S&P 500: What to Expect in 2023

Very few investors would've anticipated a bear market going into 2022. The zeitgeist was still optimistic on Wall Street, and macroeconomic indicators aligned towards a late-stage bull market. At its very worst, some analysts anticipated a flat year with pockets of overvalued stocks correcting.

Nonetheless, life is full of surprises, and the financial markets embody the harsh reality of risk-taking. Given the surprising year we've experienced, let's take a closer look at S&P 500's prospects going into 2023. This analysis assumes a theoretical and quantitative vantage point to ensure confirmation bias doesn't enter the fray via anecdotal thinking.

Risk premiums

A primary influence on the S&P 500 is the equity risk premium. The equity risk premium is the incremental return investors demand per unit of risk. According to Wall Street Mojo, this can be calculated by subracting the risk free rate of return from the market's expected rate of return.

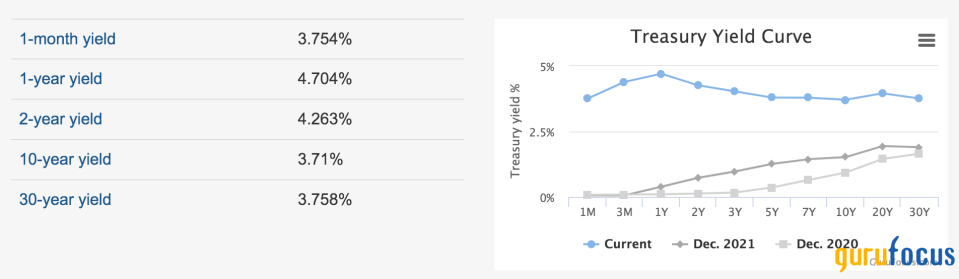

The equity risk premium's primary influencing variables are real return on stocks less the risk-free return on treasury securities. The latter is often measured by utilizing the 10-year yield or, alternatively, by considering short-term bond yields.

As of this writing, the yields on both long and short-dated bonds are at multi-year highs, which indicates that the financial markets believe there's a high probability of a credit event occurring. In isolation, higher yields reduce the equity risk premium; however, the knock-on effect on the market risk premium must be assessed before drawing any conclusions.

The market risk premium (or expected return) has surged during 2022 for various reasons. The primary reasons include geopolitical risk amid the war between Russia and Ukraine, tensions between the U.S. and China, an unstable financial market and a volatile foreign exchange market. Therefore, much of the benefits of a higher risk-free rate have been phased out by elevated systemic risk.

Source: Market Risk Premia

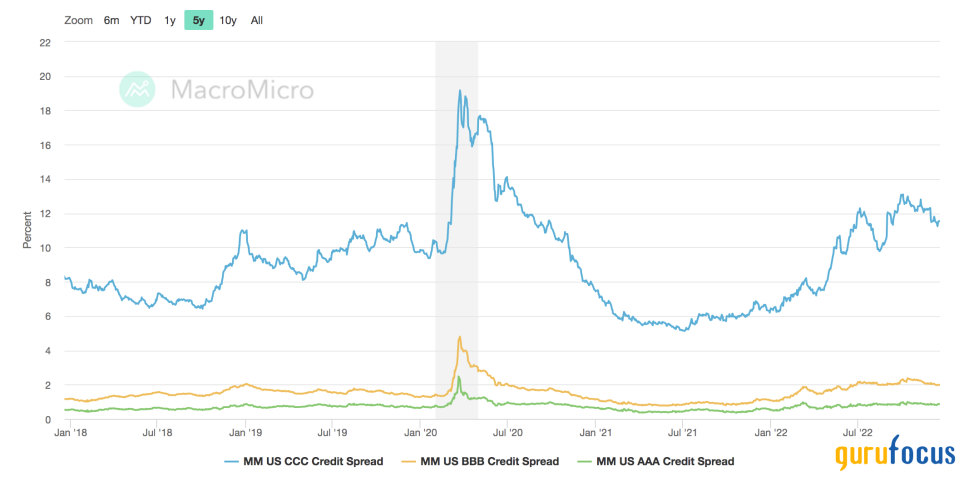

Lastly, the nature of the rising yields needs to be analyzed. A bullish risk-free rate increase would be beneficial to the equity markets. However, the most recent rise in yields has been due to push-side inflation and exacerbating credit spreads. Thus, the isolated quantitative advantages of a higher risk-free rate might be bogus.

Source: MacroMicro

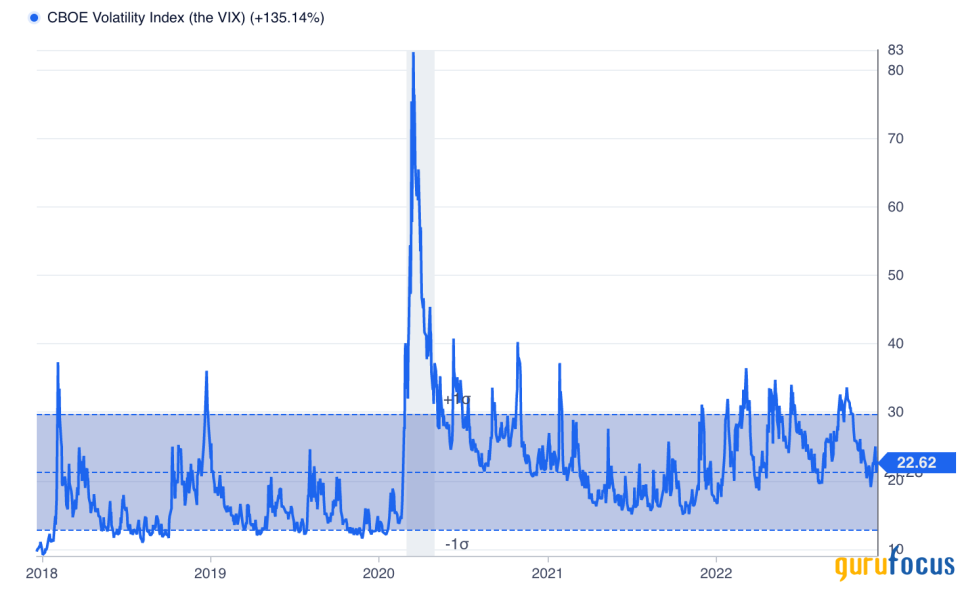

In summary, the S&P 500 might be in for higher risk premiums in 2023. Additionally, the volatility index (VIX) remains elevated. Collectively, a higher risk premium and an elevated VIX might drive down the index's Sharpe Ratio, in turn reducting investor interest due to unfavorable risk-return utility.

Valuation

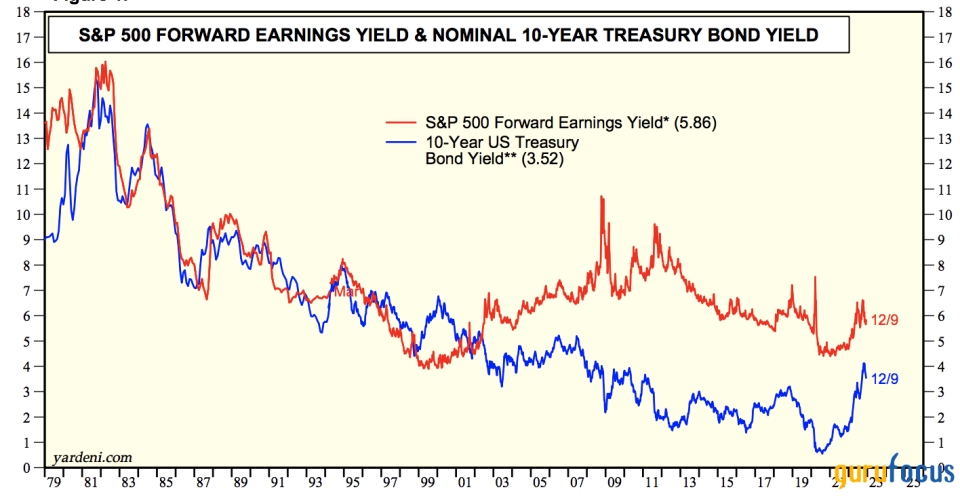

The Fed Model and Dr. Edward Yardeni's "Yardeni Model" are market participants' two main standardized valuation models. The prior measures the S&P 500's prospects by observing the trajectory of the 10-year yield curve and the index's earnings yield, whereas the latter monitors the same variables but adds in an expected earnings yield function.

The Yardeni Model anticipates a drop in the S&P 500's earnings yield going into 2023. In addition, the recent rise in the 10-year yield signals that the two variables could soon converge. If convergence occurs, investors will likely head for the exit door as it suggests the index's value for the money has waned.

Source: Yardeni Research

Mike Wilson of JPMorgan (NYSE:JPM) recently opined on earnings yields estimates, stating that investors still need to price in the possibility of lower earnings. He wrote the following in a recently published note: "We've got significantly lower lows if our earnings forecast is correct."

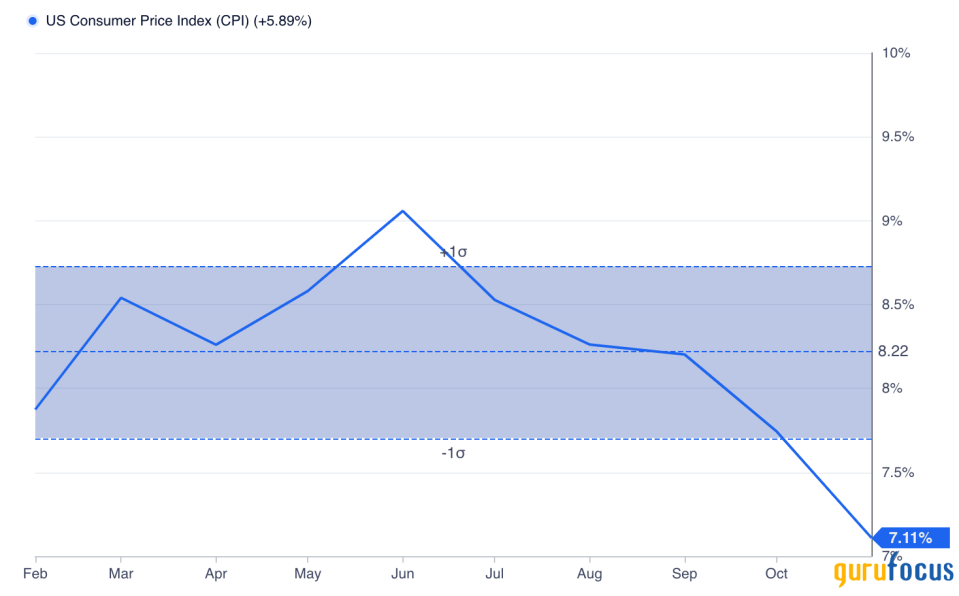

There's a high possibility that Wilson might've hit the nail on the head in my view, as cyclicality is yet to play its entire hand. As for the yield curve, inflation will be a key influencing factor. The U.S. consumer price index settled at 7.1% for November, coming in lower than anticipated but still much higher than is healthy. However, investors need to be careful of anticipating a "Fed Pivot" as macroeconomic variables remain volatile, meaning it's unlikely that a predictable trendline will occur anytime soon. Nevertheless, if inflation breaks, we'll likely see flatter credit spreads, which could drag down the yield curve, subsequently providing support to the stock market.

Sector allocation

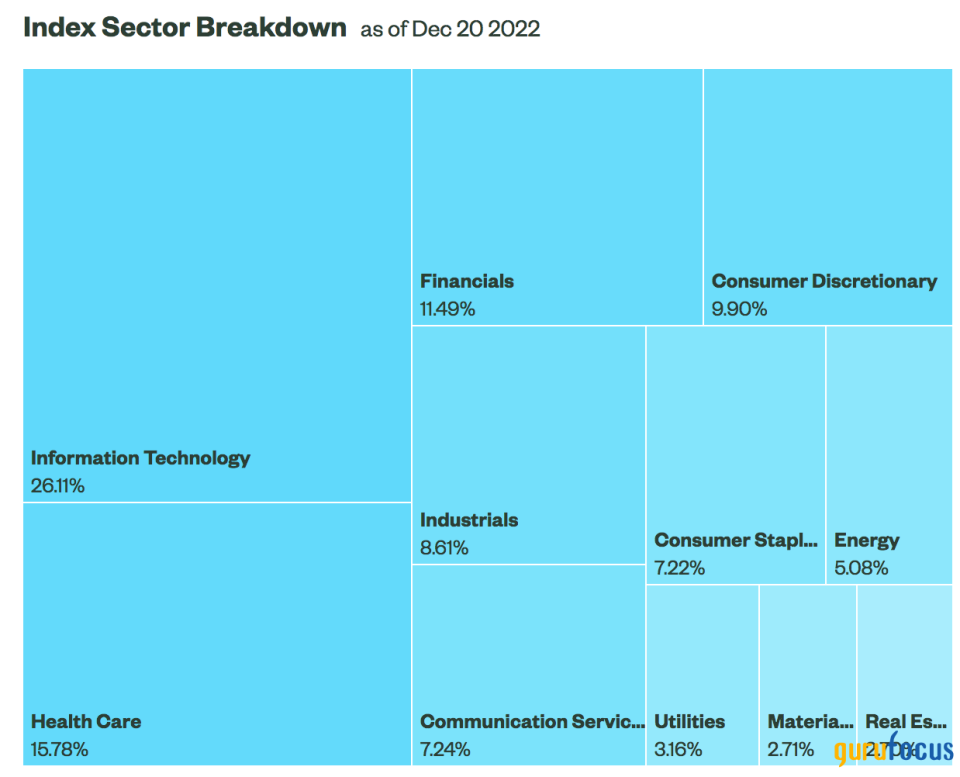

Lastly, the index's sector exposure needs to be dissected to make sense of its risk premiums and valuation. As displayed in the diagram below, the index is still top-heavy with technology bets, which tend to be vulnerable to unfavorable economic conditions due to their high beta coefficients. Furthermore, the index is highly exposed to the financial sector, leaving it open to recession risk.

Although the S&P 500 does have reasonable exposure to defensive sectors such as health care, consumer staples and utilities, its general composition is cyclical, meaning it's highly vulnerable in a risk-off market.

Source: State Street Global Advisors

Concluding thoughts

Many investors might expect the S&P 500 to rebound in 2023 as factors such as recent price spikes and cooling inflation have surfaced. However, the index's risk-return situation is in poor condition, its valuation metrics look unfavorable and it remains top-heavy with cyclical stocks. This indicates that its risk-return profile remains unappealing.

This article first appeared on GuruFocus.