Options Traders React to Tentative GM-UAW Deal

General Motors Company (NYSE:GM) is in focus today, after the car maker reached a tentative deal with the United Auto Workers (UAW) union. The four-year labor deal could end a month-long strike of roughly 48,000 hourly workers. GM stock is up 2% to trade at $36.98 in response, but some options traders aren't as optimistic.

With around one hour left in trading today, more than 62,000 options have changed hands, double the average intraday amount. There is significant activity at both the weekly 10/18 35.50-strike put, and the weekly 10/18 37-strike call, where new positions are being opened at both. Those buying the currently out-of-the-money put see a quick pivot lower by the week's end, and those buying the latter contract see today's gains holding over the next 48 hours.

Calls have held the advantage in recent weeks. In the last 10 days, At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), 1.94 calls bought to open for every put, which indicates calls outnumbered puts by a nearly 2-to-1 ratio in the past two weeks.

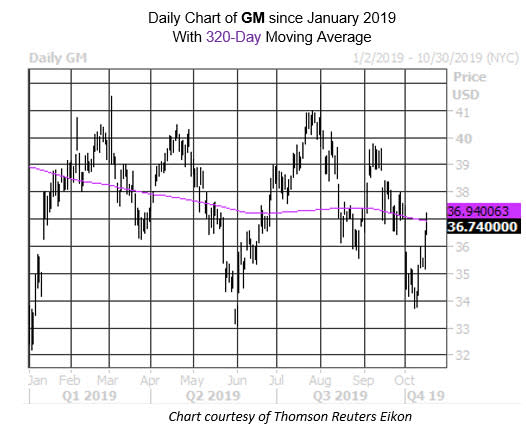

During the strike, General Motors stock sunk to as low as $33.71, an area that contained a pullback in June as well. And while the shares have bounced from here, they're running smack into resistance at their 320-day moving average.