Penny Stock Attracts Option Bulls on FAANG Partnership

The shares of Stein Mart, Inc. (NASDAQ:SMRT) are popping today, after the discount retailer said it's installing Amazon Hub Lockers in almost 200 stores. The lockers -- used for in-store pickups and returns -- will be available early next month, and consumers can have items shipped to a Stein Mart store for no charge. In light of the FAANG partnership, SMRT shares are pacing for their best day in more than a year, and with earnings expected tomorrow morning, options traders are betting on even more upside for the penny stock.

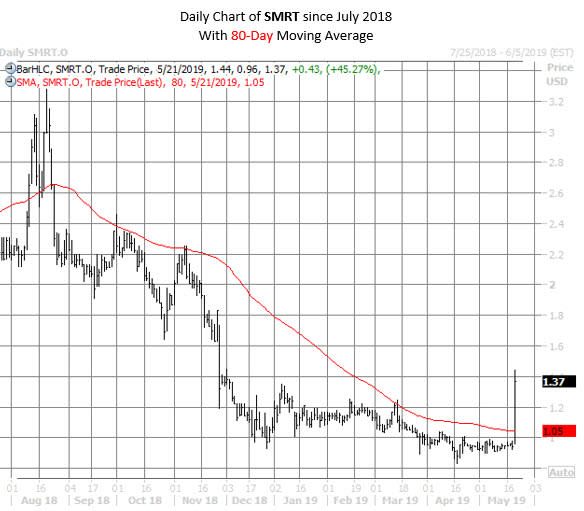

SMRT stock was last seen 45.3% higher at $1.37, set for its best day since March 15, 2018. The equity is now on pace to end atop its 80-day moving average for the first time since August 2018, when the shares were exploring the $3 region. Further, SMRT is set to conquer the $1.20-$1.30 area, which has stifled rebound attempts since December.

So far today, Stein Mart has seen more than 1,100 call options change hands -- a whopping 161 times the average intraday call volume, and more than 12 times the number of puts exchanged. For context, SMRT has traded an average of just 12 calls a day. Today's call volume is easily on pace to top the previous annual high of 1,376 calls traded last May 24.

Most of today's action has transpired at the June 2 call, where close to 900 contracts have traded. Buyers of the call expect SMRT to topple the $2 level -- still uncharted territory for the shares in 2019 -- by the close on Friday, June 21, when the options expire.

However, history does not favor the bulls after Stein Mart earnings. After the company's last eight quarterly reports, SMRT moved lower six times, with the last post-earnings win coming last May 24 -- the same day that daily call volume peaked. On average, though, SMRT has moved an impressive 21.1% the day after earnings, regardless of direction, so the shares are accustomed to big moves.