The over-50s could save Britain's economy – if Jeremy Hunt let them

Britain needs to become a country where millionaires want to live, not one that they want to leave.

The Chancellor must improve productivity to achieve this and crucially needs to get experienced workers back into the workforce and encourage them to build up capital.

People between 50 and retirement age are usually at peak earning power with the lowest expenses: their mortgages have been paid off, their children have left home and they have acquired most of the large material goods they need.

This should allow them to put money into savings and pensions which are then invested in businesses and government bonds, which help the economy to grow.

Unfortunately, this isn’t happening anymore.

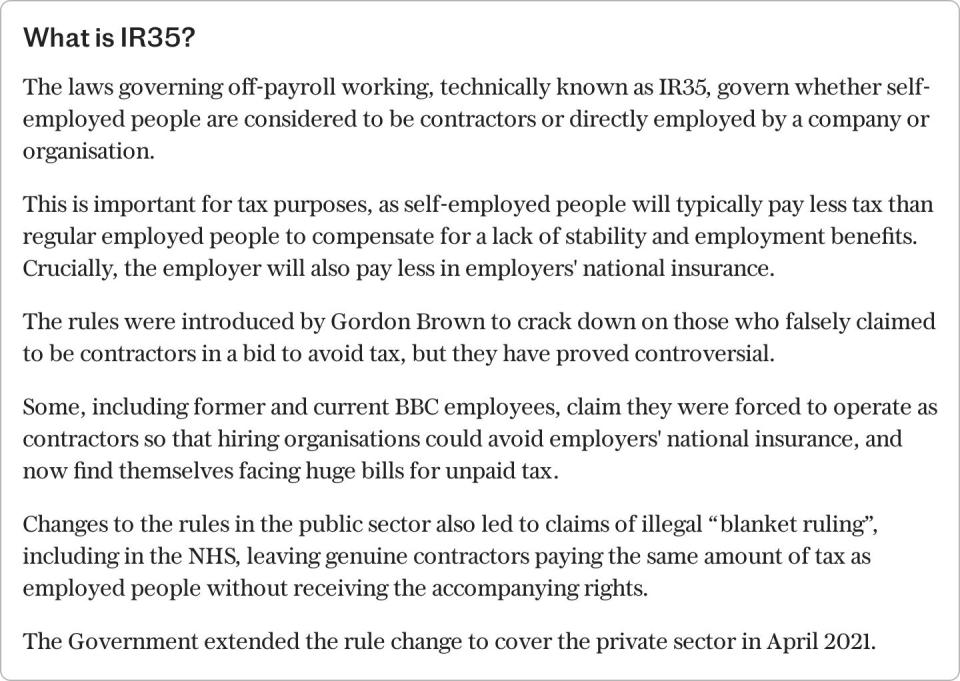

Instead, the over-50s are dropping out of the workforce. Something that even Jeremy Hunt has noticed but apparently not questioned. I suspect the recent changes to “off payroll” tax rules for the self-employed, known as IR35, and the UK’s high inheritance taxes are behind this mass early retirement.

Gone are the days of jobs for life in factories and offices where a person in their 50s could work alongside a person in their 20s. Now the UK is a heavily service-orientated economy, and most services have very flat employment structures.

For every 100 junior low-paid employees, less than a quarter will rise to better-paid middle management, and less than a quarter of those will rise to highly paid senior management and have a job for life. All of the rest will have to reinvent themselves or set up their own businesses.

Many did just that but out of necessity rather than a desire to work for themselves. Working for yourself isn’t easy and requires time spent finding clients as well as doing the work, sending out invoices, chasing payments, calculating VAT, paying taxes, etc. But the self-employed can often offer the same services as their previous employers but more cheaply by working on contract.

Contract work improves productivity. Companies pay for the work completed and not for time spent on holiday, away sick or merely gossiping at the water cooler. Contractors often work from home, especially if the work can be done online, so they save employers office costs, as well as the cost of making a permanent employee redundant when a project is completed.

Consequently, even if a former middle manager wanted to be a full-time employee, many companies don’t want the cost and hassle of employing them. On the plus side, companies that save money by employing contractors rather than employees, make higher profits and pay higher taxes. So the economy also wins.

Contract work is likely to become the preferable way of employing people who work from home. Managers will only have to assess the quality and timeliness of completed work, and not worry about whether a WFH employee is sitting at their computer during prescribed office hours. This allows companies to pay for work done and allows contractors to do as much or as little work as they want to be paid for.

The only people who don’t seem to like contract employment is HMRC. They prefer full-time employees because it makes the collection of taxes and VAT much simpler – at least for them. Unfortunately for HMRC, the alternative to self-employment seems to be unemployment or retirement, not full-time employees.

If Hunt wants to get the over-50s back to work, there needs to be something in it for them and something in it for their employers.

But if a contract worker deemed to be “inside IR35” costs companies the same amount as a full-time employee, as is increasingly the case following recent changes in how the regime is governed, then there is no reason to use the contractor.

The contractor retires, the economy loses their skills, HMRC loses its tax, while the company may simply employ offshore contract staff instead.

HMRC seems to believe that the self-employed are gaming the tax system even though they are saving their employers money and must endure all the risks of finding work, completing it, invoicing, chasing late payments, or non-payments as well as life without paid holidays, sick pay, or company pensions.

Consequently, the changes to IR35 have tipped the balance and driven people who should be at their peak earnings, into retirement. While this may benefit their competitors, it doesn’t benefit the economy. We are losing experienced contractors and replacing them with inexperienced employees, or with offshore contract workers.

But tax rules for freelancers are not the only reason the over-50s are dropping out of the workforce. Inheritance taxes also dissuade people from continuing to work. What is the point of building up capital if the Government takes 40pc of it when you die?

Once upon a time, families wanted to build up capital to pass on to their children and grandchildren. Now, people retire early and spend their savings rather than leaving them for the taxman. Inheritance tax disincentives capital formation.

And the British are not just retiring early, many are leaving the country entirely. According to Mansion Global, approximately 120,000 millionaires moved country in 2023.

The top five destinations were Australia, the UAE, Singapore, the US and Switzerland. Australia, the top destination, has no inheritance taxes, nor does the UAE or Singapore. US Federal Estate Tax will only apply to estates worth more than $13.61 million (£10.7m) in 2024 and starts at 18pc and goes up to 40pc.

More worrying is the list of countries with the largest number of departing millionaires in 2023: China, India, Britain, Russia and Brazil. When the UK is the only developed Western country in the millionaire departure list, (ahead of Russia), it is obvious that the UK government needs to revisit its inheritance tax policies.

While many people believe that abolishing inheritance tax is unfair because it only hits 4pc of the population, I would suggest that this low proportion is by design, not accident.

While the merely wealthy may be leaving the country, the very wealthy have arranged their finances to minimise inheritance tax. This includes the many high-net-worth non-farmers who have purchased farmland in the UK. Farmland is exempt from inheritance tax in order to protect family farms.

However, this has had the unintended consequence of making farmland a desirable investment for non-farmers, which has pushed the price of farmland well above its earning capacity. Farmland is now too expensive for genuine farmers to buy to expand their farms even though larger farms are generally more efficient and would be better able to compete with larger Canadian, American and Australian farms.

Now there is another unintended consequence of inheritance tax: workers who could be building capital have decided not to bother and spend their money instead. This would be good for consumer spending if they stayed in the UK but not so good if they move to Australia or spend their retirement travelling.

The loss of experienced workers and the lack of capital formation are both serious drags on UK productivity: an issue that the Government regularly complains about but never seemingly tries to fix. The Chancellor could fix both issues in the March budget by reversing the changes to IR35 and abolishing inheritance tax. This will increase investment funds, improve productivity and even increase tax revenues.

Catherine McBride is an economist and a fellow at the Centre for Brexit Policy

Recommended

Where to move to in America – to pay the least tax