Some Paradise Entertainment (HKG:1180) Shareholders Have Taken A Painful 80% Share Price Drop

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held Paradise Entertainment Limited (HKG:1180) for five whole years - as the share price tanked 80%. Furthermore, it's down 10% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 7.3% in the same period.

Check out our latest analysis for Paradise Entertainment

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Paradise Entertainment moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

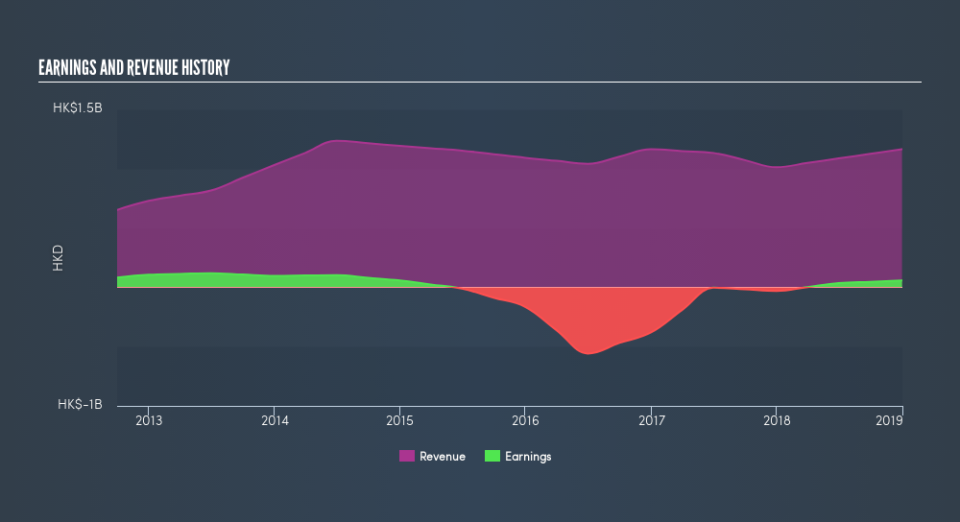

The revenue fall of 1.2% per year for five years is neither good nor terrible. But it's quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Paradise Entertainment's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Paradise Entertainment's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Paradise Entertainment's TSR, which was a 79% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We're pleased to report that Paradise Entertainment shareholders have received a total shareholder return of 27% over one year. And that does include the dividend. That certainly beats the loss of about 27% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Before deciding if you like the current share price, check how Paradise Entertainment scores on these 3 valuation metrics.

Of course Paradise Entertainment may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.