A Pair of Regional Banks Offering 25% Total Return Potential

- By Nathan Parsh

One feature I like to use to help evaluate potential investments is the GuruFocus Fair Value Line, which seeks to estimate the current intrinsic value of a security. The GF Value incorporates:

Historical multiples, including price-earnings and price-to-free-cash-flow.

A GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business performance.

In this article, we will explore two regional banks that currently offer at least a 25% total potential for returns based on the current price compared to GF Value.

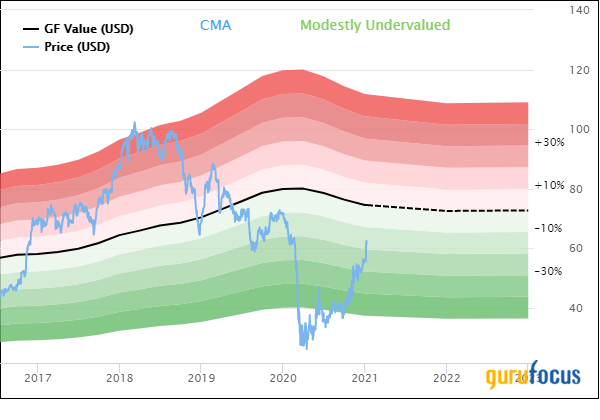

Comerica Incorporated

Comerica Incorporated (NYSE:CMA) is a financial services company with operations in California, Michigan and Texas. The bank also offers select services in several other U.S. states along with Canada and Mexico. Comerica has a market capitalization of $8.5 billion and generated revenue of $3.35 billion in 2019.

Comerica has increased its earnings per share with a compound annual growth rate of nearly 26% over the last decade. This is somewhat misleading as the start of this period of time was directly after the last recession, when the bank had cut its dividend. However, even over the last five years, the growth rate is still almost 23%, though much of this growth has occurred in the last two years. A lower share count has helped, but net profit has a CAGR of more than 18% from 2015 through 2019. Analysts surveyed by Yahoo Finance expect EPS to grow 10.4% to $2.96 in 2020.

The bank cut its dividend twice in the last recession for a total reduction of 92%. Comerica had raised its dividend for nearly four decades prior to this. The dividend did begin to grow again in 2010, but did not make a pre-recession high until just last year. Comerica has raised its dividend for 11 consecutive years.

Dividend growth over the last decade has been robust with shareholders seeing a CAGR of 27%. That growth has slowed in recent years. Following three separate raises equaling a total of 100% in 2018 and an 11.7% increase in 2019, Comerica raised its dividend just 1.5% in 2020. Perhaps this is more of a positive given that many of the large financial institutions did not raise their dividends in 2020.

With a current annualized dividend of $2.72 and a current share price of $61.38, Comerica has a yield of 4.4%. This compares very favorably to the stock's 10-year average yield of 1.8%. For context on how unusually high the current yield is, this would be the stock's highest yield since before the last recession if Comerica were to average it for the entire year.

Using the annualized dividend and expected EPS for the year, Comerica is projected to have a dividend payout ratio of 92%. This is well above the 10-year average payout ratio of 27%. The bank's EPS have been significantly impaired by the pandemic. This could help explain why shareholders received a smaller than usual raise this year.

For those willing to see past the near term, Comerica could be an excellent investment opportunity:

Comerica has a GF Value of $74.44. Using the most recent closing price, shares trade with a price-to-GF Value ratio of 0.82. This earns the stock a rating of modestly undervalued from GuruFocus. Investors could see a return of 21.3% from current levels. Add in the dividend, which would be 3.7% at the GF Value, and the total return could be 25%.

Comerica did cut its dividend significantly during the last recession, but the growth since has been very impressive. A recovery from the pandemic would likely mean a more normalized business performance.

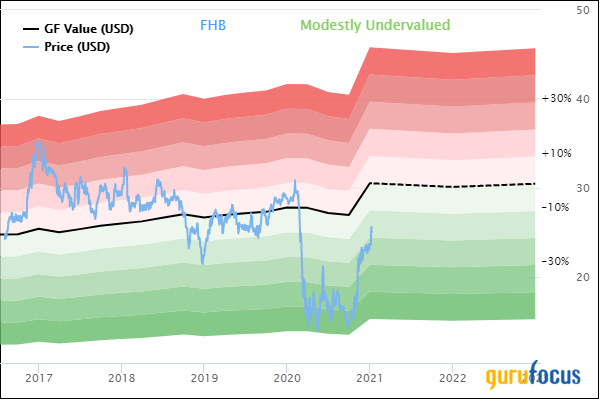

First Hawaiian, Inc

First Hawaiian, Inc (NASDAQ:FHB) is a bank holding company for First Hawaiian Bank, which was founded in 1858. The bank has 53 branches in Hawaii, three in Guam and two in Saipan. First Hawaiian provides banking services to consumer and commercial customers, including deposits, loan services and wealth management. The bank has a market capitalization of $3.25 billion and generated sales of $573.4 million last year.

First Hawaiian only recently became a publicly traded company, as the bank had its initial public offering on Aug. 4, 2016. EPS has increased with a CAGR of 7.1% since then, in part due to a lower share count in certain years. Net profit has improved at a rate of 5.4% per year from 2016 through 2019. Analysts believe that EPS will decrease 34.3% to $1.40 in 2020.

The bank had increased its dividend each year since its IPO, but paused its growth in 2020. Shareholders have received the same $0.26 per share dividend for eight consecutive quarters. First Hawaiian has a dividend growth of 4.3% for the four full years that the bank has been publicly traded.

The annualized dividend of $1.04 equates to a dividend yield of 4.2% using Friday's closing price of $25.02. This is higher than the average yield of 3.4% that shares have traded with over the last four years.

Based off the annualized dividend and projected EPS for 2020, First Hawaiian has an expected payout ratio of 74%. This is above the four-year average payout ratio of 54%. As with Comerica, First Hawaiian's expected payout ratio for 2020 is much higher due to Covid-19 related economic weakness.

First Hawaiian also appears to offer a good reward potential:

The bank's GF Value is $30.52. Using the most recent price, shares have a price-to-GF Value ratio of 0.82. First Hawaiian is rated as modestly undervalued. Reaching the GF Value would result in a 22% gain in the share price. At the GF Value, the dividend yield would be 3.4%. This could mean that shareholders have the potential for total returns of 25.4%.

First Hawaiian is very much in its publicly traded infancy, but it has been in existence for a very long time and is Hawaii's largest bank. The bank's dividend is not recession tested, but dividend growth was evident prior to the pandemic. First Hawaiian might be better suited for investors with more of a risk appetite due to its limited public history.

Final thoughts

Comerica and First Hawaiian are two regional banks trading well below their GF Values. Each bank has some question marks. Namely, Comerica's dividend didn't survive the last recession and took almost a decade to make a new high. First Hawaiian has a very short publicly history and paused its dividend growth last year.

That being said, EPS and dividend growth rates have been at least solid for both names prior to 2020. Both banks also offer total return potential of at least 25%. This provides a nice risk/reward propostion in my view.

Author disclosure: the author has no position in any security mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.