Paths to homeownership: Daytona housing fair to help first-time buyers amid record prices

DAYTONA BEACH — As home prices continue to soar, several Realtors and other industry professionals are working with the nonprofit Mid-Florida Housing Partnership to help first-time buyers achieve their dream of becoming homeowners.

On Saturday, they will hold the 2022 Housing Fair & Financial Clinic in the parking lot of the Allen Chapel AME Church in Daytona Beach.

The event from 10 a.m. to 2 p.m. will inform the public about options for financial assistance as well as pointers on how to improve their chances to qualify for a mortgage loan.

"We hold the housing fair in observance of April Fair Housing Month," said Lydia Gregg, assistant director of the Mid-Florida Housing Partnership. "This fair is a great place to come and find out about the steps needed (to qualify for a mortgage loan and/or other financial assistance). It's a process. You don't just snap your fingers and become a homeowner overnight."

The U.S. Fair Housing Act was signed into law in April 1968 to protect Americans from facing discrimination in selling or buying homes.

This weekend's event will be the first time that the Housing Fair & Financial Clinic will be held in Daytona Beach since 2019. The annual event was put on hold when the COVID-19 pandemic broke out in early 2020.

Since then, the Volusia-Flagler area has seen home prices climb to unprecedented heights.

HOT TO HANDLE: Report ranks Daytona 25th most 'overheated' housing market

HEAT CHECK: Volusia-Flagler area Realtors outnumber listings 3-to-1

LONG-TERM VIEW: How long can the housing market stay on a roll?

ADDRESSING THE PROBLEM: Council considers ways to create more affordable housing

Area home prices set new records

The median sale price for existing single-family homes sold in March jumped to new all-time highs locally, up 20.4% to $330,000 in Volusia County, from $274,000 a year ago, and up 30.8% to $369,000 in Flagler County, from $282,095 the same month last year, according to the latest monthly Realtor association reports.

Of the 1,077 closed sales in March reported by Realtors in Volusia County, only 25 were for less than $150,000, according to countywide data provided by the West Volusia Association of Realtors.

In Flagler County, of the 307 closed sales in March, the number of houses less than $150,000 totaled just one, according to the Flagler County Association of Realtors.

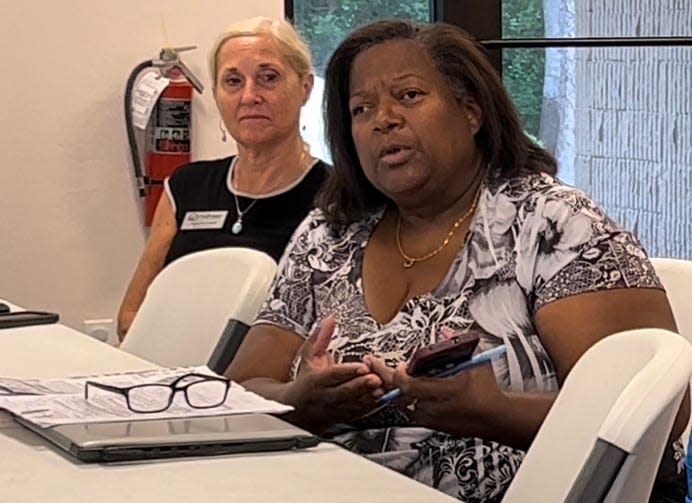

"The housing fair is more important than ever for our locals," said Marsha Evans Cooksey, an agent with Realty Pros Assured who serves as this year's board president for the Daytona Beach Area Association of Realtors. Rising home prices, combined with the recent increase in average rates for new mortgage loans, "has made this issue (the need for affordable and workforce housing) far more challenging."

While worker pay has been slowly rising locally, overall wages in both Volusia and Flagler counties remain below both statewide and national averages.

Home prices are rising faster than wages thanks in large part to the steady influx of newcomers which is causing the demand to far exceed the supply of available properties.

In addition, many of those newcomers are buying homes with cash. In March, all-cash deals accounted for nearly one out of every three of the homes sold in both Volusia (338) and Flagler (97) counties.

That has made it extremely difficult for would-be first-time homebuyers, especially with the number of available homes in both counties hovering at or near all-time low levels. As of the end of March, Volusia County just had 823 active listings of existing homes for sale, down 12.7% from a year ago, while Flagler County only had 258, down 18.9% from the same month last year.

Help available to bridge 'affordability gap'

Down-payment assistance programs offered by Daytona Beach and other area cities as well as Volusia County can help "bridge the affordability gap because when you're at a low to moderate income, the affordability gap keeps growing as those shocking (home sale price) numbers keep going up," said Gregg. "Subsidy is absolutely needed to bridge that gap."

Lucy Stewart Desmore, an agent with Realty Pros Assured, serves as both a member of the Housing Fair Action Committee as well as chair of the Daytona Beach Area Association of Realtors' newly formed Housing Opportunities Committee.

The formation of the Housing Opportunities Committee was an initiative of the DBAAR's board president for 2021: Alisa Rogers, a broker associate with Lifestyle Realty Group.

Desmore said those attending this year's Housing Fair will also be able to learn about the new trend of so-called "tiny homes" as a potential more affordably priced housing option.

"Tiny homes is just a slang word," said Desmore. "It is very much preferred when you are presenting to the various government municipalities that you use the term 'small footprint homes.'"

Desmore said the Housing Opportunities Committee is pushing for the launch of a pilot program in Daytona Beach that could create up to three dozen small footprint homes that could range in size from 430 to 600 square feet and be priced at $150,000 or less.

Newton White, a Realtor with Herb Lubansky Realty, said he was "amazed" at a presentation he saw on small footprint homes and is also urging the city of Port Orange, where he lives and serves on the Planning Commission, to consider a pilot program as well.

Currently, building codes in Volusia County as well as most of its cities require traditional homes to be at least 740 square feet in size, said White. He hopes to convince Port Orange as well as other local cities to change that minimum size requirement to allow for the construction of small footprint homes.

"There is a tremendous need," he said.

Area rents also on the rise

Amaya Albury, a Realtor with EXP Realty, noted that rental rates for apartments and homes locally have risen sharply in the past year, which is all the more reason to encourage more people to buy instead of rent a home.

Many "have a mindset that that have to rent" because they can't afford to buy a home, she said. The problem with that line of thinking is the fact that rental rates locally "have increased 30%" in the past year, with further increases likely as more relocate here.

"A lot of times, we've found that (monthly mortgage loan payments) is actually cheaper (than average monthly rents)," she said.

Homeownership also has other benefits, said White. "A survey released in 2020 by the Federal Reserve found the difference in median household net worth between homeowners versus renters is staggering. For homeowners, it was $255,000 while renters had a median net worth of just $6,300. If we can get people to be homeowners rather than renting, we're really promoting financial health in our community."

IF YOU GO

WHAT: 2022 Housing Fair & Financial Clinic

WHEN: Saturday, 10 a.m. to 2 p.m.

WHERE: Allen Chapel AME Church parking lot, 580 George W. Engram Blvd., Daytona Beach

DESCRIPTION: Free event held in observance of Fair Housing Month. HUD counselors, Realtors, lenders, home inspectors and title company representatives will be on hand to answer questions and provide information on paths to homeownership including financial options and downpayment assistance programs.

FOR MORE INFORMATION: Call Lydia Gregg of the Mid-Florida Housing Partnership at 386-274-4441 extension 304 or email her at lydia.gregg@mfhp.org

This article originally appeared on The Daytona Beach News-Journal: Daytona housing fair to help first-time buyers amid record prices