Opinion: What’s wrong with the Sam Bankman-Fried cultural moment

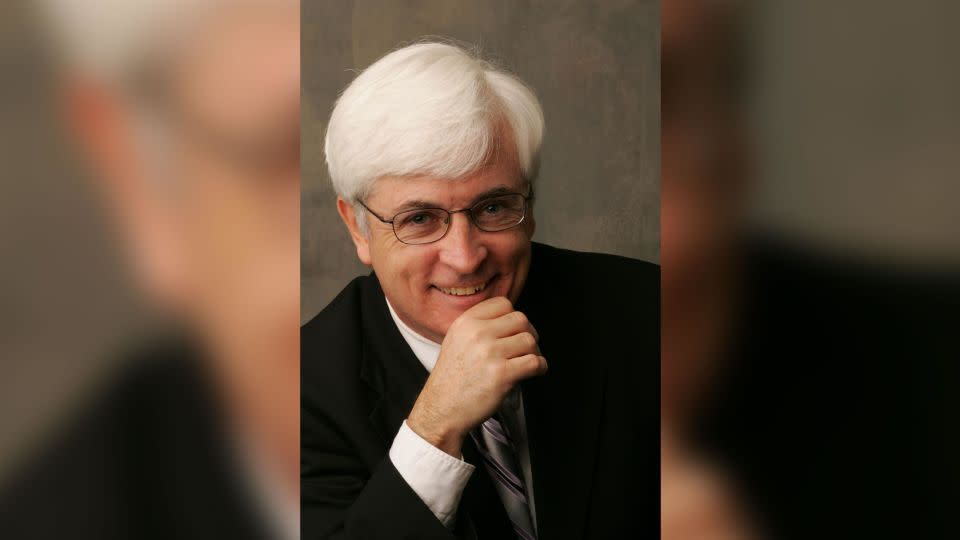

Editor’s Note: Bill Carter covered the media business for more than 25 years at The New York Times. He has also been a contributor to CNN, and the author of four books about television, including “The Late Shift.” He was the Emmy-nominated writer of the HBO film adaptation of that book. The opinions expressed in this commentary are his own. View more opinion on CNN.

Sam Bankman-Fried showed up for the first day of his financial fraud trial Tuesday in a suit and tie. That likely disappointed his fanboys and myth-makers who would have preferred he maintained his signature fashion statement: T-shirt and baggy cargo shorts. The unofficial playbook for the true cultural rebel, after all, dictates they are not supposed to give in to convention, no matter what the circumstances.

Of course, Sam Bankman-Fried — or SBF, as he is cutely known — is the latest tech/disruptor/money-magnet wunderkind, who parlayed the frenzy over the quick payday bonanza of cryptocurrency into a personal fortune estimated at $22.5 billion, before it vaporized into lost billions and criminal charges. (He has pleaded not guilty.)

But the turn of bad fortune has not totally undermined the Sam Bankman-Fried cultural moment. The best-selling author Michael Lewis has published a new bio of SBF, “Going Infinite” (released Tuesday to coincide with the first day of his trial), and that follows a “60 Minutes” interview with Lewis that included extensive footage of Sam at work displaying all his eccentricities. And coming soon to your TV set, a streaming series from Amazon, which we can expect to be a classic “rise-and-fall” chronicle of a genius manqué.

It seems that the path to eclipsing all the other tech wanna-be billionaires and becoming a true cultural phenomenon — which is distinct from a genuine historical phenomenon — contains just a few essentials, but being extraordinarily young is one. (Alexander may have been “The Great” because he conquered the known world in the 4th century, but what made him really cool was he was barely 20 when he got the ball rolling.)

At just 31, Bankman-Fried certainly checks that box. (He’s also so addicted to video games that he plays them instead of paying attention to conversations! Amazing, right?)

What is somewhat new, of course, is that he is also an alleged scam artist.

The field of venture capitalism originated in the years after WWII, but it exploded in Silicon Valley post-Apple. The child genius with the next hot thing was not only the ticket to riches, he/she was on the way to Hollywood celebrity status.

The breakthrough movie really happened in 2010 with “The Social Network,” which elevated Mark Zuckerberg of Facebook to the icon-osphere. The Oscar for writer Aaron Sorkin validated that the exaltation of the youthful tech-genius could be turned into art.

Steve Jobs was the original prototype of the genre. He founded Apple when he was 21 and achieved true cult-figure status, which he kept justifying as the innovations Apple produced not only thrilled his obsessive followers, they worked. Millions of people around the globe used them. Jobs was an actor-portrayed character but just one of a bunch of tech characters in a TV-movie “Pirates of Silicon Valley” in 1999; and he was central in a panned 2013 film “Jobs.” But he only got the full-on Hollywood treatment in 2015’s “Steve Jobs” — Sorkin wrote that one too.

The TV series about Elizabeth Holmes, “The Dropout,” which Amanda Seyfried won an Emmy for, is what really put a new spin on the tech tale: total failure. Holmes was the tech/disruptor/money-magnet wunderkind whose invention — a device to diagnose every illness short of hangnails from one drop of blood — was actually relying on third-party devices. She faked her way into becoming a talked-about cultural phenomenon.

The added element was the scam: Get the greedy suckers to buy into the faux innovation and fleece your way to fame and fortune.

SBF is just the newest entry in that category. His defenders, including, at least in a mixed way, Lewis, see that as somewhat unfair. (A review of his book in The New York Times notes that “Lewis seems so attached to the protagonist of his narrative that he takes an awful lot in stride.”) Lewis, in the “60 Minutes” piece, suggested SBF was no Ponzi-schemer; he said Sam had a real business that would still be making fistfuls of money if there hadn’t been a run on customer deposits. And after all, Sam was trying to use his wealth for good, funding all kinds of causes, and even trying to keep Donald Trump from destroying democracy. (SBF’s alleged plan was to buy Trump off from running again with a $5 billion check.)

As for the charges of self-dealing in selling and buying cryptocurrency, resulting in the disappearance of $8 billion, the defense seems to come down to Bankman-Fried was not venal but sloppy, not evil but weird.

In the interview “60 Minutes” did with Lewis, SBF was seen jiggling his leg and shuffling playing cards excessively, while he never made eye contact. And then there was the account from his ex-girlfriend Caroline Ellison (now expected to be the star witness against him) that Sam described himself as lacking a soul.

Of course, if FTX hadn’t flamed out, all that would have just been part of the adorable legend of the richest guy under 30.

For more CNN news and newsletters create an account at CNN.com