Payday complaints soar to five year high

Complaints against payday lenders has rocketed to a five year high, says the UK’s industry watchdog in its annual review.

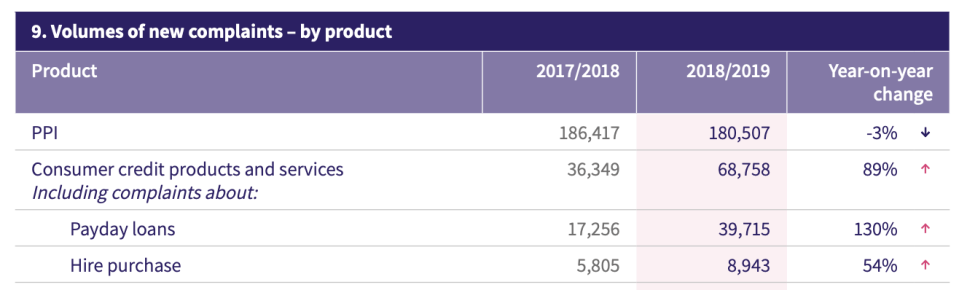

The Financial Ombudsman Service said that complaints for payday loan companies — firms that lend money on a short term basis but carry repayment interest rates that can hit thousands of percent — were up 130% from the previous year. For the 2018/2019 period, there were nearly 40,000 new complaints.

Most people who use payday lenders are some of the nations poorest people and use this type of funding to pay for bills. The Ombudsman found that some customers took out up to 30 loans in a short space of time to pay for household bills or even pay off other loans. Most of the complaints centred around affordability which has left many struggling with debt.

The Consumer Finance Association (CFA), which represents the short term lending industry, blamed “a flood from claims management companies” for the increase in complaints and said “complaints are often of poor quality.” It added that most of the complaints dated back a number of years.

Meanwhile, complaints about financial services also rose to a five-year high.

“Too often we see that the interests of consumers are not hard-wired into financial services,” said Caroline Wayman, chief ombudsman and chief executive of the Financial Ombudsman Service. “This marks a five-year high in the number of complaints that consumers have brought to us, and the behaviour we’ve seen from some businesses is simply not good enough.”

Yahoo Finance

Yahoo Finance