Paying at a gas station or ATM in Kansas? Here’s how you can spot and avoid card skimmers

You may not think twice about using your debit card, but sometimes it’s best to take a second look before swiping it in case of possible card skimmers.

Skimmers are installed on card readers to collect card numbers, unbeknownst to the customer making a purchase. Card skimmers have been found at gas pumps, in grocery stores, ATMs and department and convenience stores, including spots around Kansas.

In October, two card skimmers were found on gas pumps in Salina, and in January 2023, skimmers were also found on pumps in Rawlins County.

While a debit or credit card can be a safe option for making payments, it’s important to familiarize yourself with ways to avoid skimmer fraud. If you’re worried about card skimmers in Kansas, here’s a quick guide to help you spot and avoid them.

Tips for employees to detect card skimmer

According to the Kansas Department of Agriculture, the best way to stop card skimmers is for businesses and employees to stop their installation in the first place. It takes an average of 10 seconds for someone to install a skimmer, so knowing the signs ahead of time could be critical.

Here are some tips for businesses and employees to use to protect their customers from being victims of card skimmers:

Know what the insides of your card readers look like.

Check for skimmers in readers daily.

Change the locks on readers.

Place security cameras effectively.

Keep an eye on suspicious activity around readers.

Tips for customers to detect card skimmers

Customers should be vigilant to signs of potential fraud to protect their personal data, like card and bank account information.

If possible, you should consider using credit instead of debit when paying at card readers. Credit cards often have more protection when it comes to cases of fraud, banking company Capital One says.

Here are some warning signs to look out for if you are a customer, from Capital One:

Make sure the card reader is completely in tact with no missing pieces.

Feel the card reader. If it feels like it’s coming apart, that’s a red flag.

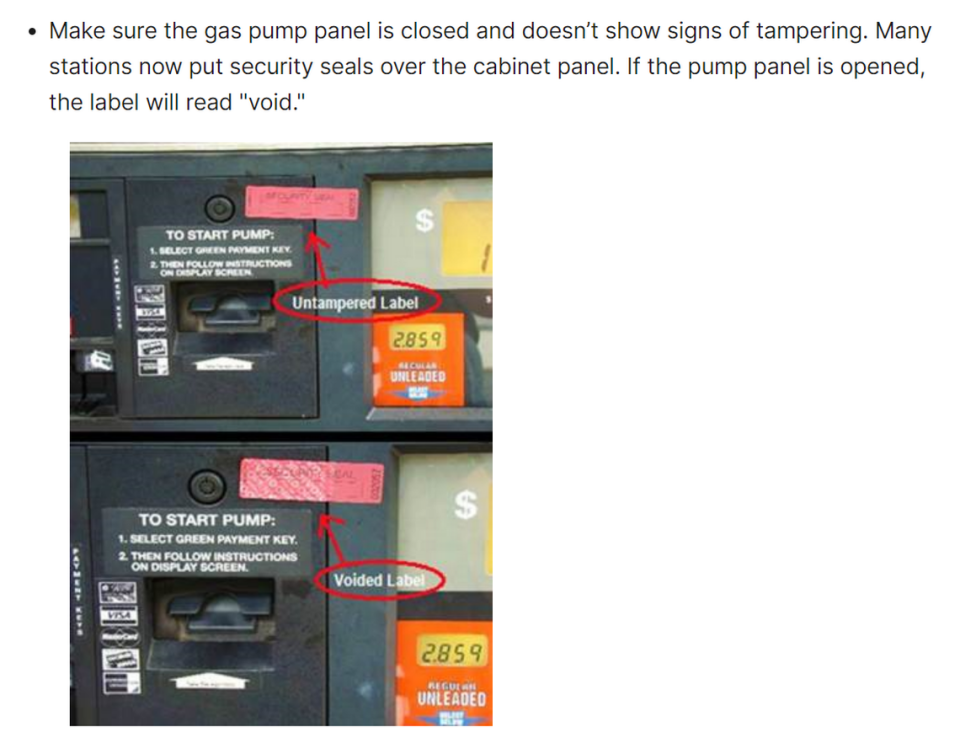

Look at the security seal.

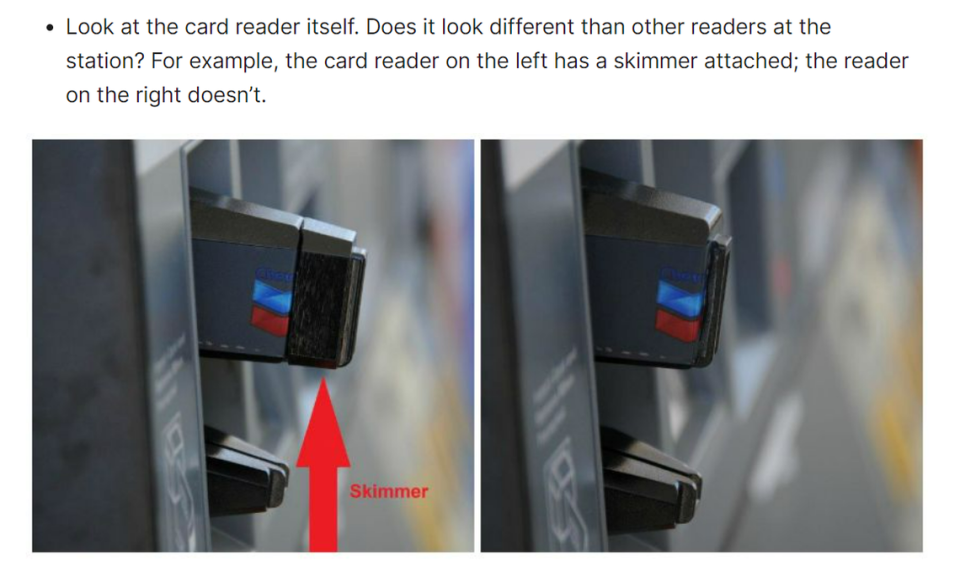

Compare with other card readers around it.

Look around for any hidden cameras that may be used to see your PIN number.

You should also check your bank account regularly to make sure there are no mysterious charges. If you notice anything out of the ordinary, contact your bank right away to cancel your card and get a new one.