Outperforming Semiconductor Stock Set to Surge Even Higher

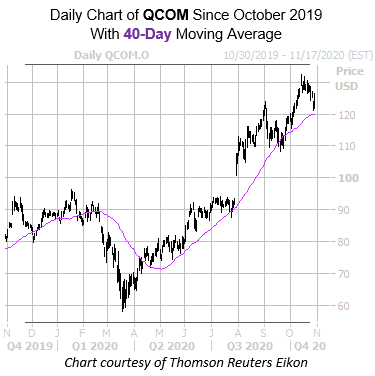

The shares of QUALCOMM, Inc. (NASDAQ:QCOM) are up 3.8% at $126.21 at last check. And while the semiconductor concern has cooled off from its Oct. 14, all-time-high of $132.42 in the last couple of weeks, it still sports a 54.7% year-over-year lead. The even better news is that the stock's latest pullback is near a historically bullish trendline, which could soon push QCOM to a fresh peak.

More specifically, Qualcomm stock just came within one standard deviation of its 40-day moving average, after spending several weeks above the trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, six similar signals have occurred during the past three years. QCOM has closed higher 83% of the time one month after each signal, averaging a 11.2% gain. From the stock's current perch, a move of similar magnitude would put it just above the $140 mark -- to another record high.

A short squeeze could create even more tailwinds for the security. Short interest rose 17.6% during the past two reporting periods, and the 16.06 million shares sold short now make up 1.4% of the stock's available float. In simpler terms, it would take just about two days to buy back these bearish bets, at QCOM's average pace of daily trading.

An unwinding of pessimism in the options pits could also push Qualcomm stock higher. This is per the equity's Schaeffer's put/call open interest ratio (SOIR) of 1.13, which sits higher than 98% of readings from the past year. This suggests short-term option traders have rarely been more put-biased.