Optimism around Goosehead Insurance (NASDAQ:GSHD) delivering new earnings growth may be shrinking as stock declines 6.2% this past week

Investing in stocks comes with the risk that the share price will fall. Anyone who held Goosehead Insurance, Inc (NASDAQ:GSHD) over the last year knows what a loser feels like. The share price is down a hefty 63% in that time. At least the damage isn't so bad if you look at the last three years, since the stock is down 4.1% in that time. The falls have accelerated recently, with the share price down 38% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 17% in the same timeframe.

If the past week is anything to go by, investor sentiment for Goosehead Insurance isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Goosehead Insurance

While Goosehead Insurance made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Goosehead Insurance saw its revenue grow by 26%. That's definitely a respectable growth rate. Meanwhile, the share price tanked 63%, suggesting the market had much higher expectations. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

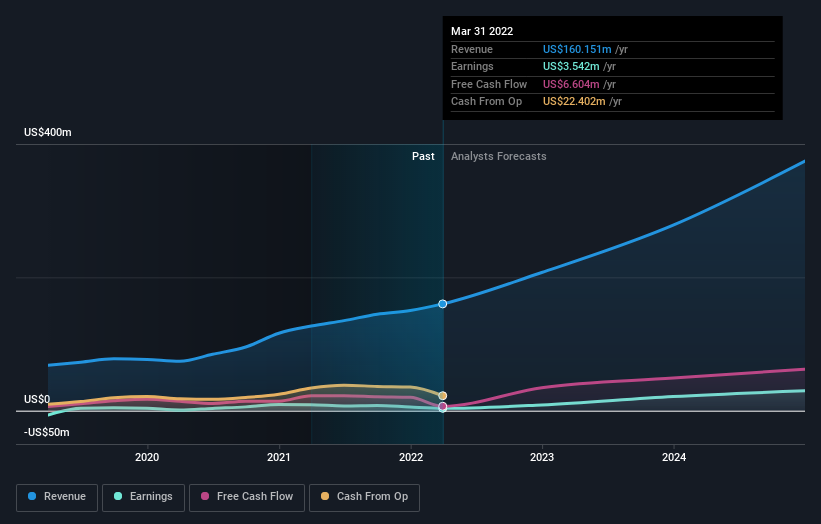

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

The last twelve months weren't great for Goosehead Insurance shares, which performed worse than the market, costing holders 63%, including dividends. Meanwhile, the broader market slid about 18%, likely weighing on the stock. Shareholders have lost 0.6% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Goosehead Insurance (of which 2 can't be ignored!) you should know about.

We will like Goosehead Insurance better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.