Ohio's sales tax holiday for back to school runs Aug. 5 to 7 for select purchases

Ohio's sales tax holiday is coming.

And that means summer is coming to a close and kids will soon be going back to school.

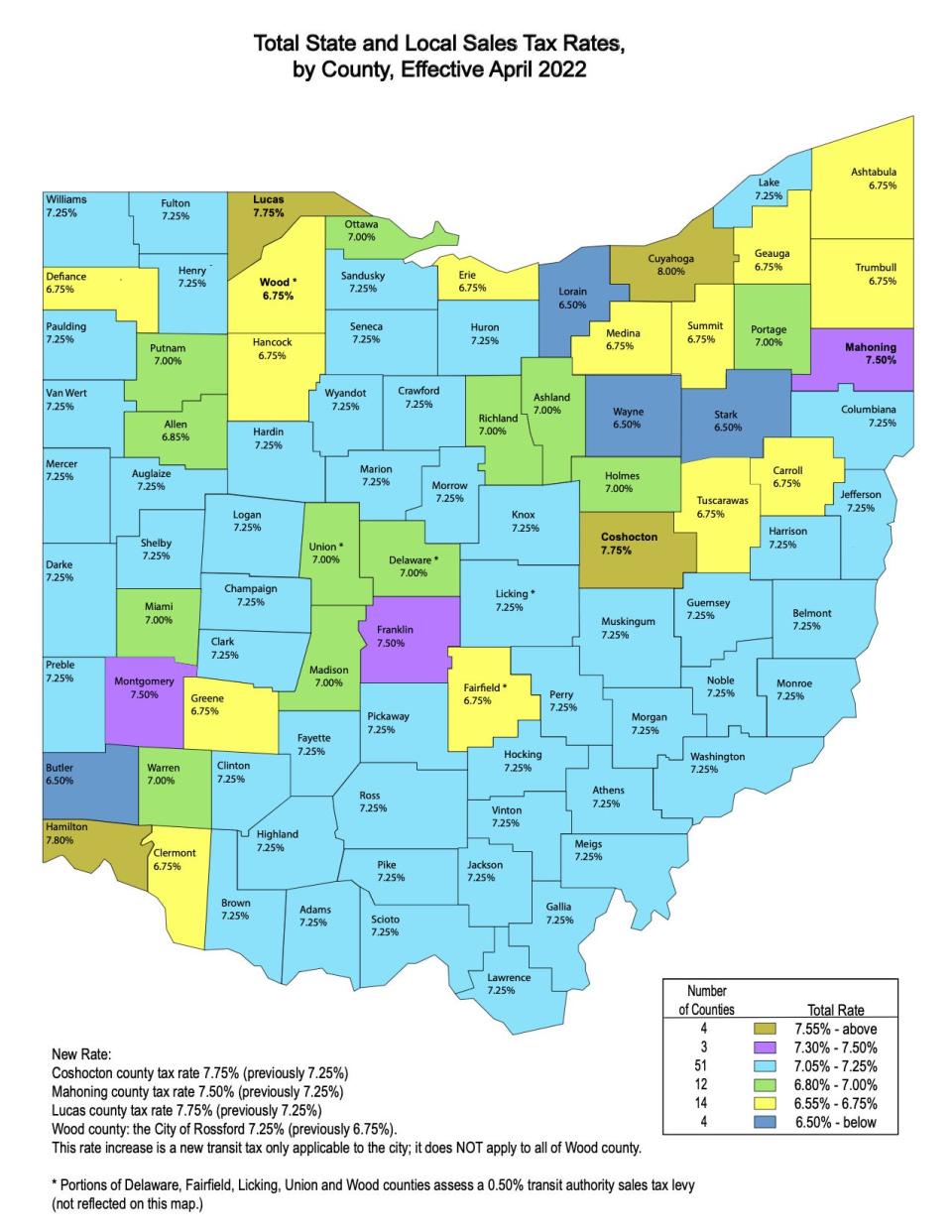

The state's tax-free weekend for school supplies will be from Aug. 5 to Aug. 7 this year. The sales tax rates across northern Ohio range from 6.75% to a high of 8% in Cuyahoga County.

The tax break will be for school supplies and some clothing purchases.

Here are the basic rules of what will be exempt from sales tax:

An item of clothing priced at $75 or less.

An item of school supplies priced at $20 or less.

An item of school instructional material priced at $20 or less.

The Ohio Department of Taxation notes that items that are typically used for trade or a business are not exempt.

The state has a wide definition of what it considers to be an item of clothing eligible for the tax break, and some of the items — like a wedding dress as long as it is under the $75 threshold — might surprise you.

Clothing eligible for tax break in Ohio

The state defines clothing as "all human wearing apparel suitable for general use."

The eligible items include: shirts; blouses; sweaters; pants; shorts; skirts; dresses; uniforms (athletic and nonathletic); shoes and shoelaces; insoles for shoes; sneakers; sandals; boots; overshoes; slippers; steel-toed shoes; underwear; socks and stockings; hosiery; pantyhose; footlets; coats and jackets; rainwear; gloves and mittens for general use; hats and caps; earmuffs; belts and suspenders; neckties; scarves; aprons (household and shop); lab coats; athletic supporters; bathing suits and caps; beach capes and coats; costumes; baby receiving blankets; diapers, children and adult, including disposable diapers; rubber pants; garters and garter belts; girdles; formal wear and wedding apparel.

Here's a list of some of the items that are not eligible. They include:

Clothing accessories or equipment including briefcases; cosmetics; hair notions, including, but not limited to, barrettes, hair bows, and hairnets; handbags; handkerchiefs; jewelry; sunglasses (non-prescription); umbrellas; wallets; watches; and wigs and hair pieces.

Protective equipment including breathing masks; ear and hearing protectors; face shields; hard hats; helmets; paint or dust respirators; protective gloves; safety glasses and goggles; safety belts; tool belts; and welders gloves and masks.

Sewing equipment and supplies including knitting needles, patterns, pins, scissors, sewing machines, sewing needles, tape measures and thimbles; and sewing materials that become part of “clothing” including, but not limited to, buttons, fabric, lace, thread, yarn and zippers.

Sports or recreational equipment including ballet and tap shoes; cleated or spiked athletic shoes; gloves; hand and elbow guards; life preservers and vests; mouth guards; roller and ice skates; shin guards; shoulder pads; ski boots; waders; and wetsuits and fins.

Belt buckles sold separately.

Costume masks sold separately.

Patches and emblems sold separately.

For more information, visit https://tax.ohio.gov/home.

This article originally appeared on The Times-Reporter: When is Ohio's tax free weekend for school clothes, supplies?