Paging the Murdochs: Expert Advice for Squabbling Billionaire Dynasties

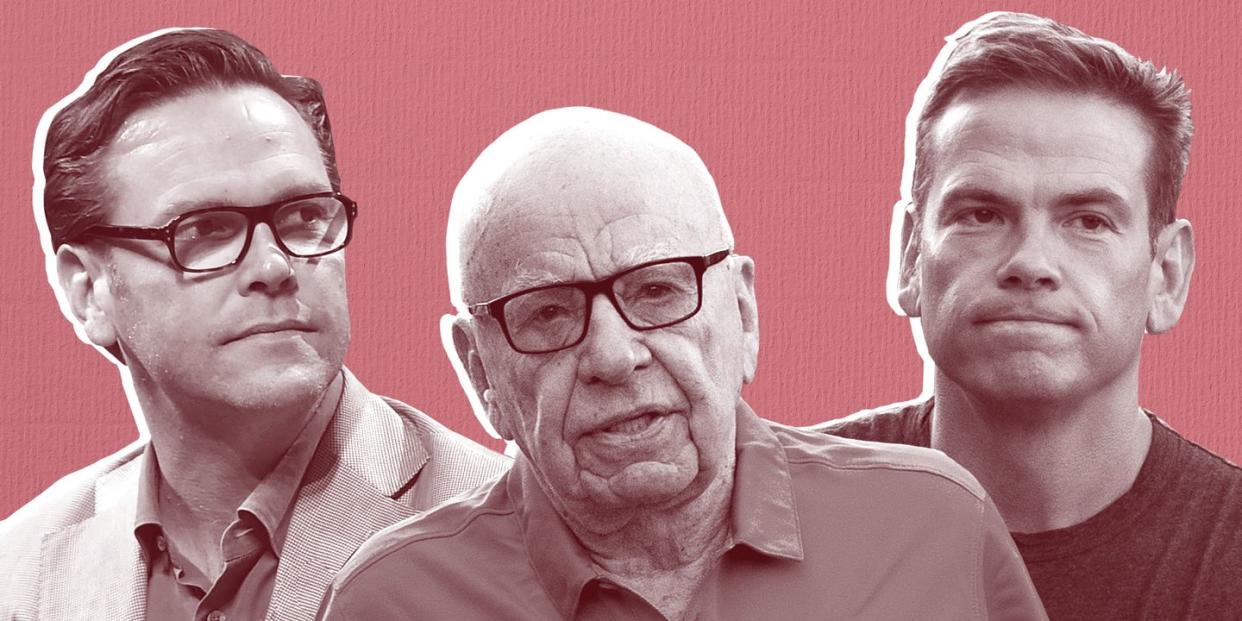

During the first season of Succession, HBO’s delicious drama about a squabbling billionaire family widely believed to be modeled on Rupert Murdoch and his children, it was unclear whether life was imitating art, or vice versa.

“We hate that they’re stealing our jokes,” producer Frank Rich recently joked in T&C about how the Murdoch siblings’ real-life power struggles mirror the fictional Roy clan.

In one set piece, the Roys submit to family therapy held at the eldest son’s New Mexico ranch. It didn’t go well. The episode aired nine months before a blockbuster New York Times report on the bitter battle for succession between Murdoch’s two sons, James and Lachlan, whom it claimed were “barely on speaking terms.”

“Murdoch tried to manage the tensions, arranging for group therapy with his children and their spouses with a counselor in London who specialized in working with dynastic families,” the Times reported. “There was even a therapeutic retreat to the Murdoch ranch in Australia. But these sessions provided just another forum for power games and manipulation.”

This tantalizing nugget raises more questions than it answers: When one sees “dynastic families” and “London” in the same sentence, it’s impossible not to wonder if the dysfunctional House of Windsor might also be clients. But it does shine light on the fascinating, little-known field of inter-generational counseling for gazillionaires.

Plutocrats who want to transfer empires to their children without causing a scene worthy of King Lear sometimes approach people like Patricia Angus, who is chief executive of Angus Advisory Group, as well as founding managing director of the Family Business Program at Columbia University.

Since 1993, she has worked with dozens of families–many with famous names, although she won’t say who–with a combined net worth in the billions.

“I work with families who have multigenerational businesses, trusts, and foundations, to help them think strategically across generations,” she says, speaking over the phone from her office on Manhattan’s Upper West Side.

Angus has worked all over the world, and in vastly different cultures, including Asia, Latin America and the Middle East. Sometimes the meetings take place at a resort or family homestead, other times in the conference room of a hotel. But what ultra-wealthy people have in common with each other, and the rest of us, is the complicated nature of family relationships.

“The fundamental parent-child dynamic; sibling dynamic; power struggles, identity, control, culture-that's all the same,” she says. “What's different is the magnitude of the consequences of those conflicts, and also the complexity of the issues.”

Angus is a wealth adviser, not a therapist-although sometimes the two fields overlap.

“You will always have the psychological and emotional issues on the table no matter what family you’re working with,” she said. “There's a misperception that life is easy as a member of a family that has such great holdings.”

Hugely successful people, of course, often have egos to match-and not all of them want to listen to a consultant. “Imagine trying to give advice to somebody who has spent their whole career doing stuff that people told them not to do,” says Angus.

She mentioned one family (not her own clients) whose dispute over assets was so bitter that two members split a pair of earrings. But unlike regular families, who may bicker over who gets the silverware, Angus works with dynasties who control global empires.

“The world's resources, especially in the last 10 years, have been heavily consolidated in the hands of a very small number of families,” she says. “You could easily say 75 percent of the world's businesses are owned by families. Anything that happens in those families affects every one of us on a personal basis.”

One clan Angus will discuss by name is the Pritzkers, heirs to the Hyatt Hotel fortune, who offer an epic cautionary tale in plutocratic dysfunction. She never worked with them directly, but using publicly available information she made their schism the subject of her 2014 scholarly work, Pritzker Family Enterprise: A Family Governance Case Study.

“There were three generations of patriarchs who were calling all the shots and making decisions for the family,” she says.

But when Jay Pritzker died in 1999, four years after laying down his blueprint for succession, the heirs rebelled and began suing each other. The resulting feud splintered the family’s assets and lead to what one report called “the destruction of a great American fortune.”

Given that the extended family is currently worth $29 billion, that may have been an overstatement. Nonetheless, it dragged a famously press-shy branch of the American aristocracy through both the courts and the tabloids, tarnishing their name for generations.

Today, Angus’s field exists so that other ultra-wealthy families can avoid the same fate-if, unlike the Murdochs, they choose to listen.

“Are the rich really different from you and me,“ Angus asks rhetorically. “The issues they are facing have more complexity legally, financially and often emotionally. But they’re not so far off that the families interact differently from everybody else.”

('You Might Also Like',)