Pasco property values are soaring. What does it mean for your next tax bill?

Franklin County residents may be getting some sticker shock soon when they see their 2023 home appraisal values.

That’s because the valuations are being brought up to market value rates through the end of 2022. That was before interest rates helped the record high markets cool down a bit in the Tri-Cities.

Unlike the Seattle area, Tri-Cities area homeowners shouldn’t expect to see their assessed values take a dip.

Franklin County valuation change notices — for all of the county, including Pasco, Mesa, Connell and unincorporated areas like Eltopia — are being mailed now and residents have until July 3 to appeal.

Benton County residents can expect to see their changes come in around August.

Undervalued homes

Franklin County homes were on average undervalued by about 15% because the prior assessed values came in at nearly 85% of market value.

Washington state law requires appraisals to be brought in line with market values each year, based on what properties actually sold for in the area.

Franklin County Assessor John Rosenau said various factors can impact a home’s assessed value, and each neighborhood will have distinct differences.

That average does not mean all homes in the county were undervalued and will be adjusted.

The values are based on home sales in 2022, so cooling markets this year won’t be factored in.

Travis Davis, president of the Tri-Cities Association of Realtors, said it’s important to remember that assessed values trail actual sales because of a Jan. 1 cutoff, and may not always reflect current trends happening with market values.

Tax bill impact

Will this impact my taxes?

The simple answer is yes, but the amount your home value changes may not be the same percent property taxes will increase next year.

In most cases property taxes are due by April 30, but homeowners can pay half up front and the rest by Oct. 31 of each year.

This “Change of Value” will just give you the number which taxing districts will use to base their levies on next year.

The assessor doesn’t set your property taxes, though.

They’re set by the individual taxing districts where your home is located, so the amount due each year can vary based on many factors such as levies, bonds, public safety and other taxing districts.

Typically changes to property taxes require voter approval. In Washington levy collection is capped at a 1% increase per year from the prior year’s budget unless voters approve collection beyond that 1%. That means more rooftops helps limit the increase in property taxes from year to year.

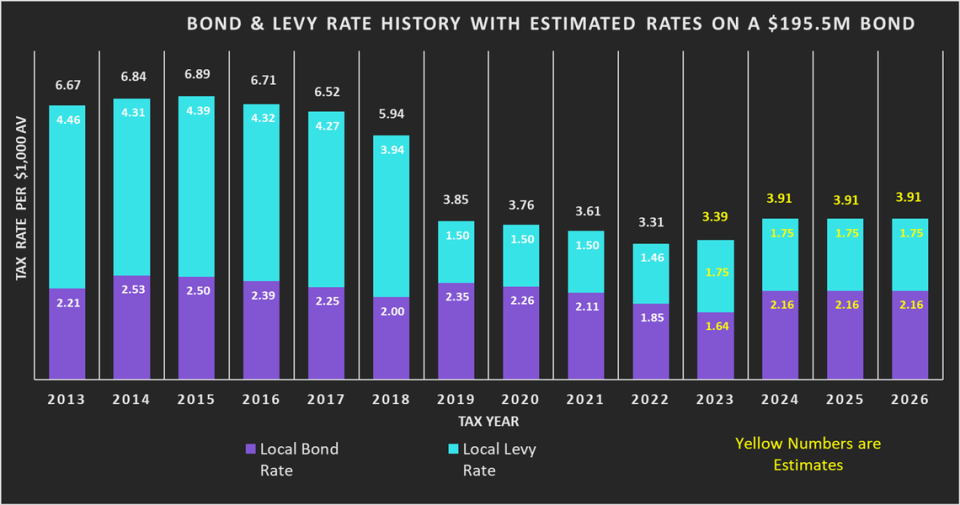

For example, homeowners in the Pasco School District will see an estimated increase in their tax bills of about 51 cents per $1,000 of assessed property value.

That’s because they renewed the district’s operating levy and approved a 21-year bond to build a new high school, small career academy and other projects.

Residents in the Finley and Kennewick school districts saw a drop in their taxes this year because they initially voted down their school levies last year before approving them in 2023. Homeowners will see that back on their tax bills next spring.

Rosenau explained that the assessor’s office has no control over the tax rates, but if homeowners feel their home has been overvalued, they can contact the assessor’s office to be sure.

“The big thing is that if they have questions they need to call our offices, the worst thing they can do is speculate what’s not fair or how they perceive it,” Rosenau said. “It may be that there’s something about their property or their home we don’t know. We want to know that if our data isn’t right. We want to correct that.”

The assessor’s office can be reached at 509-545-3506 or by emailing assessor@franklincountywa.gov.

Determining assessed value

The assessed value of a home is based on its market rate, meaning the value it could sell for based on what homes in your area have sold for.

Your home can increase in value through remodeling and renovation or drop in value if damaged in a fire or natural disaster.

Changes in growth in your area can also cause your assessed value to grow or decrease.

If your neighborhood suddenly finds itself next to a hot new development, you might expect to see it lift your property’s value as well.

In Washington, counties are divided into zones, and one zone per year will have physical assessments done by county employees.

All zones receive updated assessments every year, but the one in-cycle will have records such as photos updated. Updates in the zone physically inspected each year does not impact other zones.

An area is considered “conforming” to the Department of Revenue’s Real Property Ratio if assessed values fall between 90% and 110% of prior year market values.

Because Franklin County averaged almost 85%, many areas should expect to see their assessed values shift to reflect more accurate market values.

It does not mean that all properties in Franklin County must increase in assessed value by 15%.

In some areas, new assessments may have been within the conforming range, and might not see major changes. For example, the Kahlotus area was at 99%.

Data about the home sales that helped determine market value in individual neighborhoods can be found on the Franklin County Assessor’s Office website.

Cooling market

Homeowners may have seen recent headlines that home values are dropping elsewhere in Washington and nationally.

Is that likely to happen in the Tri-Cities? Probably not.

The Tri-Cities market is particularly resilient. It is one of the few in the state that saw no loss in property values after the 2008 financial crisis that hit so hard in many other places.

While other metro areas took until 2013 or 2014 to recover to pre-crash prices, values in the Tri-Cities just held steady.

Davis believes this cooling market is no different.

“I think we’ll just remain steady, I don’t think we’ll have a dramatic drop,” he said. “We’ll have a plateau for a while, a year or two. I think with the prices kind of flat-lining and inventory staying low, I don’t think there’s going to be a whole lot of relief expected.”

Builders in the Tri-Cities have struggled to keep up with growth for years, leaving the market with a very lean inventory.

It reached critically low levels during the buying boom during the pandemic and only recently started to ease back up.

Builders also were stymied by shifting supply chain issues, which kept homes from being completed on schedule.

Davis said that the best shot the Tri-Cities area has for home values to drop is for a lot more homes to be added.

Tax exemptions

Some homeowners also will become eligible for exemptions this year. That could be because of factors such as being 61 or older, disability or because income requirements have shifted.

Rosenau said that increasing median household income in Franklin County means that the number of homeowners eligible for exemptions is going to expand, as the income requirement raises along with the median household income of the county.

A variety of factors can play into whether someone is eligible for an exemption, and then the amount can vary by levels of qualification.

For example, a person at the lowest level can qualify for exemption from municipal and school excess levies. Higher levels exempt a homeowner from the excess levies, plus taxes on a portion of the regular levy for as much as 60% of the home’s assessed value.

That means the income threshold for exemptions will increase significantly, Rosenau told the Herald.

“It will change this year. (The threshold) is going to be considerably higher this year going forward,” he said. “It certainly will help a lot of people.”

The new income requirements for exemptions should be released later this summer. Growth in Benton County means residents there can also expect to see their exemption income limits increase.

The state also offers deferrals for homeowners with qualifying events such as loss of income or disability.

The Benton County Assessor’s Office told the Herald they expect to finish their assessments by the end of July, with change of value information going out shortly after.