As pandemic subsides, now is a good time to improve your financial literacy. Here's where to start

Over the past two years, as the pandemic has touched all aspects of society, Americans have shifted their money behaviors and attitudes a bit. Early on, there was belt-tightening and reliance on stimulus checks, enhanced unemployment benefits and the like.

That gave way to revenge spending and YOLO, or "you only live once," attitudes.

Now, with the gradual winding down of the pandemic and a more normal economic backdrop in place, more Americans might return to the basics such as a possible renewed emphasis on saving and improving their financial knowledge or literacy.

A new Fidelity Investments survey suggests it may have already started, with many people recognizing that they're still not doing the right things with their money and conceding that they still lack financial knowledge.

For example, among the more than 2,500 respondents who are currently investing or saving, 51% said they're not putting away as much as they want, with 31% attributing it to a lack of knowledge about investing. And plenty of other people still aren't saving or investing at all, with only two in five respondents in a Bankrate.com survey saying they have enough money to cover a $1,000 unplanned expense.

In the Fidelity survey, budgeting/saving, inflation and retirement accounts were listed among the top topics Americans consider important for managing their finances.

Financial literacy always has been difficult to master for many people who struggle with budgeting, credit scores, debt, taxes and other issues. The heightened stock-market volatility of late, rising inflation and other trends also have exposed a need for financial education, said Roberta King, a Fidelity Investments vice president.

The study also found that people who work with an adviser follow better money habits, such as prioritizing long-term goals. Yet many advisers don't deal much with the people who need it the most — beginners and those living paycheck to paycheck.

Proposition 208 ruling: What to know about filing taxes

In-person assistance grows knowledge

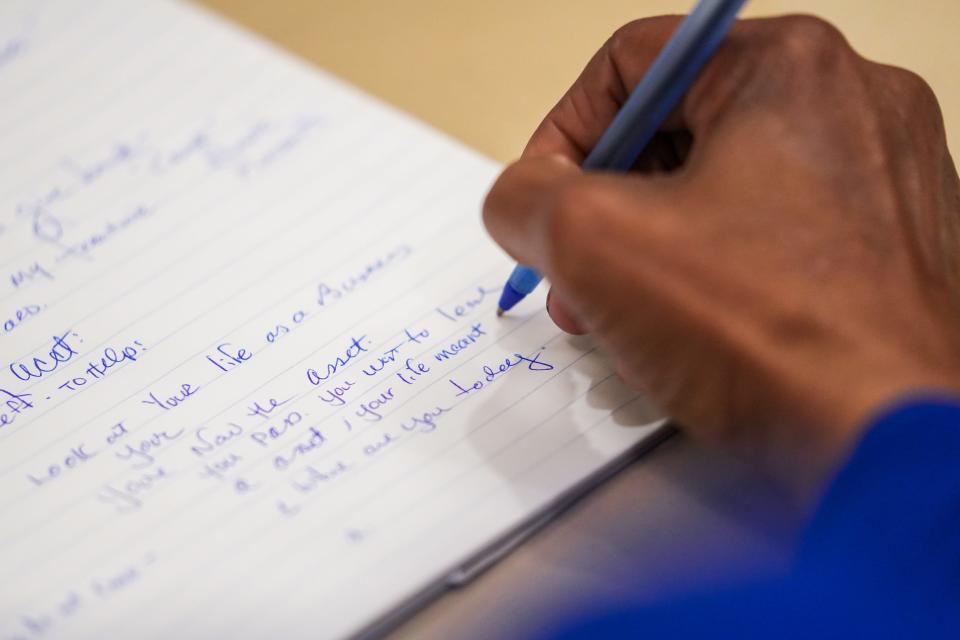

Karen Tucker is striving to improve her money knowledge. She has attended a series of free financial literacy courses sponsored by the Salvation Army at its Ray and Joan Kroc Center in south Phoenix. Tucker, an Ahwatukee resident, said she’s trying to prepare for retirement while living with two children at home.

“I need to be able to teach them financial literacy, and I need more information for that,” she said, citing budgeting, spending decisions and debt payments in particular.

“It’s about being accountable for money, down to what you spend on coffee every day,” Tucker said. “When you can take care of yourself, you’ll feel better.”

Kyli Alvarez, a Tolleson resident who recently graduated from college but still lives at home while working part-time, said she wants to learn how to pay off her student loans, manage her credit cards and prepare for living on her own.

Like many people, “I didn’t learn a lot of this in college,” said Alvarez, who also has attended the classes.

Trying to spark an interest

Phalen Booker, an Edward Jones adviser in Scottsdale who taught a recent class, touched on a variety of topics including assets and liabilities, investing basics, some insurance fundamentals, the importance of paying bills and building a good credit score. That's a lot of ground to cover in a one-hour session.

“I’m just trying to give them a foundation that hopefully sparks their interest,” he said. “It’s more like a skeleton; I’m letting them put the meat on the bones.”

Booker said he, too, got a late start learning about personal finance. “Money wasn’t discussed in our house,” he said. “It was pretty much taboo.”

He suggested further reading for the students, citing favorite personal finance books including Dave Ramsey’s “The Total Money Makeover,” Robert Kiyosaki’s “Rich Dad Poor Dad,” Tony Robbins’ “Unshakeable: Your Financial Freedom Playbook” and “The Millionaire Next Door” by Thomas Stanley and William Danko.

Recession incoming?: These are the key signs to watch

Much more to learn

One ongoing challenge with financial literacy is that the topics continue to grow in number and complexity. For decades, numerous types of investments, bank accounts, borrowing options, homeownership tips and more were available.

Now there are cryptocurrencies, NTFs or non-fungible tokens, credit-scoring complexities, more workplace retirement benefits, health-plan complications, identity-theft threats and an ever expanding federal tax code.

One point Booker emphasized was to learn the basics, especially for beginners, and avoid investing in areas with which you're not familiar.

"You could accumulate so much more if you were a little more diligent, invested a little more and had a better idea of what you're investing in," he said.

Another difficulty is that financial education often falls on deaf ears unless people have skin in the game. That is, if you don't have enough money to invest, you probably don't care whether value or growth stocks might be the better bet right now.

Fewer 'feel good' purchases

As for people who already are active investors, a majority of respondents in the Fidelity study are expressing more of a conservative bent, though that also could reflect a tougher stock market climate so far in 2022. For example, more respondents said they are prioritizing long-term gains over short-term trades and focusing more on lower-risk, lower-reward investments.

Many respondents also said they are trying to build an emergency fund over spending money on things like travel, and they're striving to save more for retirement over making "feel good" purchases.

Much of it starts with budgeting — learning how to limit expenses below your income. Once you can build up a cash surplus, you can get that emergency fund in place to meet unexpected costs without relying on credit cards or other short-term loans. Eventually, you can start investing for long-term goals such as retirement planning.

Now is a good time of year to build an emergency fund. Tax refunds, the largest sum of cash many people will see all year, provide a catalyst.

Individual tax refunds were averaging roughly $3,400 through early March, and 46% of respondents to a recent LendingTree survey said they planned to save their refunds, up from 41% last year. Most of the rest planned to use their refunds to pay down debts.

Reach the reporter at russ.wiles@arizonarepublic.com.

Support local journalism. Subscribe to azcentral.com today.

This article originally appeared on Arizona Republic: Looking to improve your financial literacy? Start here