Palm Beach County looking for record millage rate cut to keep property tax bills from rising

Palm Beach County commissioners, concerned with the impact of another year of soaring property values on tax bills, are looking for a record millage rate cut this year to keep most property tax bills from rising.

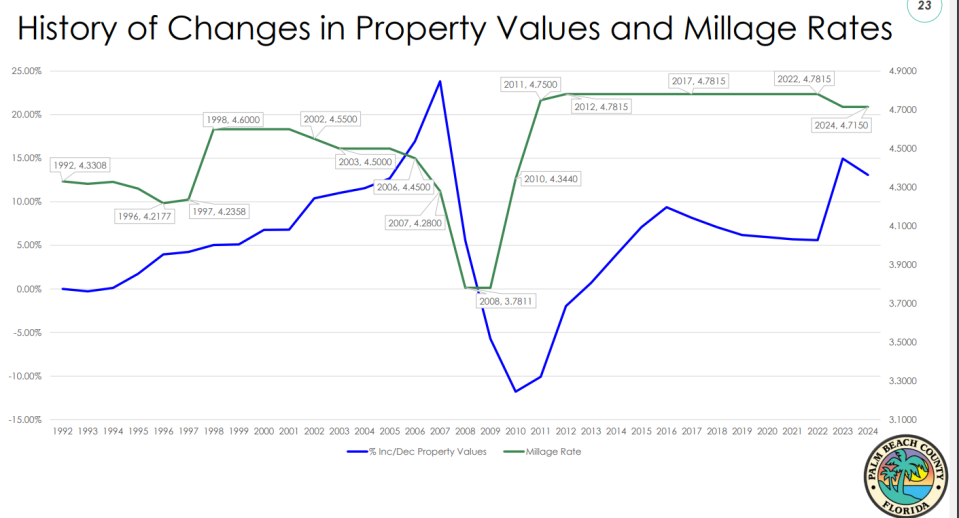

Under consideration is a 4.6% reduction, to $4.500 from the current rate of $4.715. The only larger percentage cut in the past 31 years was 12% during the great recession in 2008.

The county millage rate is applied to a tax base to raise funds for county government. The school district, county library and local government taxes will be in addition to the county levy.

The county staff was instructed during a recent budget meeting to examine the impact of a large millage rate cut. Last year’s reduction was a modest one of 1.4%, not nearly enough in most cases to make up for a property value increase of 13%, about the same as this year.

“Everything is going up,” said Commissioner Maria Marino. “If we keep the rate at the same level, we are raising the dollars people pay due to the higher assessments. I want to see the rate fall enough so that tax bills do not increase.”

She argued that a lower rate will accomplish two goals: stimulate economic growth and help address the region’s housing-affordability issue.

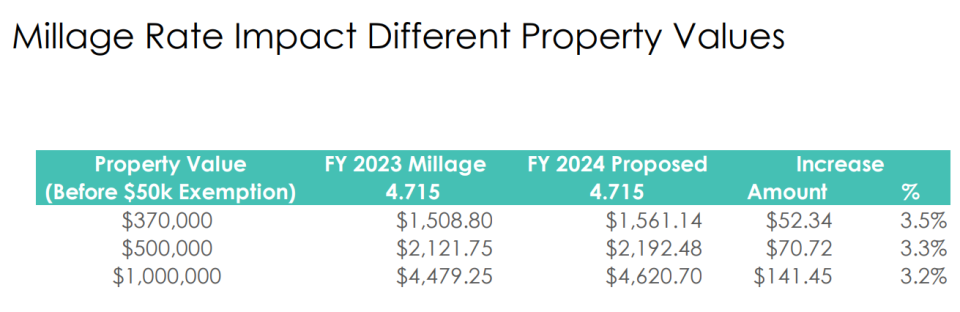

How much would a property owner of a $500,000 county home pay in property taxes?

If the millage rate stays at the same level of $4.715, a property with a value of $500,000 would pay a county tax bill of $2,192, an increase of $70. A property with a value of $1 million would generate a tax bill of $4,384, an increase of $140.

Marino’s proposed millage rate of $4.500 would, for the most part, wipe out tax-bill increases for homesteaded properties but because property values have risen so much, the rate would still provide a significant boost in county tax revenues, also called ad valorem taxes.

The current $4.715 millage rate would generate $1.4 billion in revenue for the county. For the rate to be brought down to $4.500, the spending plan would have to be reduced by more than $50 million.

So how could that be done?

Marino wants to use more reserve or surplus funds. She brushed aside concerns that doing so could impact the county’s triple-A bond rating. According to Marino, the fund balance was just 8% in 2013, and the county had a triple-A rating then. Today, the balance is more than 23%.

The proposed fund balance stands at $429 million, and some of that, she argued, could easily be diverted to the budget.

Marino said the county also must do a better job of looking at how many positions are absorbed once grants expire. And another source of savings is to eliminate vacant positions. She said there have been an average of more than 500 vacancies the past 26 pay periods. Eliminating half of them could save more than $20 million a year, she said.

Good or bad business? Using reserves to make up for lost property tax revenue

County Administrator Verdenia Baker cautioned against lowering the reserve, saying the county has the lowest reserve balance among triple-A rated Florida counties, and that it is well below the statewide average of 36%. It needs to be raised to bring it up toward the statewide average, Baker noted adding that the high bond rating saves millions of dollars in borrowing costs.

“The bond rating agencies look closely at what your peers are doing,” Baker said. “A higher reserve will help us cope with natural disasters or economic downturns.”

Marino responded by saying she has confidence in Baker’s ability to make the cuts needed to prevent homeowners from paying more in property taxes. Some takeaways from the current spending plan:

The county expects to raise salaries by 6%, a hike that will cost $17 million.

Twenty-three new positions will be funded with property taxes; most of them in Palm Beach County Fire Rescue.

The total expense budget for the sheriff’s office is $877 million, an increase of $53.5 million from the current fiscal year. The figure represents another record increase.

$85 million has been set aside for capital projects, an increase of $26 million.

With the significant increase in property values, most homesteaded properties will see their values rise to the cap of 3%. That is a rare event, according to county officials.

County Commissioner Sara Baxter said she was concerned with the impact of the increase on area businesses. They have no cap protection at all, making it difficult for them to cope with tax bills that can increase as much as 30%.

Commissioner Maria Sachs said county officials need to follow the lead of Tax Appraiser Dorothy Jacks, who again this year reduced her staff by relying on technology to do some inspections that once required in-person visits. She eliminated two positions.

After a lengthy discussion on the need to cut the millage rate, county commissioners heard an hour’s worth of testimony from residents who called for a budget to fund animal control and the county’s transportation needs.

More: Taxable property values up 13% to $289B in Palm Beach County amid hot market, new construction

More: Your property taxes: County millage rate cut, but soaring property values likely means higher taxes

Heather Smith, a volunteer at Palm Beach County Animal Care and Control, said overcrowding is such a problem that potential adoptees often walk out after seeing the deplorable conditions at the center, on Belvedere Road near Florida's Turnpike.

“Dogs and cats are going to die if don’t get them into foster care,” she said, noting that only three dogs were adopted during May. And with inadequate staffing, volunteers are placed at risk, she added.

Valerie Neilson, executive director of the Palm Beach Transportation Planning Agency, called on the commissioners to revamp the county's mass transit system to make Palm Tran more efficient. She said the agency needs to look at areas that are not performing well.

Neilson again called for the county to support a dedicated funding source for mass transit, noting that both Broward and Miami-Dade counties have done that to pay for their transportation maintenance costs. Doing so, she said, will allow the county to obtain significantly more federal funding.

County commissioners will set the millage rate on July 11. The first public hearing will be held on Sept. 7 and the final hearing on Sept. 26.

The county’s total taxable value now stands at $288.8 billion. Its "just" value, which includes, homesteaded property along with public property that is not taxed, is $481.5 billion.

Mike Diamond is a journalist at The Palm Beach Post, part of the USA TODAY Florida Network. He covers Palm Beach County government and transportation. You can reach him at mdiamond@pbpost.com. Help support local journalism. Subscribe today

This article originally appeared on Palm Beach Post: Palm Beach County looks to cut millage rate to keep tax bills from rising