OUE Commercial Real Estate Investment Trust (SGX:TS0U) Looks Interesting, And It's About To Pay A Dividend

OUE Commercial Real Estate Investment Trust (SGX:TS0U) stock is about to trade ex-dividend in 3 days time. You will need to purchase shares before the 16th of August to receive the dividend, which will be paid on the 12th of September.

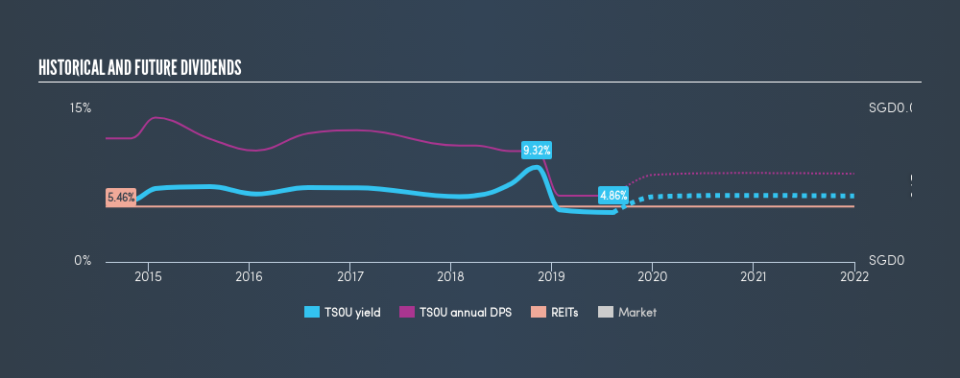

OUE Commercial Real Estate Investment Trust's upcoming dividend is S$0.017 a share, following on from the last 12 months, when the company distributed a total of S$0.026 per share to shareholders. Based on the last year's worth of payments, OUE Commercial Real Estate Investment Trust stock has a trailing yield of around 4.9% on the current share price of SGD0.535. If you buy this business for its dividend, you should have an idea of whether OUE Commercial Real Estate Investment Trust's dividend is reliable and sustainable. So we need to investigate whether OUE Commercial Real Estate Investment Trust can afford its dividend, and if the dividend could grow.

View our latest analysis for OUE Commercial Real Estate Investment Trust

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. OUE Commercial Real Estate Investment Trust is paying out an acceptable 51% of its profit, a common payout level among most companies. That said, REITs are often required by law to distribute all of their earnings, and it's not unusual to see a REIT with a payout ratio around 100%. We wouldn't read too much into this. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It distributed 50% of its free cash flow as dividends, a comfortable payout level for most companies.

It's positive to see that OUE Commercial Real Estate Investment Trust's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. For this reason, we're glad to see OUE Commercial Real Estate Investment Trust's earnings per share have risen 11% per annum over the last five years. OUE Commercial Real Estate Investment Trust is paying out a bit over half its earnings, which suggests the company is striking a balance between reinvesting in growth, and paying dividends. Given the quick rate of earnings per share growth and current level of payout, there may be a chance of further dividend increases in the future.

OUE Commercial Real Estate Investment Trust also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. It's hard to grow dividends per share when a company keeps creating new shares.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. OUE Commercial Real Estate Investment Trust's dividend payments per share have declined at 12% per year on average over the past 5 years, which is uninspiring. OUE Commercial Real Estate Investment Trust is a rare case where dividends have been decreasing at the same time as earnings per share have been improving. It's unusual to see, and could point to unstable conditions in the core business, or more rarely an intensified focus on reinvesting profits.

To Sum It Up

Is OUE Commercial Real Estate Investment Trust an attractive dividend stock, or better left on the shelf? We like OUE Commercial Real Estate Investment Trust's growing earnings per share and the fact that - while its payout ratio is around average - it paid out a lower percentage of its cash flow. OUE Commercial Real Estate Investment Trust looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

Curious what other investors think of OUE Commercial Real Estate Investment Trust? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow .

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.