Pemex Rally Fades as Traders Bet Mexico Aid Is Short-Term Fix

(Bloomberg) -- An early rally in Petroleos Mexicanos’ bonds faded as traders grow tired of signals of short-term government support for the state-owned oil giant.

Most Read from Bloomberg

India’s Moment Has Arrived, and Modi Wants a New Global Order

Fed Set to Double Its Economic Growth Forecast After Strong US Data

Soaring US Dollar Raises Alarm as China, Japan Escalate FX Pushback

China Slowdown Means It May Never Overtake US Economy, Forecast Shows

Huawei Teardown Shows Chip Breakthrough in Blow to US Sanctions

Notes jumped at open Tuesday after people familiar with the matter said the government of President Andres Manuel Lopez Obrador set aside money in the country’s draft budget to help the company cover debt payments. Bonds due in 2045 rose as much as 2 cents to the highest in a month, according to Trace data.

But excitement over the draft budget, which will be presented Friday, soon gave way to skepticism. The 2045 notes were up less than 1 cent, while some of the most traded bonds declined across the curve.

Read More: Pemex Gets Billions for Debt Payment in Mexico Draft Budget

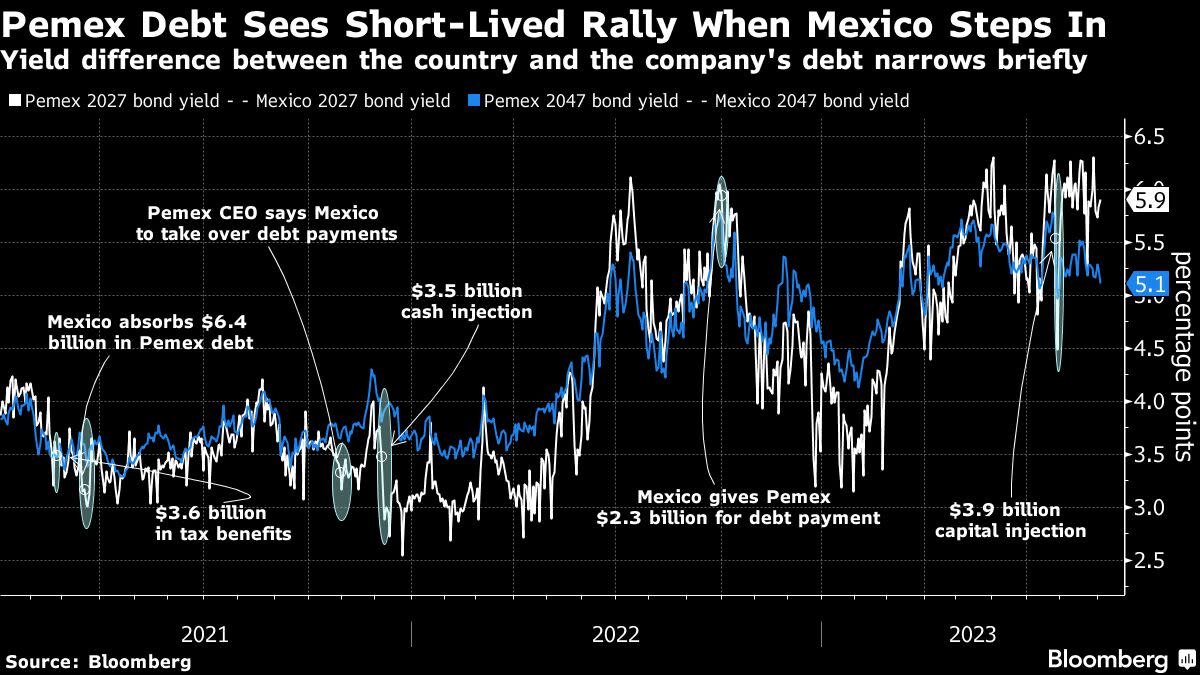

It’s become a familiar pattern for Pemex, the world’s most indebted oil major. While investors initially cheer on any signs of government support to the company, the moves are seen as short-term fixes that do little to improve the driller’s credit profile.

“At the end of the day government support for Pemex is only a stop-gap measure and doesn’t fundamentally change the issues at the company,” said Brendan McKenna, a strategist at Wells Fargo. “The jump in bond prices makes sense when government support is deployed, but that’s only a short-term fix.”

Read More: Pemex Bond Investors Are Tiring of AMLO’s Temporary Fixes

It’s unclear how much the government allocated to Pemex, which has $11.2 billion in debt amortizations coming due in 2024, according to a June presentation.

The extra yield investors demand to hold Pemex debt over the Mexican sovereign has grown as traders worry about the oil giant’s mounting debt load, which has swelled to $110.5 billion.

The company is stuck relying on the government for support since it can’t come to market to refinance that debt because it’d be too expensive, analysts say.

While President Andres Manuel Lopez Obrador has given Pemex about $77 billion, the government hasn’t traditionally allocated money for Pemex in the budget in advance. It may be the government’s latest maneuver to lower the company’s borrowing cost and tap international capital markets.

--With assistance from Amy Stillman.

Most Read from Bloomberg Businessweek

Lyme Disease Has Exploded, and a New Vaccine Is (Almost) Here

Nigeria’s Train to Nowhere Shows How Not to Build Public Transit

©2023 Bloomberg L.P.