Oklahoma treasurer criticizes pension system for taking exemption his office exercised

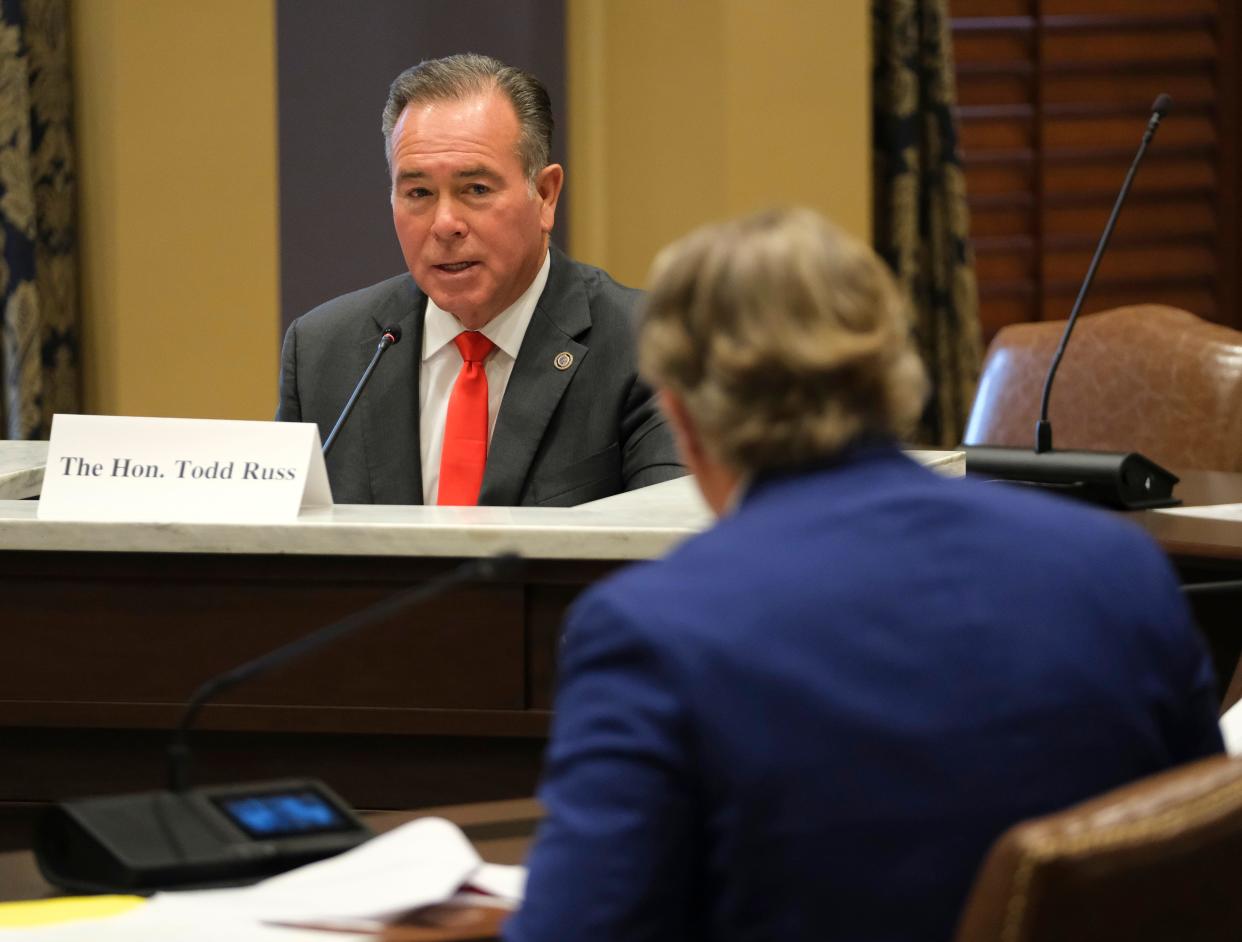

Oklahoma Treasurer Todd Russ has publicly criticized one of the state’s largest pension funds for taking an exemption to a new law forbidding state pension funds from doing business with financial companies perceived to be hostile to the oil and gas industry.

But Russ has quietly taken an exemption to the law when it comes to investments managed by his own office. The treasurer’s office exercised one for investments with Bank of America and is negotiating with JP Morgan Chase on another exemption. Both companies are among six Russ placed on a list of restricted financial companies.

The exemptions illustrate how tricky it’s been for pension funds like the Oklahoma Public Employees Retirement System to navigate the Oklahoma Energy Discrimination Elimination Act. Lawmakers passed the law last year in response to concerns that large public financial companies were too focused on climate pledges and goals at the expense of investments in fossil fuels.

The treasurer’s office has hundreds of millions of dollars invested with JP Morgan Chase money market accounts, part of a $16 billion portfolio managed by the office. Bank of America, meanwhile, provides credit card services to the state.

More: Retired state worker says bank blacklist harms his pension in lawsuit

“The State Treasurer has determined that Bank of America provides services to the Treasurer’s Office that are not otherwise reasonably available,” said a May 3 letter to Bank of America’s public sector banking division. “Accordingly, the State Treasurer fully intends to continue the current contractual relationship with Bank of America as it applies to credit card services until further notice.”

In an interview, Russ said the state’s JP Morgan holdings are from typical banking operations offered by the company, not its investment division. His office continues to negotiate with JP Morgan on a possible exemption.

“It’s not really an investment with them, and they’re not holding a pure investment,” Russ said. “That is an area that at least for a while, we’re going to have to make some exceptions because there’s not anyone that can actually handle some of the transactional volumes. And it would probably take us 18 to 24 months to get set back up somebody else.”

Russ said JP Morgan's inclusion on the restricted financial company list was from the financial company’s investment policies. He conceded that profits from all of the company’s operations, whether banking or investments, were going to the same corporate entity.

“The parent company’s philosophical position is what it is, even though the banking side doesn’t make those kinds of decisions on the investment portfolios,” Russ said. “But until we can find appropriate relationships, we can’t really separate ourselves from those accounts. They are more of a day-to-day checking account than an investment.”

Oklahoma Treasurer Todd Russ voted against bank boycott exemption for state pension commission

The Oklahoma Public Employees Retirement System has responded to a September letter sent by the Oklahoma State Pension Commission at Russ’ request criticizing its process for taking an exemption to the energy boycott law. Russ, who chairs the State Pension Commission, said the retirement system acted too quickly in taking the exemption.

Russ was the lone no vote when the retirement system's board voted 9-1 in August to exercise a financial responsibility exemption to the law so it wouldn’t have to divest $6 billion in pension assets managed by BlackRock Inc. Staff for the pension system said it could cost an estimated $10 million to divest holdings from BlackRock.

The retirement system's letter to the State Pension Commission, dated Nov. 9, said the system's board properly followed the law in taking an exemption. The pension system’s request for proposal process for other potential investment managers attracted 51 responses, a number in line with industry norms.

“It is important to note at the outset that despite the claims, criticisms, misunderstandings of law and fact made in the (Pension Commission) letter and rhetoric displayed in meetings and the news media, the OPERS Board of Trustees and staff have been completely open and transparent in all actions and have at all times been willing to answer any questions regarding the RFP process and the resulting actions taken by the Board of Trustees,” the 16-page letter said.

Last month, the Senate held an interim study on the implementation of the energy boycott law. Russ told senators the law needs to be clarified on how exemptions are taken. He also agreed with several senators that a provision affecting cities and counties should be removed from the law.

The State Financial Officers Foundation, a nonprofit headquartered in Kansas, has been supplying talking points and opinion columns to Russ and fellow Republican state treasurers and financial officials. The materials critique the climate policies endorsed by shareholders of publicly traded banks and financial firms, part of a broader effort waged by conservative groups against environmental, social and governance policies.

Paul Monies has been a reporter with Oklahoma Watch since 2017 and covers state agencies and public health. Contact him at 571-319-3289 or pmonies@oklahomawatch.org. Follow him on Twitter @pmonies.

Oklahoma Watch, at oklahomawatch.org, is a nonprofit, nonpartisan news organization that covers public-policy issues facing the state.

This article originally appeared on Oklahoman: Treasurer Todd Russ using exemption to bank blacklist he criticized