PagerDuty in 5 Charts

What an odd name for a company. PagerDuty (NYSE: PD)? Really? It's enough to make any millennial feel like they've entered a portal back to the 1990s.

But once you get past the name, you might be duly impressed with this newly IPO'd company. Not only is PagerDuty providing very real value to its customers, it's doing so using the Software-as-a-Service (SaaS) model to create leverage and a widening competitive moat. The combination could enrich investors for years to come.

Image source: Getty Images.

A quick primer

Before getting started, let's get one thing out of the way: PagerDuty actually has nothing to do with pagers. Its name comes from the fact that engineers need to be on-call 24/7 when bugs and downtime occur with company networks.

PagerDuty takes all of the data it can from a company's servers and tries to identify areas that need immediate attention -- like a website not responding when a customer tries to buy an item or a critical page that's not loading.

Its value proposition comes from digging through all that data, making sense of it, then notifying the key people -- and only the key people -- who can fix it.

Growth spurs the network effect

PagerDuty co-founder and Chief Technology Officer Alex Solomon is a big believer in artificial intelligence (AI) and machine learning (ML). But just as you need to feed your children food for them to grow, AI and ML need "food". Their food is data.

"The more data you have, when you're applying AI and ML, the better the results will be," says Solomon.

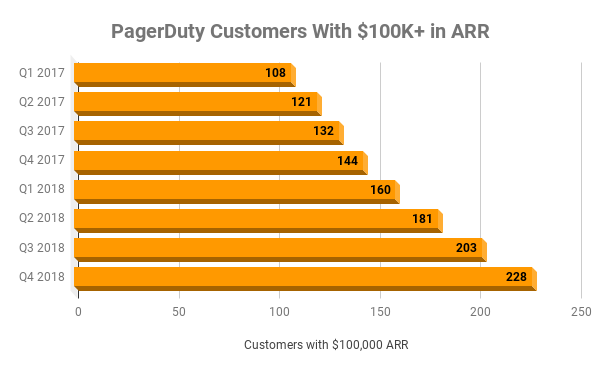

One of the best ways to gauge the amount of data which PagerDuty's AI and ML are parsing is to track the number of customers paying over $100,000 annually in subscription revenue.

Chart by author. Data source: SEC filings.

Note that this growth occurred over eight quarters, not eight years! Each additional big customer is feeding big data into PagerDuty's servers, making the overall system more powerful and useful. That's the classic network effect.

PagerDuty has been doing this since 2009, so you can see how this helps form a formidable competitive moat around the company.

Investing in the future

But PagerDuty is not resting on its laurels.

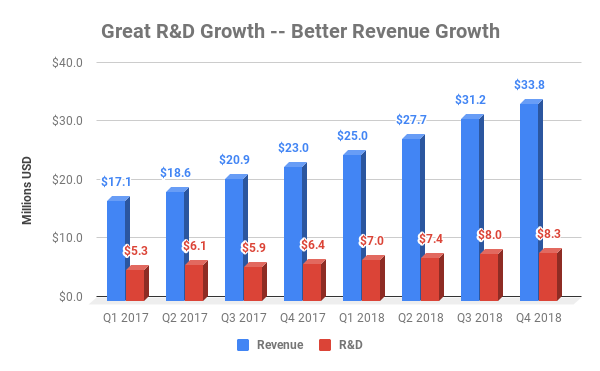

In fact, over the past two years, spending on research and development has increased by 29%, eating up nearly one-quarter of revenue. For forward-looking investors, this is a great sign. This spending has helped the company expand from its core On-Call Management tool to now include five other services (more on that below).

But here's the even better part: Revenue is growing even faster than R&D:

Chart by author. Data source: SEC filings. R&D spending does not include stock-based compensation.

PagerDuty believes it has a $25 billion total addressable market to tackle. With just over $100 million in revenue last year, the company is just scratching the surface. It intends to keep its foot on the gas pedal of R&D to tackle more market share over time.

Pricing strategy leads to easy up-selling

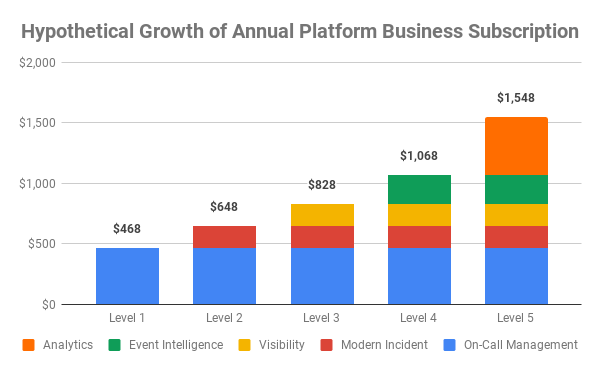

Speaking of those new tools, let's get a hypothetical look at how they play out.

The core On-Call Management solution helps track and report incidents in real time. Over the last few years, however, the company has come out with several popular add-ons, including:

Modern Incident Response: Helps direct alerts to the right people at the right time, and prioritize alerts. Also benefits from post-mortem machine learning.

PagerDuty Visibility: Dashboard that gives real-time feedback on operations and business impacts.

Event Intelligence: An ML tool to help predict and manage problems.

PagerDuty Analytics: Combines the full breadth of ML, AI, and human input to drive better outcomes.

Most subscribers start out with On-Call Management ("Level 1") but add more functionality over time. The chart below shows annual revenue per user that PagerDuty garners as customers add more solutions.

Chart by author. Hypothetical growth of Platform Business subscription. Data source: PagerDuty.

Crucially, there's far less money devoted to sales and marketing when it comes to add-ons. Once customers are in the ecosystem, they are far more efficient as prospects for up-selling.

High switching-costs

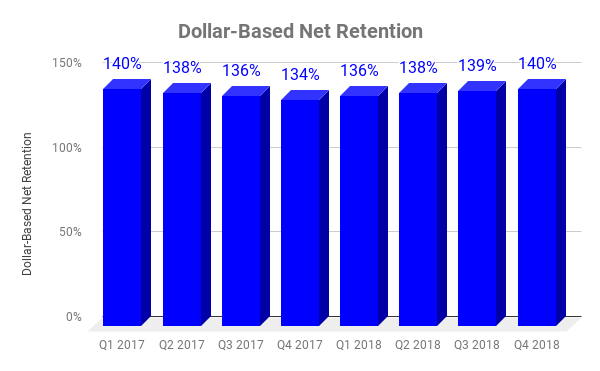

Perhaps no metric is more important to SaaS businesses than dollar-based net retention (DBNR). This measures the total amount of money that a cohort of customers brings in in year one, and compares it to year two.

By filtering out the effects of new customers, we know if customers are staying with PagerDuty (DBNR near 100%), and/or if they are paying the company more year after year (DBNR well over 100%).

PagerDuty has very high marks in this regard, likely thanks to the tiered pricing covered above.

Chart by author. Data source: SEC filings.

Think about this for a second: A company paying 40% more every year is buying more solutions for more users from PagerDuty. Not only does this help the bottom line, but it widens the moat around PagerDuty via high switching costs.

No one would want to go through the trouble -- in terms of financing, retraining employees, or giving up mission-critical data -- of switching providers unless they absolutely had to.

What leverage looks like

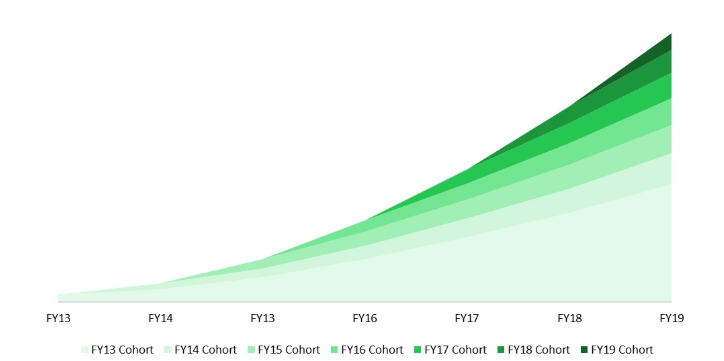

When you put all of these pieces together -- network effects, tiered pricing, and high switching-costs -- this is what you see: rapid growth from every cohort of customers signing up over time:

Image source: SEC filings.

A long-term view for investors

This is the type of chart investors should love to see. And it's why I'm considering adding shares to my own portfolio in the month to come. It's true that recently public, unprofitable stocks can be very volatile. But by buying in small chunks and taking the long view, investors can gain outsized rewards.

More From The Motley Fool

Brian Stoffel has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.