Oil Stock Rally Triggers Technical Sell Signal

Energy stocks have been in focus lately amid the rampant volatility in oil prices. This has translated into outsized gains for Continental Resources, Inc. (NYSE:CLR), up 17% in September. However, this surge has a downside; it takes the oil & gas name right up to a trendline with historically bearish implications.

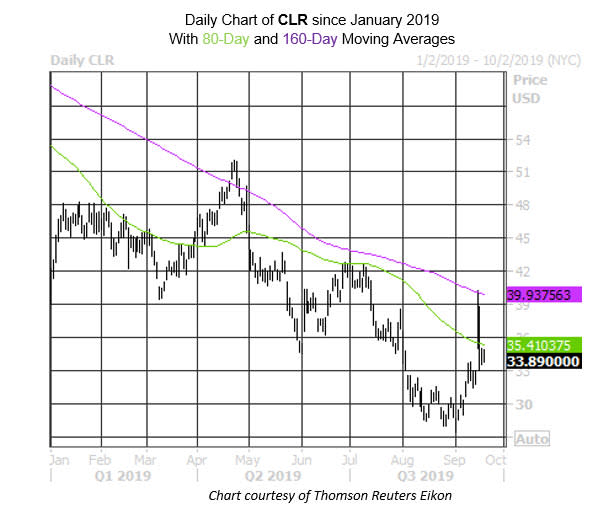

More specifically, CLR has run head-first into its 80-day moving average after a lengthy stretch below it -- defined for this study as having traded south of the moving average 60% of the time in the past two months, and in eight of the last 10 trading days. There have been seven similar encounters by CLR with this moving average in the last three years, after which the stock was lower 21 days later by 4.4%, on average, per data from Schaeffer's Senior Quantitative Analyst Rocky White, with six of the seven returns negative.

On Monday, CLR gapped higher with the broader energy sector in response to spiking oil prices. However, that surge was quickly rejected by the shares' 160-day moving average, an additional trendline of resistance in place.

Yet for a stock that's down roughly 46% over the past year, analysts sure seem confident. Of the 24 brokerages covering Continental Resources, 20 rate it a "strong buy," with zero "sells" on the books. Plus, the stock's consensus 12-month price target of $50.06 is a 47% premium to its current perch. What this means is that there's ample potential for future downgrades and price-target cuts, which could amplify pressure on the struggling energy name.

Meanwhile, in the options pits, the focus has been almost exclusively on calls. Amid limited absolute volume, 9,456 calls have been bought to open over the past 10 days at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), compared to just 3,820 puts. However, considering short interest increased by 33% in the most recent reporting period, it's possible some of this call buying could be the result of shorts seeking an options hedge.