Is Olam International (SGX:O32) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Olam International Limited (SGX:O32) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Olam International

What Is Olam International's Net Debt?

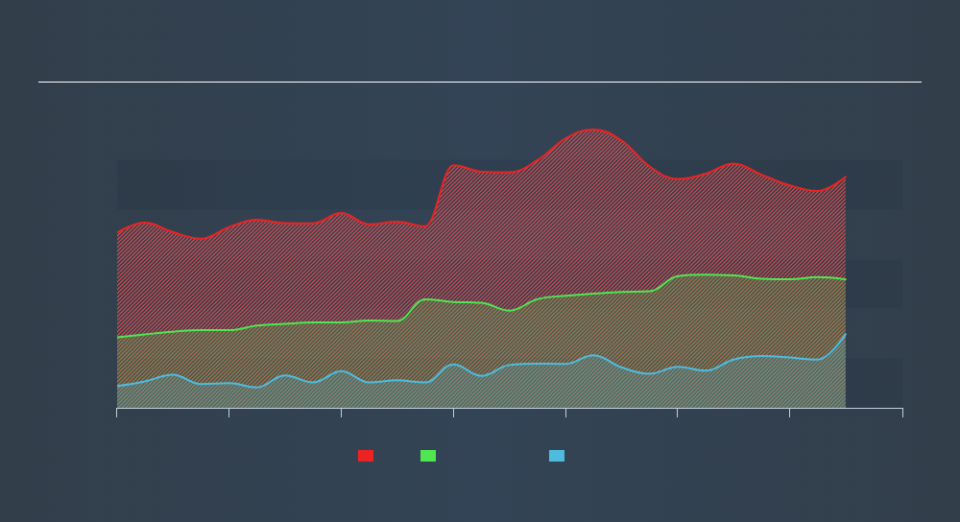

You can click the graphic below for the historical numbers, but it shows that Olam International had S$11.6b of debt in June 2019, down from S$12.4b, one year before. However, because it has a cash reserve of S$3.70b, its net debt is less, at about S$7.91b.

How Healthy Is Olam International's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Olam International had liabilities of S$11.2b due within 12 months and liabilities of S$7.52b due beyond that. On the other hand, it had cash of S$3.70b and S$2.01b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by S$13.0b.

The deficiency here weighs heavily on the S$5.80b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we'd watch its balance sheet closely, without a doubt After all, Olam International would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Olam International shareholders face the double whammy of a high net debt to EBITDA ratio (7.2), and fairly weak interest coverage, since EBIT is just 1.3 times the interest expense. This means we'd consider it to have a heavy debt load. Even worse, Olam International saw its EBIT tank 21% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Olam International will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Olam International produced sturdy free cash flow equating to 77% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

To be frank both Olam International's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. After considering the datapoints discussed, we think Olam International has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. Given Olam International has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.