Paul Tudor Jones' Firm Buys Caesars Entertainment, Audentes Therapeutics

Paul Tudor Jones (Trades, Portfolio)' firm, Tudor Investments, bought shares of the following stocks during the fourth quarter.

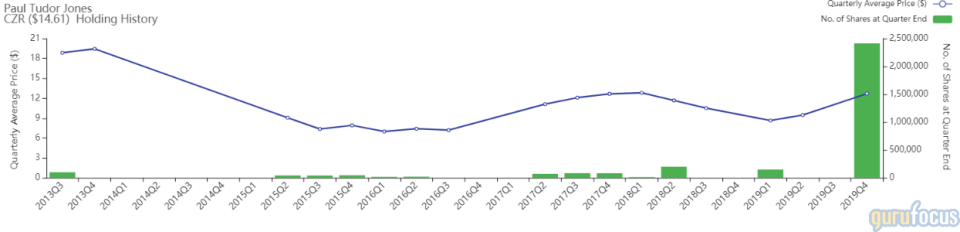

Caesars Entertainment

The firm entered a new stake in Caesars Entertainment Corp. (NASDAQ:CZR), buying 2.4 million shares. The portfolio was impacted by 1.47%.

The owner and operator of casinos in the United States has a market cap of $9.94 billion and an enterprise value of $27.36 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of -23.93% and return on assets of -2.68% are underperforming 76% of companies in the travel and leisure industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.07 is below the industry median of 0.44.

The largest guru shareholder of the company is Carl Icahn (Trades, Portfolio) with 16.79% of outstanding shares, followed by Howard Marks (Trades, Portfolio) with 2.24% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.87%.

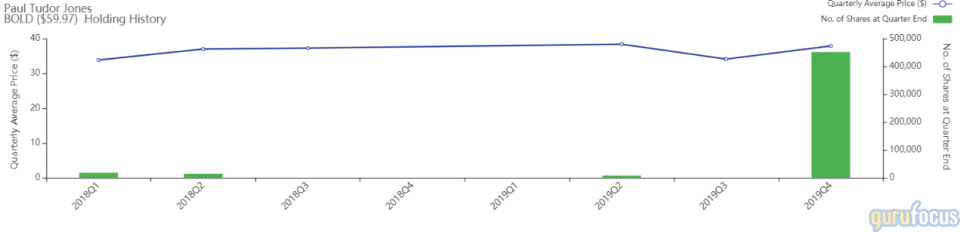

Audentes Therapeutics

The firm bought 451,689 shares of Audentes Therapeutics Inc. (NASDAQ:BOLD). The portfolio was impacted by 1.21%.

The biotechnology company has a market cap of $2.75 billion and an enterprise value of $2.43 billion.

GuruFocus gives the company a profitability and growth rating of 1 out of 10. The return on equity of -44.8% and return on assets of -40.16% are underperforming 52% of companies in the biotechnology industry. Its financial strength is rated 5 out of 10. The company has a cash-debt ratio of 11.76.

The largest guru shareholder of the company is Jones with 0.98% of outstanding shares, followed by Simons' firm with 0.50% and Louis Moore Bacon (Trades, Portfolio) with 0.33%.

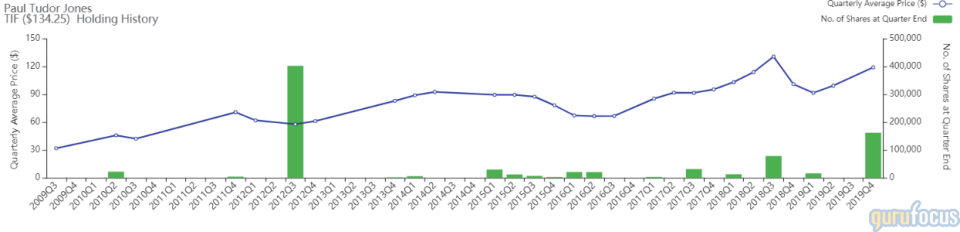

Tiffany

Jones' firm bought 162,039 shares of Tiffany & Co. (NYSE:TIF), impacting the portfolio by 0.97%.

The jeweler has a market cap of $16.25 billion and enterprise value of $17.89 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 17.46% and return on assets of 9.3% are outperforming 81% of companies in the retail, cyclical industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.25 is below the industry median of 0.45.

The largest guru shareholder of the company is First Eagle Investment (Trades, Portfolio) with 1.46% of outstanding shares, followed by Ron Baron (Trades, Portfolio) with 0.42% and Jeremy Grantham (Trades, Portfolio) with 0.33%.

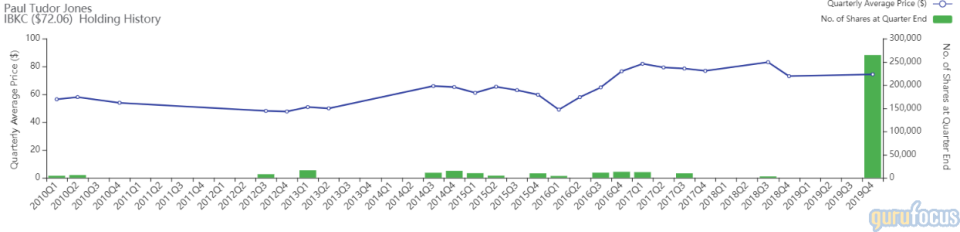

IBERIABANK

The investor's firm bought 264,544 shares of IBERIABANK Corp. (NASDAQ:IBKC). The trade had an impact of 0.89% on the portfolio.

The bank holding company has a market cap of $3.77 billion and an enterprise value of $718 million.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. While the return on equity of 8.74% is underperforming competitors, the return on assets of 1.22% is outperforming 67% of companies in the banks industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 0.73.

The company's largest guru shareholders are Grantham with 0.67% of outstanding shares, Jones with 0.51% and Simons' firm with 0.27%.

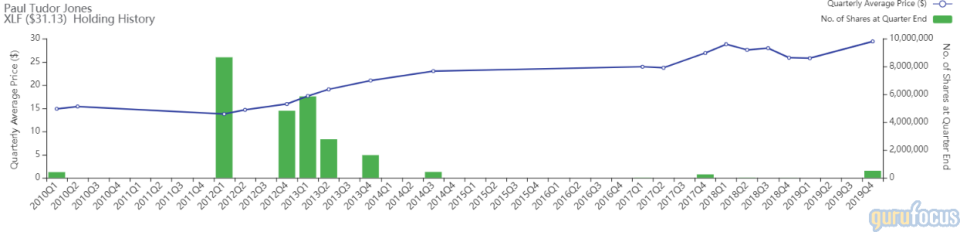

SPDR Select Sector Fund - Financial

Tudor Investments opened a new position in the SPDR Select Sector Fund - Financial (XLF), buying 511,503 shares. The portfolio was impacted by 0.71%.

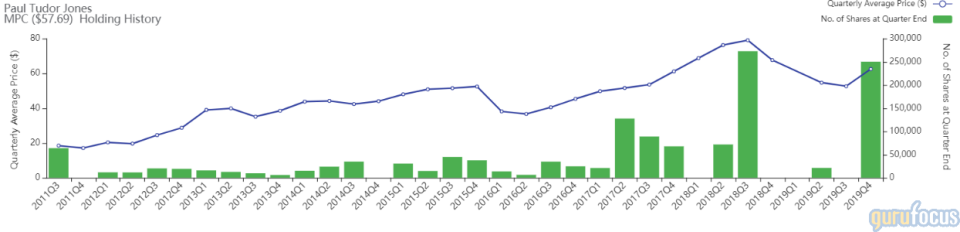

Marathon Petroleum

Jones' firm bought 250,270 shares of Marathon Petroleum Corp. (NYSE:MPC). The portfolio was impacted by 0.68%.

The independent oil and gas refiner has a market cap of $38.07 billion and an enterprise value of $76.85 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 8.66% and return on assets of 3.01% are outperforming 80% of companies in the oil and gas industry. Its financial strength is rated 4 out of 10. The equity-asset ratio of 0.34 is below the industry median of 0.47.

The largest guru shareholder of the company is Paul Singer (Trades, Portfolio) with 1.49% of outstanding shares, followed by Sarah Ketterer (Trades, Portfolio) with 0.57% and Hotchkis & Wiley with 0.49%.

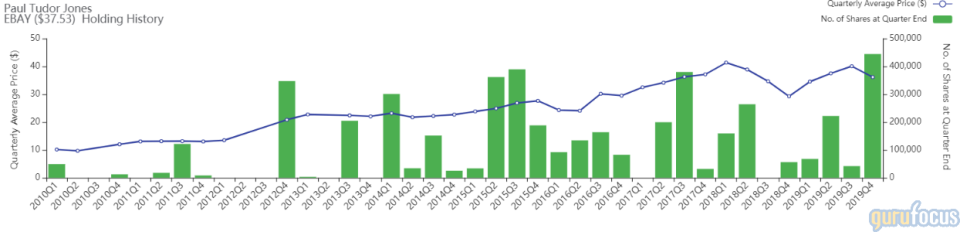

EBay

The firm boosted the eBay Inc. (NASDAQ:EBAY) holding by 954.87%. The portfolio was impacted by 0.65%.

The online auction giant has a market cap of $29.73 billion and an enterprise value of $35.15 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 41.1% and return on assets of 8.65% are outperforming 84% of companies in the retail industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.34 underperforms 55% of competitors.

Seth Klarman (Trades, Portfolio) is the largest guru shareholder of the company with 2.51% of outstanding shares, followed by Simons' firm with 1.90% and Singer with 1.24%.

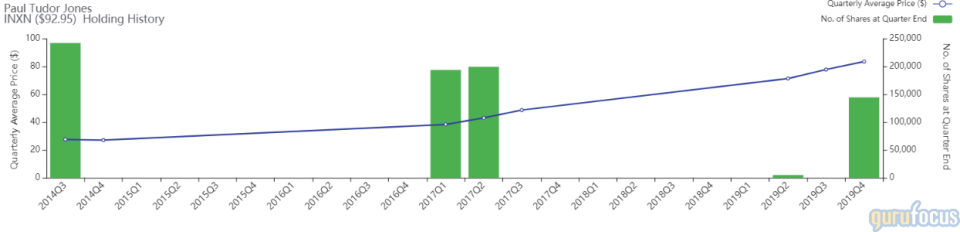

InterXion Holding NV

The guru's firm bought 144,586 shares of InterXion Holding NV (NYSE:INXN), starting a new position. The trade had an impact of 0.54% on the portfolio.

The data center provider has a market cap of $7.19 billion and an enterprise value of $8.85 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 6.47% and return on assets of 1.78% are underperforming 51% of companies in the software industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.12 is below the industry median of 2.16.

The largest guru shareholder of the company is Grantham with 0.98% of outstanding shares, followed by Baron with 0.51% and Simons' firm with 0.43%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Lee Ainslie Cuts Ownes-Corning, Microsoft

David Rolfe's Firm Cuts Apple, Visa

Richard Pzena's Firm Buys Westinghouse Air Brake Technologies

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.