Our patient approach means readers have now made a 55pc gain on this previous tip

Many investors have all but given up on the London stock market; judging by its performance over recent years, it is not difficult to see why.

Over the past decade, the FTSE All-Share index has produced an annualised capital gain of just 1.5pc and currently trades no higher than it did in spring 2017.

However, it has not always been such a dismal performer. In the decade to December 2013, the index posted an annualised capital return of around 5pc. When dividends are added to that figure, investors enjoyed a high single-digit annualised total return between 2003 and 2013.

Clearly, no one knows how the market will perform over the next decade. But investors should not abandon British shares just because they have experienced a period of poor returns. In fact, from a logical standpoint, the “lost decade” of returns should make them even more bullish about future performance thanks to the current low valuation of the market, something that provides scope for strong share price gains in future.

Questor’s very first share tip following the column’s relaunch in autumn 2016 was Sage, the payroll and accounting systems provider. As recently as December last year, when we last updated readers on its progress, it had posted a meagre 9pc capital gain since that initial tip. Over the same period, the FTSE 100 had risen by 10pc. A one percentage point underperformance of an index that had itself risen at snail’s pace was undoubtedly very disappointing.

Since December last year, though, shares in Sage have surged 43pc higher. Our capital gain since we tipped the stock in 2016 therefore stands at 55pc, which is 46 percentage points greater than the FTSE 100’s return. Had we not been patient and sold the stock at any point before this year – had we followed, in other words, the strategy being employed by many despairing investors in British shares – we would have missed out on its stunning recent gains.

The company’s recently released full-year results show how it is now delivering on its longstanding potential. Revenue increased by 10pc, while operating profits rose by 18pc relative to the previous year. The latter figure benefited from a 1.4 percentage point increase in operating profit margins as the company delivered on its plans to scale up and become more efficient. This is a major achievement; many companies have failed to increase, or even maintain, profit margins in the current era of high inflation and weak economic growth.

Operating profit margins are again expected to expand in the new financial year, while the company has said it expects sales growth to match the rate achieved in 2023. Its solid financial position, as evidenced by a net gearing ratio of 40pc and net interest cover of 14, highlights its scope to invest for long-term growth. And with recurring revenues now accounting for more than 96pc of total sales, its financial performance is likely to be robust.

Undoubtedly, its operating environment is challenging at present. According to the IMF, global GDP growth will slow both in 2023 and in 2024 as interest rate rises weigh on economic activity levels. While this does not bode well for the small and medium-sized businesses that Sage caters to, its long-term prospects are far more upbeat. Monetary policy is extremely likely to become looser over the coming years, which has historically boosted corporate profitability and investor sentiment.

Investors are already bullish about Sage’s prospects. Its shares now trade at 35 times earnings, which is expensive even when double-digit forecast rises in sales and profits are taken into account. Therefore, Questor does not expect 2024 to be as profitable for holders of the stock as this year has been.

Yet Sage remains a highly appealing long-term investment. It has a solid financial position and an excellent business model that provides it with very strong pricing power thanks to the difficulty customers would face in switching to a competitor. It also has cross-selling opportunities among existing customers, as well as that high proportion of recurring revenues, which limits volatility in financial performance.

Alongside this, the prospect of an improving economic environment as interest rate cuts beckon gives its shares further room to run. Investors should therefore remain patient and continue to hold.

Questor says: hold

Ticker: SGE

Share price at close: £11.34

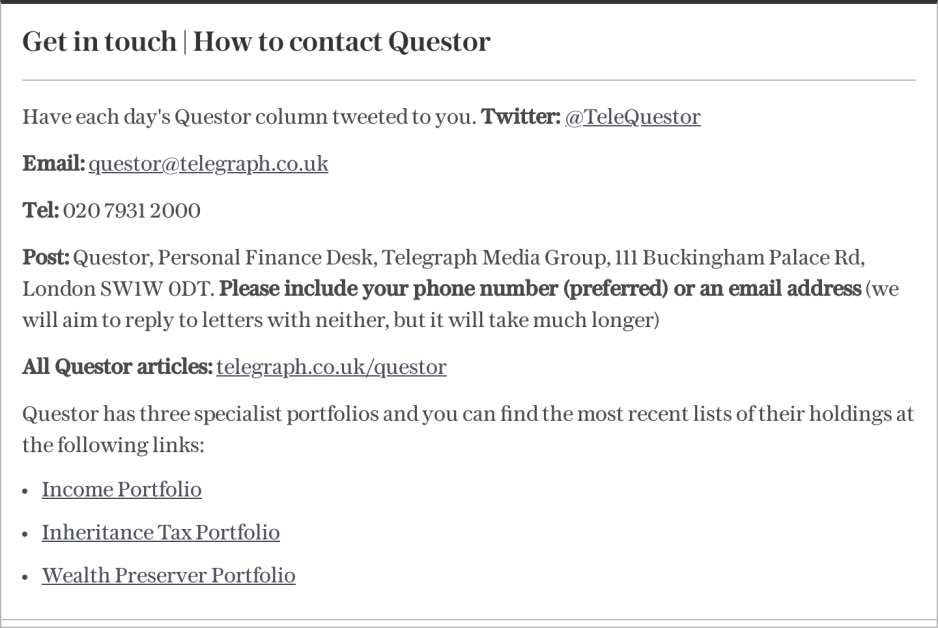

Read the latest Questor column on telegraph.co.uk every Monday, Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips