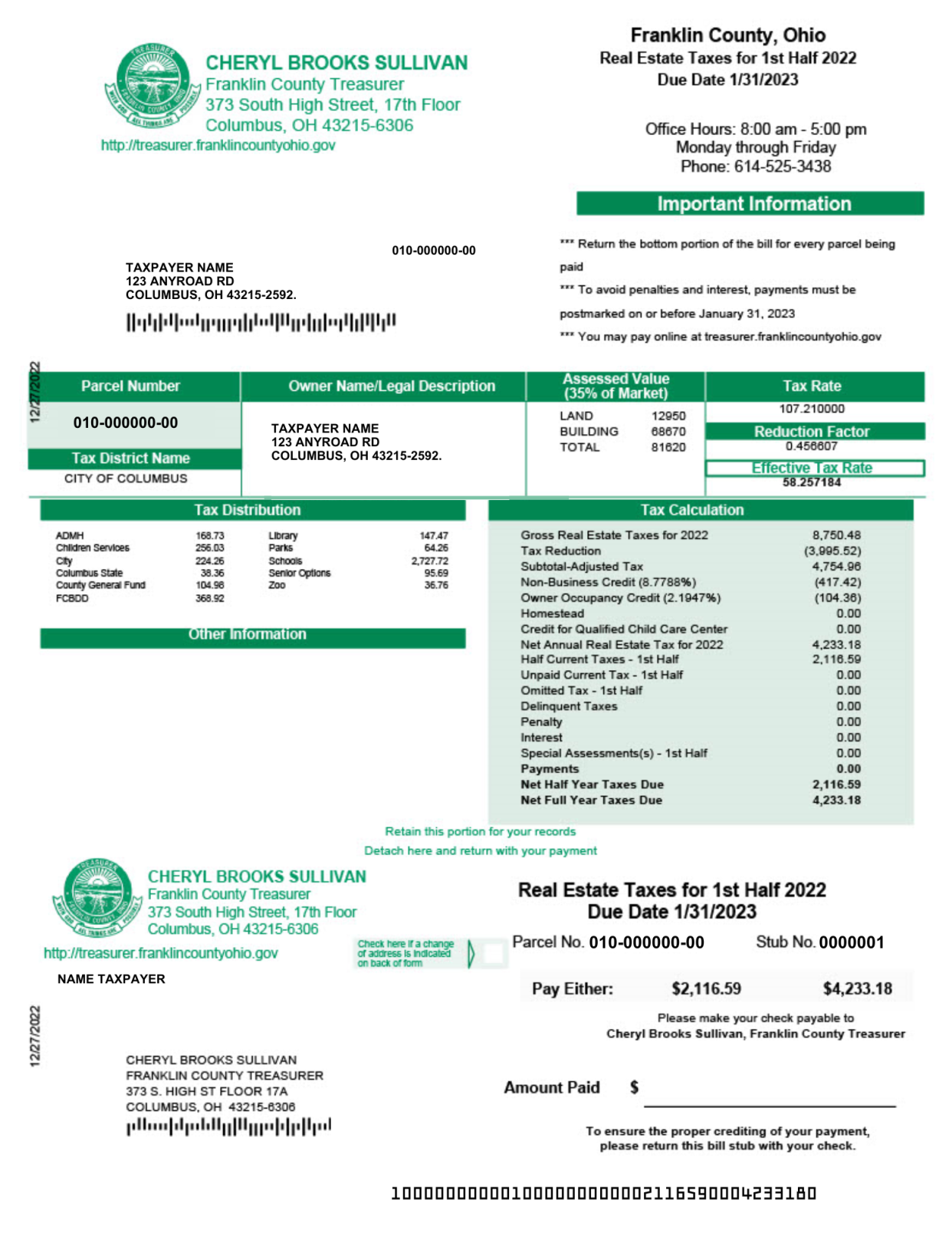

But wait, there's another caveat ... Because of the "effective millage" provision mentioned above and other reductions, properties are not taxed at their full rate. To find out what the actual tax rate is, look under "Tax & Payments" on your property's page on the auditor's site. Or look up the tax bill itself on the Franklin County Treasurer's website.

Schools drive taxes

Property taxes go to a variety of public entities such as county and local governments, parks, libraries and the Columbus Zoo and Aquarium. But the biggest chunk by far — about two-thirds of the total — goes to school districts, even though the Ohio Supreme Court ruled more than 25 years ago that the state's school funding system is unconstitutional.

School districts collect the lion's share of property tax revenue across Ohio, but the amount collected varies tremendously by district. In Franklin County, school district millage ranges from lows of 34.75 in Jonathan Alder school district, 48.45 in Madison-Plains and 51.65 in Hamilton Local, to highs of 113.44 in Worthington, 120.73 in Bexley, and 121.26 in Upper Arlington.

The Columbus school tax rate is is 81.03, roughly in the middle of the Franklin County pack and similar to rates in Gahanna, Westerville and Whitehall.

You have to have a reason to challenge your property values

Homeowners should learn the county's new appraised value of their homes in August. Those homeowners who think the value is excessive need an argument beyond "my taxes are too high." They must have evidence that the appraised value of their home is incorrect.

Evidence could come in several forms: a legitimate appraisal of the property; recent sale prices of comparable homes in the same neighborhood; or proof that the auditor's information about the property is incorrect (number of bedrooms, year built, etc.).

There is some - slight - relief available on property taxes

As Ben Franklin noted, taxes (and death) are certain. But there are ways of at least slightly reducing the burden.

The most common ways for homeowners to reduce their taxes are through the owner-occupied credit and the homestead credit. The owner-occupied credit should be automatic, but homeowners can confirm that they are receiving it by looking at the "Tax Year Detail" under "Tax & Payments" field on their property on the auditor's website.

Homeowners must apply for the homestead credit, which exempts part of the market value of their home from taxes. Applications for the homestead credit are available on county auditor websites. Homeowners can qualify if they:

are over 65 or disabled and make less than $34,600 a year. Those who qualify can exempt $25,000 from the market value of their home.

are a disabled veteran. This allows $50,000 to be reduced from the home's market value.

In addition, some local governments including Franklin County, offer other ways to reduce property taxes to qualifying homeowners. Find guidelines on the Franklin County Auditor and Franklin County Treasurer websites.

jweiker@dispatch.com

@JimWeiker

This article originally appeared on The Columbus Dispatch: A guide to Ohio property taxes