Option Traders Go Wild for AAL Ahead of Earnings

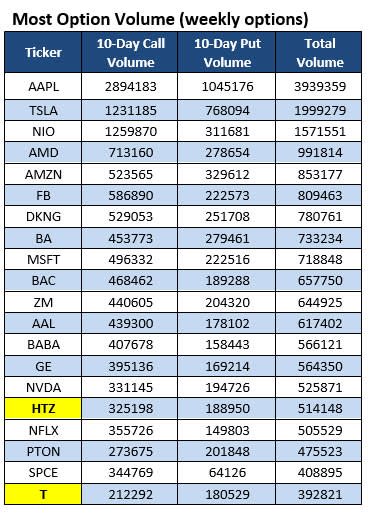

Below is a list of 20 stocks that have attracted the highest weekly options volume in the last 10 trading days, courtesy of Schaeffer's Senior Quantitative Analyst Rocky White, with highlighted named new to the list. With earnings season picking up steam, many traders are turning to options to speculate on outsized moves and potential volatility. One such name is American Airlines Group Inc (NASDAQ:AAL), which is slated to release its third-quarter earnings ahead of the open on Thursday, Oct. 22. Below, we'll dig into some of this recent option activity, and take a look at how AAL has performed after quarterly reports in the past.

A closer look at White's data shows 439,300 calls and 178,102 puts exchanged in the last 10 days. The weekly 10/9 contract was quite popular during this time period, with the 13.50- and 13-strike calls seeing plenty of activity. There's been a surge in bullish activity during today's trading, too. As of this writing, 97,000 calls have crossed the tape -- 1.2 times the intraday average -- compared to 34,000 puts. The most popular by far is the weekly 10/23 13-strike call, which expired this Friday, Oct. 23.

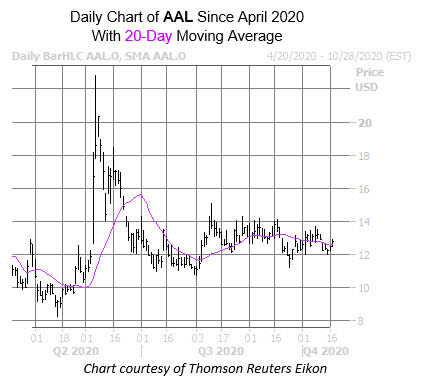

From AAL's current perch at $12.77, this suggests these traders are speculating on more upside for the equity, following its earnings event. A peek at AAL from a technical standpoint shows the equity ready to close back north of its 20-day moving average, with support near the $12 level keeping the equity in a sideways trading pattern, away from its March- May bottom.

Circling back to American Airlines' post-earnings past, it looks like the security has enjoyed a post-earnings pop after five of its last eight reports, averaging a 5.1% next-day swing, regardless of direction. This time around, the options pits are pricing in a slightly bigger move at 8.4%.