Some Ortin Laboratories (NSE:ORTINLAABS) Shareholders Are Down 49%

Ortin Laboratories Limited (NSE:ORTINLAABS) shareholders should be happy to see the share price up 11% in the last month. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact the stock is down 49% in the last year, well below the market return.

See our latest analysis for Ortin Laboratories

While Ortin Laboratories made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Ortin Laboratories saw its revenue grow by 77%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 49% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

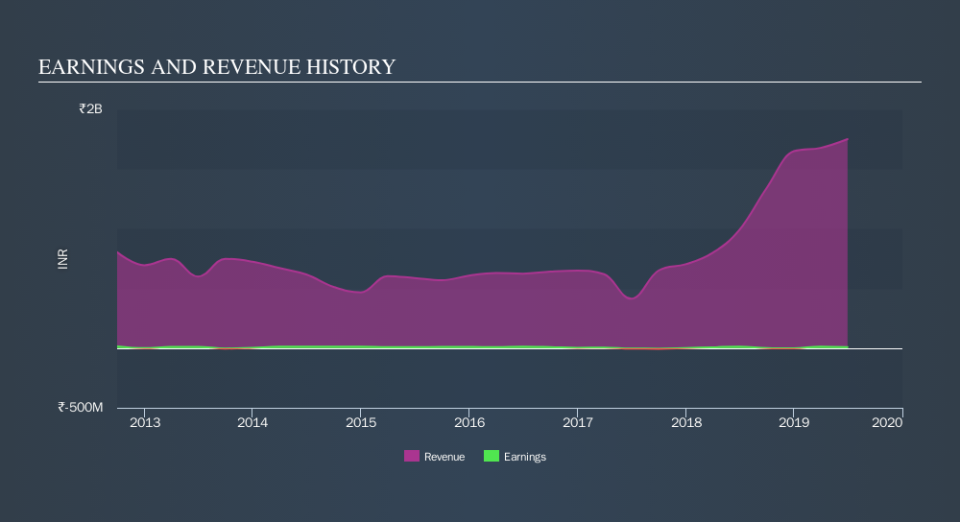

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Ortin Laboratories's earnings, revenue and cash flow.

A Different Perspective

Ortin Laboratories shareholders are down 49% for the year, falling short of the market return. The market shed around 11%, no doubt weighing on the stock price. The three-year loss of 13% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Before deciding if you like the current share price, check how Ortin Laboratories scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.