The OOH Holdings (HKG:8091) Share Price Is Down 75% So Some Shareholders Are Rather Upset

OOH Holdings Limited (HKG:8091) shareholders should be happy to see the share price up 10% in the last month. But that is meagre solace in the face of the shocking decline over three years. Indeed, the share price is down a whopping 75% in the last three years. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround.

Check out our latest analysis for OOH Holdings

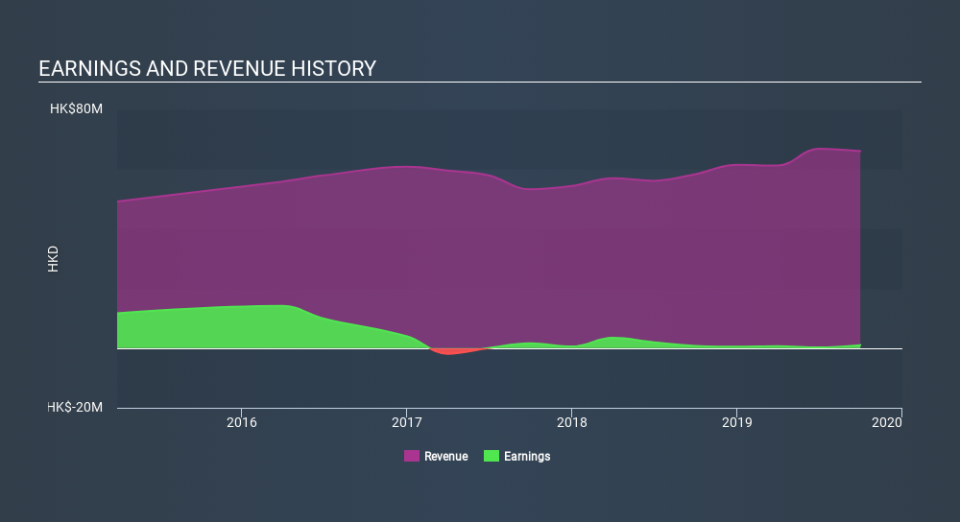

We don't think that OOH Holdings's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over three years, OOH Holdings grew revenue at 4.7% per year. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 37%, compound, over three years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Before considering a purchase, take a look at the losses the company is racking up.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

The last twelve months weren't great for OOH Holdings shares, which cost holders 32%, while the market was up about 8.4%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. However, the loss over the last year isn't as bad as the 37% per annum loss investors have suffered over the last three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for OOH Holdings that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.