Who’s paying their ‘fair share’? SC’s coastal cities file suit against Airbnb, VRBO

Cities and counties representing nearly the entire coast of South Carolina filed a lawsuit Friday against the biggest names in short-term rentals.

The governments say Airbnb, HomeAway, VRBO, Trip Advisor and nine other entities don’t remit accommodations taxes or pay for business licenses in the state. There are at least 34,000 properties listed on Airbnb and VRBO in South Carolina.

The plaintiffs are the City of Charleston, the City of North Charleston, Charleston County, the City of Isle of Palms, the City of Folly Beach, the City of Columbia, the City of Myrtle Beach, the City of North Myrtle Beach, and the Town of Hilton Head Island. The class is being represented by Charleston-based lawyer Jesse Kirchner.

The class-action suit does not specify an amount owed by the defendants — Airbnb, HomeAway, VRBO, Vacationrentals.com, Tripadvisor, Flipkey Inc., Redawning.com, Vacasa South Carolina, Apartment and Corporation Relocation Services, Myrtle Beach Resorts, Stay Duvet, Walk Away Stays and Wholesale Holiday Rentals.

On Hilton Head, the local accommodations tax generates around $3.7 million each year. Since the town doesn’t have a list of properties using the defendants’ services, how much tax money it’s missing is unclear.

Instead, the suit outlines a series of steps that the governments hope will require the companies to properly charge and remit accommodations taxes, beach preservation fees and hospitality taxes. It also asks the judge or jury to require the companies to apply for business licenses to do business in the state.

The suit points to the companies’ total dominance over the rental process, despite the dwellings being owned by individuals or corporate property managers. Guests who book on the sites are required to use the site’s payment platforms and communicate through the services in order to reserve a rental.

Property hosts don’t receive the guest’s payment information and have little control over assessing fees outside their rates and cleaning fees, the suit says.

But in South Carolina, where thousands of hosts use the platforms to make money, the lawsuit may affect how property owners charge and remit fees to the corporations that publish their postings.

And the lawsuit has sparked questions from hosts who say they’ve used the platforms to charge accommodations taxes and fees to guests with the understanding that the companies remit them to local governments.

Accommodations, hospitality and beach preservation fees are crucial to the communities in South Carolina where tourism is the main economic driver.

Often called “tourist taxes,” accommodations fees are assessed on overnight stays. Hospitality taxes are typically assessed on prepared food and beverage. Both act as stimulators to local grant programs, infrastructure projects and beach renourishment that make the coast an attractive place to visit.

How much are tourist taxes?

Each community on the coast assesses accommodations taxes differently to people booking overnight stays.

The suit includes a list of those fees by location:

City of Charleston: 2% local accommodation fee

City of North Charleston: 2% local accommodation fee

Charleston County: 2% local accommodation fee

City of Isle of Palms: 1% local accommodations fee and 1% beach preservation fee

City of Folly Beach: 1% local accommodations fee and 1% beach preservation fee

City of Columbia: 3% tourist development fee

City of Myrtle Beach: 3% local accommodations tax after June 30, 2019 and a 1% hospitality tax

City of North Myrtle Beach: 3% local accommodations tax after June 30, 2019

Town of Hilton Head Island: 1% local accommodations tax and 2% beach preservation fee

The suit says at least some of the defendants currently collect accommodations or occupancy taxes from consumers and remit them to state or local governments in other states. However, it says all but one group of the named short-term rental companies “failed and refused to collect or remit the accommodations taxes,” in South Carolina pursuant to local governments’ A-TAX ordinances.

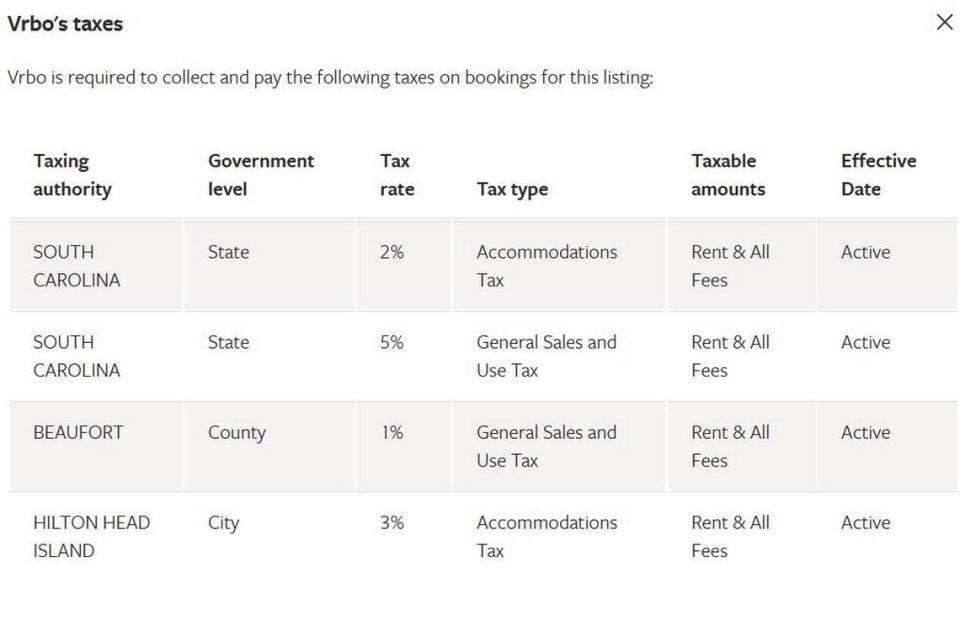

The exceptions: HomeAway and VRBO, which the suit says started collecting and remitting accommodations taxes in September 2019. The two are owned by the same parent company.

Local officials on Hilton Head who voted to join the lawsuit on April 6 said the push for more accountability in A-TAX payment is crucial to preserving island services, infrastructure and culture.

“At the end of the day everybody needs to pay their fair share,” Alex Brown, Ward 1 representative on Hilton Head Town Council, told The Island Packet. “That A-TAX money is something we definitely depend on.”

Where does the money go?

The suit alleges that some of the companies may have deceived hosts when assessing accommodations taxes.

“Defendants have led both hosts and guests to believe and rely that defendants were collecting and remitting and/or would collect and remit such taxes applicable to short-term rentals of accommodations in taxing jurisdictions including Plaintiffs.”

Screenshots from VRBO hosts shared with The Island Packet show that VRBO charged guests a 3% fee billed as local Hilton Head taxes. Hosts say they were told by the company that it would remit the tax to the town.

Meanwhile, Airbnb hosts shared with The Island Packet that the platform charges 8% in taxes at the state level, but leaves it up to local hosts to charge and remit the final 3% in Hilton Head accommodations taxes and beach preservation fees.

The lawsuit says that while most municipalities and counties require short-term rental companies to submit monthly reports detailing the total proceeds and amount of accommodations taxes, only VRBO and HomeAway have done so.

“As a result, plaintiffs are unable to ascertain the financial details of the short-term rental transactions involving properties and accommodations within their respective jurisdictions and the amounts of A-Taxes and fees owed to them,” the suit says.

Do you own a short term rental in South Carolina and use one of the listed companies to host? Use the form on The Island Packet and Beaufort Gazette’s website to tell us about your experience with charging and remitting local taxes.