The past year for Carrier Global (NYSE:CARR) investors has not been profitable

Carrier Global Corporation (NYSE:CARR) shareholders should be happy to see the share price up 14% in the last quarter. But that is minimal compensation for the share price under-performance over the last year. In fact, the price has declined 19% in a year, falling short of the returns you could get by investing in an index fund.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for Carrier Global

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the Carrier Global share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

With a low yield of 1.3% we doubt that the dividend influences the share price much. Revenue was fairly steady year on year, which isn't usually such a bad thing. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

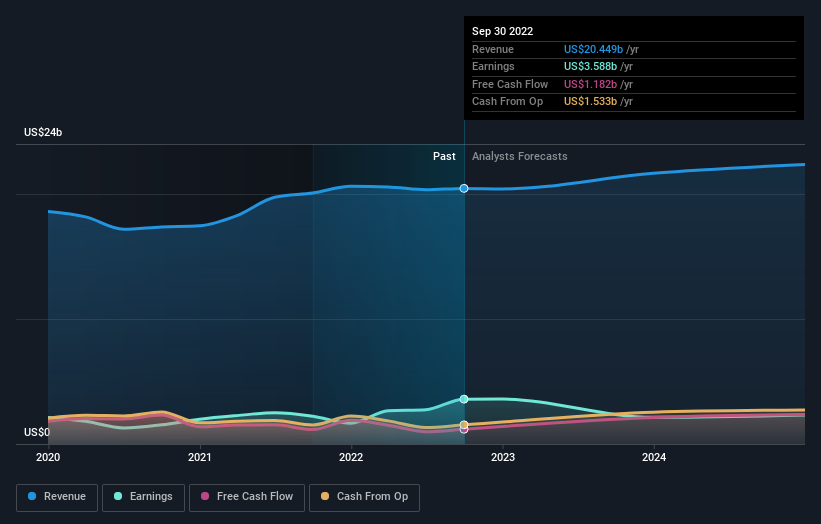

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Carrier Global is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Carrier Global stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Carrier Global shareholders are down 18% for the year (even including dividends), even worse than the market loss of 15%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Putting aside the last twelve months, it's good to see the share price has rebounded by 14%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Carrier Global better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Carrier Global you should be aware of, and 2 of them are potentially serious.

We will like Carrier Global better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here