Palm Springs will consider short-term ban on new cannabis dispensaries, plus other changes

The Palm Springs City Council could vote Thursday to temporarily bar new cannabis dispensaries while considering bigger changes for an industry some council members think has become oversaturated and unsustainable.

Among the changes the city could consider are a significant reduction in city taxes on cannabis sales, a prohibition on the transfer of permits and possibly even a cap on the number of dispensaries allowed in the city.

The idea of placing a moratorium on new permits has been brought up by council members and other figures multiple times in recent months, including by then-council candidate Jeffrey Bernstein during a candidate forum last year. Most recently, Councilmember Ron deHarte asked during an Oct. 12 meeting that the issue be brought before the council. Bernstein and Councilmember Lisa Middleton backed him.

The council received a presentation during its Sept. 26 meeting from city staff about recent declines in cannabis tax revenues and the many challenges facing the industry. Staff said then that they would bring before the council recommendations for regulatory changes to improve the viability of the industry.

How would a moratorium work?

In a memo ahead of Thursday's meeting, city staff recommend the council vote on an "urgency ordinance" to block any new permit applications from being considered for 45 days. At least four of the five councilmembers would need to vote for the moratorium for it to take effect right away.

The council could later vote to extend the moratorium for a total of up to 12 months. Applications submitted prior to Thursday would still be considered.

What changes could the council consider?

A staff report included in the agenda for Thursday’s meeting states that city staff are recommending the following changes to improve the cannabis market:

A citywide cap of 15 dispensaries to be reached over time through attrition

A prohibition on the sale or transfer of dispensary permits

A rule that would prohibit dispensaries that are not currently operational from renewing their permit

A new rule that would bar a person or company from operating more than one dispensary in the city (existing owners with more than one dispensary would be exempt)

If the council imposes a moratorium, it and staff could use the time to study these or other possible changes to laws and zoning rules aimed at managing the city’s cannabis industry and potential oversaturation within it.

Options could include reducing the taxes for production and sale of cannabis, which would make Palm Springs’ market more competitive with its neighbors. The council could also cap the number of cannabis businesses allowed in certain areas or citywide, similar to how it capped the number of short-term rentals in each of the city’s neighborhoods last year.

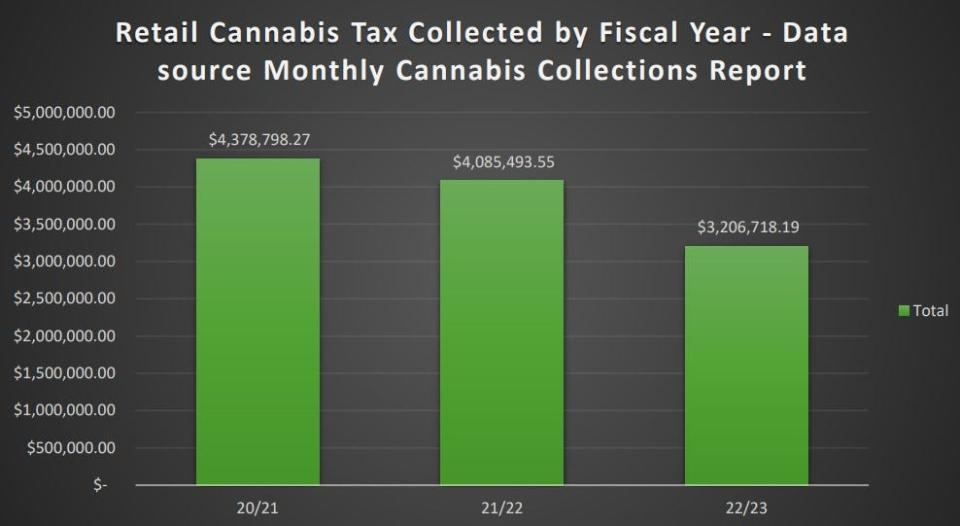

What's been happening with cannabis tax revenues?

In the first three years of legal recreational cannabis sales in Palm Springs, the amount of tax revenue generated grew steadily. The city netted $2.33 million in the 2018-2019 fiscal year, the first year of sales. Two years later, city cannabis tax revenues peaked at $4.77 million. But in the two years since, cannabis tax revenues have been dropping, to $4.22 million in the 2021-2022 fiscal year and then again to just $3.32 million in the 2022-2023 fiscal year, which ended in July.

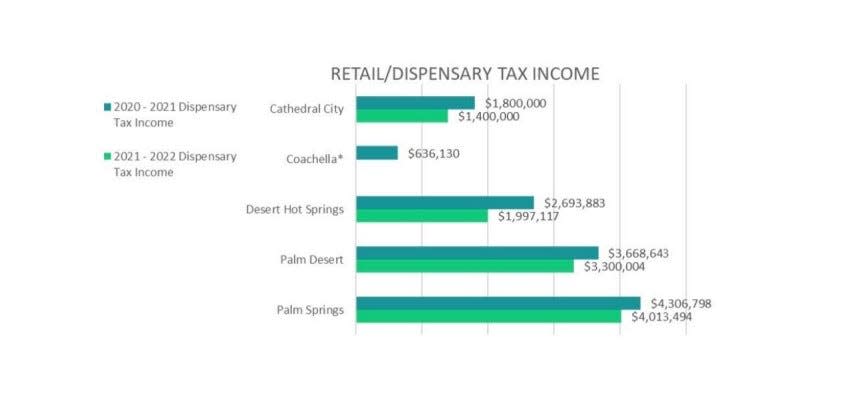

City leaders say cannabis tax revenues have been dropping in four of the five Coachella Valley cities that have recreational cannabis dispensaries, while recent data for the fifth, Coachella, was not available.

The Coachella Valley is also not alone: Cannabis revenues were down about 7% statewide in 2022 compared to 2021, although they are still up about 15% from 2020. Collections are flat roughly for the first two quarters of 2023 compared to the same period of 2022.

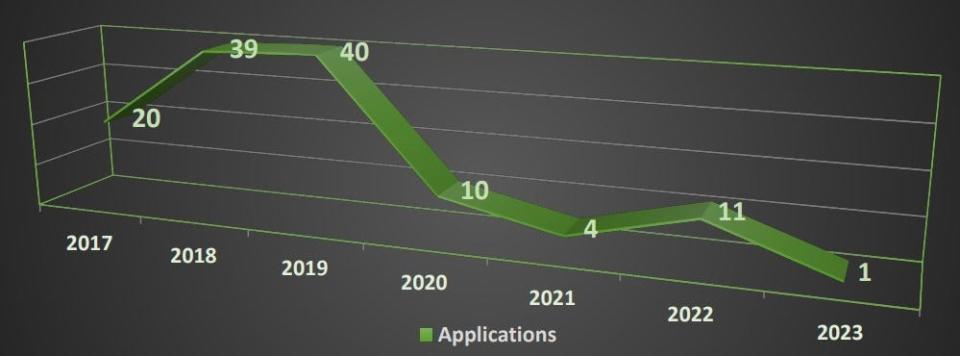

How many cannabis businesses does Palm Springs currently have?

The staff report appears to cite two different numbers of operating permitted dispensaries in the city: 33 and 24. The city’s Department of Special Programs, which collects data on cannabis, could not be reached Friday for clarification on the figure. However, the city shared data with The Desert Sun In January that pegged the number of retail cannabis businesses at 28 (including one delivery-only operation) — a number that equated to one per 1,600 permanent residents.

Is Palm Springs' cannabis industry oversaturated?

Based on data from various sources, Palm Springs seems to have one of the highest per-capita concentrations in the state and, possibly, the nation.

The staff report states that dispensaries in Palm Springs averaged $1.29 million in sales in 2021-2022, which was down from $1.7 million a year earlier. The city says that was the second lowest per-store number after Cathedral City, where stores averaged $1.16 million in sales.

Some who believe the cannabis industry is oversaturated point to the high number of closures: City records showed seven dispensaries shuttered in 2022. The owner of one, which was in business less than seven months, told The Desert Sun that the high number of dispensaries in the city had made his non-viable.

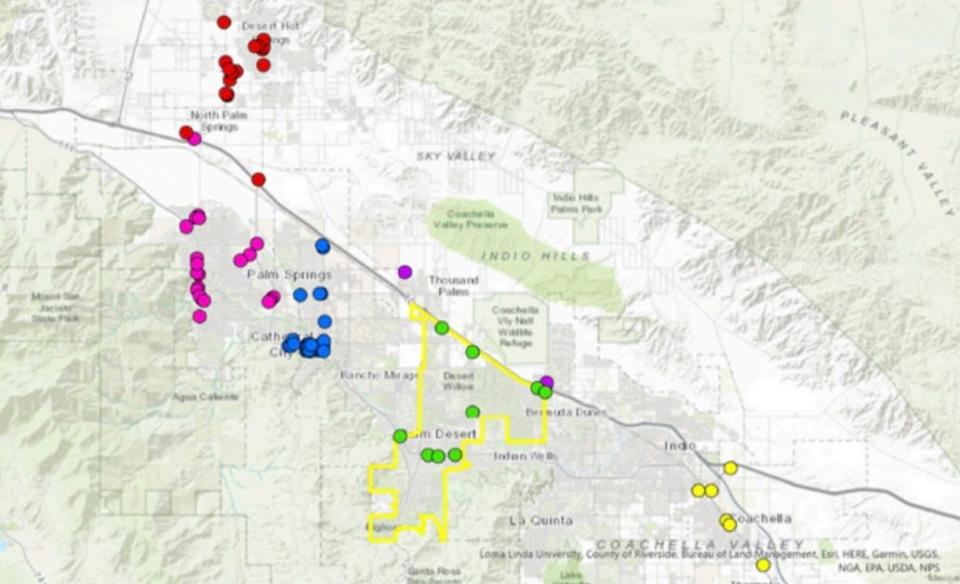

Dispensaries are also not evenly distributed throughout the city but instead concentrated in specific areas, especially Palm Canyon Drive, downtown and an area between Demuth Park and Ramon Road. Given that concentration, some voices in the community have called for the city to cap the number of dispensaries in certain areas.

Paul Albani-Burgio covers breaking news and the city of Palm Springs. Follow him on Twitter at @albaniburgiop and email him at paul.albani-burgio@desertsun.com.

This article originally appeared on Palm Springs Desert Sun: Palm Springs might temporarily ban new cannabis dispensaries