Some Pareteum (NASDAQ:TEUM) Shareholders Have Taken A Painful 87% Share Price Drop

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Imagine if you held Pareteum Corporation (NASDAQ:TEUM) for half a decade as the share price tanked 87%. Furthermore, it's down 37% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Pareteum

Given that Pareteum didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Pareteum saw its revenue increase by 15% per year. That's better than most loss-making companies. So it's not at all clear to us why the share price sunk 34% throughout that time. You'd have to assume the market is worried that profits won't come soon enough. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

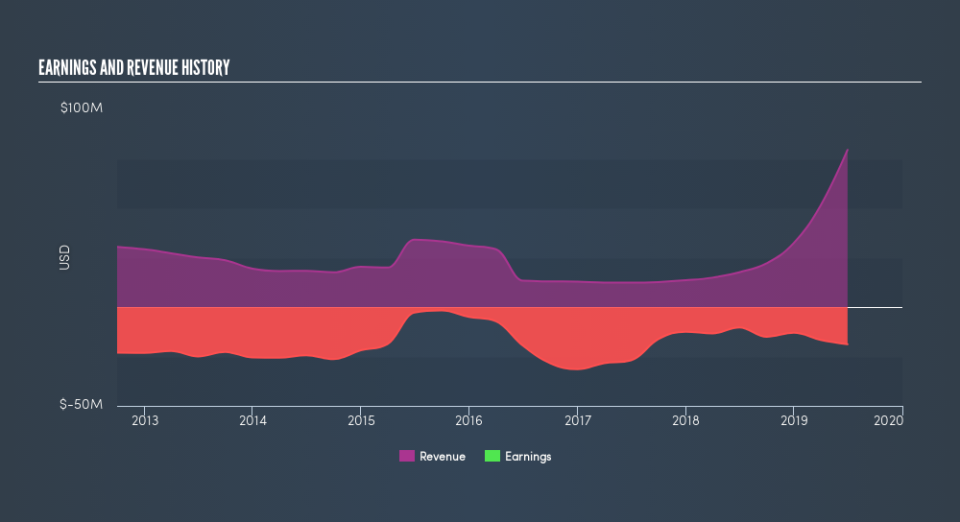

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Pareteum's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Pareteum has rewarded shareholders with a total shareholder return of 13% in the last twelve months. Notably the five-year annualised TSR loss of 34% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. You could get a better understanding of Pareteum's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Pareteum may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.