Options Bears Bombard Expedia Stock After Job Cuts

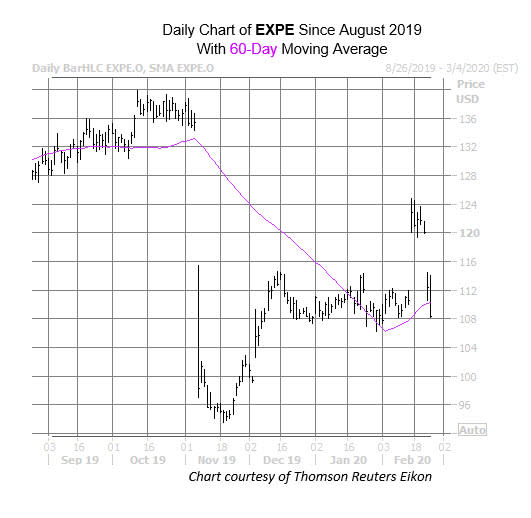

Online travel specialist Expedia Group Inc (NASDAQ:EXPE) is gapping lower today on news that the company plans on cutting 3,000 jobs -- 12% of its workforce -- in an effort to streamline its business. This comes right on the heels of the company's decision to forgo a full-year forecast amid the growing coronavirus uncertainty. EXPE is now trading back below recent support at its 60-day moving average in response, and completely erased its Feb. 14 bull gap, down 3.4% at $108.50 at last check.

Options bears have been quick to pick up EXPE stock today. So far, 12,000 puts have crossed the tape, two times the intraday average and nearly double the number of calls. Most popular is the April 105 put, where positions are being opened. On the call side, the September 120 contract is seeing quite a bit of activity, as well.

Typically, bulls rule the roost, as evidenced by EXPE's 50-day call/put volume ratio of 1.84 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio sits higher than 71% of all other readings from the past year too, suggesting that calls are being being picked up at a slightly quicker clip than usual.

Meanwhile, short interest has been rapidly unwinding, down 35.1% in the last reporting period. Now, the 6.54 million shares sold short represents 5.4% of the stock's available float, or roughly two days at its average pace of trading.