Is Peabody Energy Corporation (NYSE:BTU) A Smart Choice For Dividend Investors?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Could Peabody Energy Corporation (NYSE:BTU) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

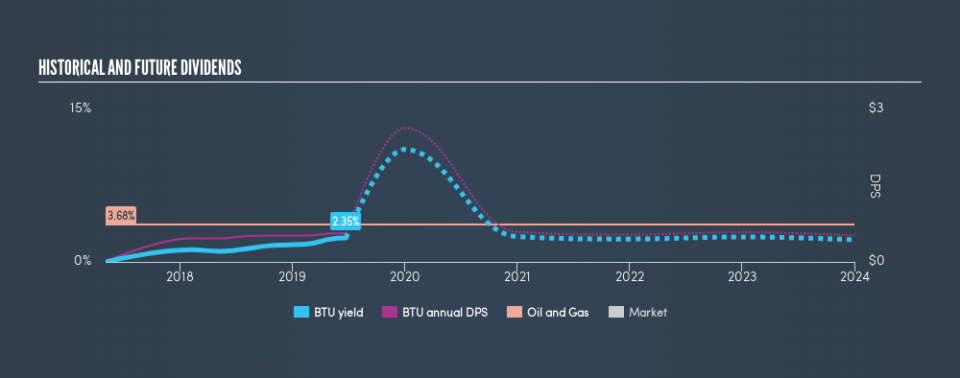

Peabody Energy has only been paying a dividend for a year or so, so investors might be curious about its 2.4% yield. The company also bought back stock during the year, equivalent to approximately 30% of the company's market capitalisation at the time. Some simple research can reduce the risk of buying Peabody Energy for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Peabody Energy paid out 11% of its profit as dividends, over the trailing twelve month period. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Peabody Energy paid out 7.2% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable. It's positive to see that Peabody Energy's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

We update our data on Peabody Energy every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. During the past one-year period, the first annual payment was US$0.46 in 2018, compared to US$0.56 last year. This works out to be a compound annual growth rate (CAGR) of approximately 22% a year over that time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Peabody Energy has grown its earnings per share at 40% per annum over the past five years. The company is only paying out a fraction of its earnings as dividends, and in the past been able to use the retained earnings to grow its profits rapidly - an ideal combination.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, we like that the company's dividend payments appear well covered, although the retained capital also needs to be effectively reinvested. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. Peabody Energy performs highly under this analysis, although it falls slightly short of our exacting standards. At the right valuation, it could be a solid dividend prospect.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 6 Peabody Energy analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.