Paylocity Holding's (NASDAQ:PCTY) Wonderful 562% Share Price Increase Shows How Capitalism Can Build Wealth

Buying shares in the best businesses can build meaningful wealth for you and your family. While not every stock performs well, when investors win, they can win big. To wit, the Paylocity Holding Corporation (NASDAQ:PCTY) share price has soared 562% over five years. And this is just one example of the epic gains achieved by some long term investors. We note the stock price is up 3.4% in the last seven days.

We love happy stories like this one. The company should be really proud of that performance!

See our latest analysis for Paylocity Holding

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

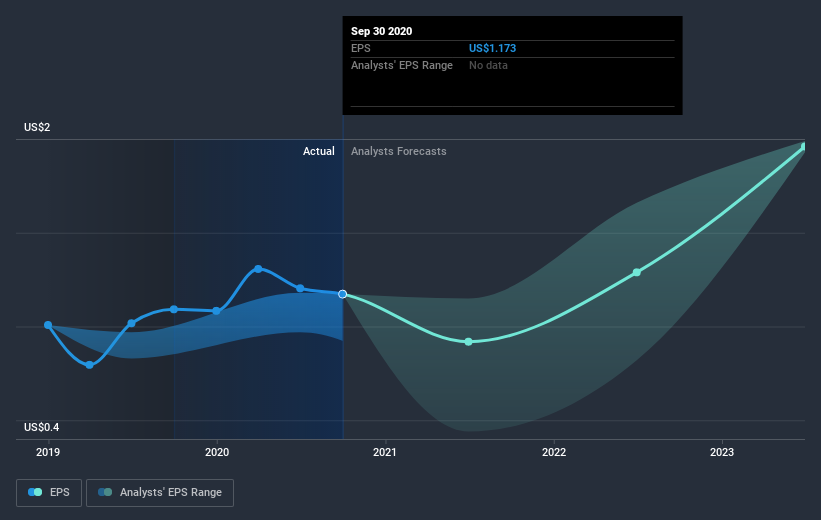

During the five years of share price growth, Paylocity Holding moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. Indeed, the Paylocity Holding share price has gained 314% in three years. In the same period, EPS is up 83% per year. This EPS growth is higher than the 61% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat. Of course, with a P/E ratio of 170.60, the market remains optimistic.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Paylocity Holding has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Paylocity Holding stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Paylocity Holding shareholders have received a total shareholder return of 43% over the last year. However, the TSR over five years, coming in at 46% per year, is even more impressive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Paylocity Holding has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.