Orthofix's (OFIX) Q4 Earnings Top Estimates, Margin Declines

Orthofix Medical Inc. OFIX delivered fourth-quarter 2020 adjusted earnings per share (“EPS”) of 44 cents, down 13.7% from the year-ago figure. However, the figure beat the Zacks Consensus Estimate by a stupendous 193.3%.

The one-time adjustments include expenses associated with long-term income tax rate adjustment, strategic investments and amortization of acquired intangibles, among others.

GAAP loss per share came in at 48 cents, down from the year-ago EPS of 60 cents.

Full-year adjusted EPS was 26 cents, reflecting an 82.3% decrease from the year-ago period. However, the metric surpassed the Zacks Consensus Estimate of a loss of 4 cents.

Total Revenues

Revenues in the fourth quarter totaled $117.6 million, down 3.2% year over year on a reported basis (down 4.1% at constant exchange rate or CER). However, the top line exceeded the Zacks Consensus Estimate by 5.9%.

Despite strength in the company’s spinal implants and a rebound in Bone Growth Therapies business, there was a significant pandemic-led adverse impact on the company’s elective procedure volume results in the reported quarter.

Full-year revenues were $406.6 million, reflecting a 11.6% plunge from the year-ago period (down 11.8% at CER). Again, the metric surpassed the Zacks Consensus Estimate by 1.7%.

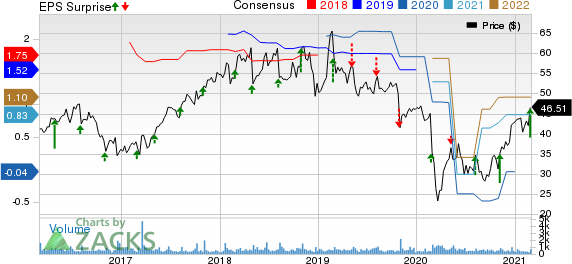

ORTHOFIX MEDICAL INC. Price, Consensus and EPS Surprise

ORTHOFIX MEDICAL INC. price-consensus-eps-surprise-chart | ORTHOFIX MEDICAL INC. Quote

Segmental Details

In the reported quarter, Global Spine business revenues inched up 0.4% year over year (up 0.2% at CER) to $93.5 million.

The Bone Growth Therapies portfolio registered a 0.9% year-over-year fall in revenues (both on a reported basis and at CER) but a sequential improvement of 7%.

The spinal implants portfolio, which surged 9.3% year over year on a reported basis and 8.6% at CER, was driven by 11% growth in U.S. spine implant revenues, largely resulting from strong M6 disc sales. However, this was offset by 6% fall in spine fixation business due to slowdown of elective procedures and performance of lower number of complex cases.

Biologic portfolio’s revenues were down 9.3% year over year (both on a reported basis and at CER), primarily due to lower elective procedure volumes during the quarter, along with channel disruption and continued pricing pressure in the market.

Revenues from the Global Extremities business were $24.1 million in the fourth quarter, down 15% year over year (down 18.4% at CER). The business experienced a decline in procedure volumes due to the pandemic, especially in the international markets. Also, the non-reoccurrence of certain large stocking orders occurring in the fourth quarter of 2019, dragged down quarterly revenues.

Margin Details

In the reported quarter, gross profit declined 7.1% year over year to $88.5 million. Gross margin contracted 316 basis points (bps) to 75.3%.

Selling, general and administrative expenses declined 7.9% year over year to $53.7 million, whereas general and administrative expenses fell 16.4% year over year to $18.5 million. However, research and development expenses climbed 22.7% year over year to $10.4 million.

Overall adjusted operating profit was $5.9 million, down 7.2% year over year. Adjusted operating margin was 5.1%, seeing a 22-bps contraction year over year.

Operational Update

The company exited 2020 with cash and cash equivalents of $96.3 million compared with $69.7 million at the end of 2019.

Cumulative net cash provided by operating activities at the end of 2020 was $ 74.3 million compared with the prior-year period’s $32 million.

Cumulative capital expenses incurred by the company at the end of 2020 were $17.1 million compared with $20.5 million a year ago. Accordingly, cumulative free cash flow reported by the company at the end of 2020 was $57.2 million, up from the year-ago free cash flow of $11.5 million.

2021 Guidance

Orthofix, despite pandemic-led restrictions and weather emergency experienced last week, has issued financial guidance for first-quarter and full-year 2021.

The company expects its net sales for the year to be in the range of $445-$460 million, reflecting an increase of 9.5-13.1% over 2019 on a reported basis. The Zacks Consensus Estimate for the same is currently pegged at $453.9 million.

Net sales for the first quarter of 2021 are likely to be within $95-$96 million, representing a year-over-year decrease of 9.4-8.4% on a reported basis.

The company expects its adjusted EPS for the year to be in the range of 46-55 cents, reflecting an uptick of 73.1-111.5% from the year-ago period. The Zacks Consensus Estimate for the same is currently pegged at 84 cents.

Our Take

Orthofix exited the fourth quarter of 2020 with better-than-expected results. Strength in the company’s Global Spine arm, driven by robust U.S. Spine implant sales amid pandemic-led headwinds, looks encouraging. The addition to Orthofix’s pediatric portfolio following the recently expanded FDA clearance for the FITBONE intramedullary lengthening and deformity system, which makes it the only pediatric lengthening nail in the United States, buoys optimism.

However, year-over-year fall in the top and bottom lines is disappointing. The dismal performance of the Global Extremities business, along with continued lower procedure volumes stemming from the pandemic, is discouraging as well. Moreover, contraction of both margins does not bode well.

Zacks Rank and Key Picks

Orthofix currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Abbott Laboratories ABT, Hologic, Inc. HOLX and IDEXX Laboratories, Inc. IDXX.

Abbott reported fourth-quarter 2020 adjusted EPS of $1.45, which surpassed the Zacks Consensus Estimate by 6.6%. Fourth-quarter worldwide sales of $10.7 billion outpaced the consensus mark by 7.9%. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic reported first-quarter fiscal 2021 adjusted EPS of $2.86, beating the Zacks Consensus Estimate by 33.6%. The company currently carries a Zacks Rank #2.

IDEXX reported fourth-quarter 2020 adjusted EPS of $2.01 which surpassed the Zacks Consensus Estimate by 40.6%. Revenues of $720.9 million beat the consensus mark by 5.8%. The company currently carries a Zacks Rank #2.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ORTHOFIX MEDICAL INC. (OFIX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Abbott Laboratories (ABT) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research