Pension fund managers poured into emerging markets right as they tumbled

After investing lightly in the asset class during its boom years, public pension fund managers increased their holdings of emerging market securities this year right as the asset class crumbled. This is according to a new report from Goldman Sachs.

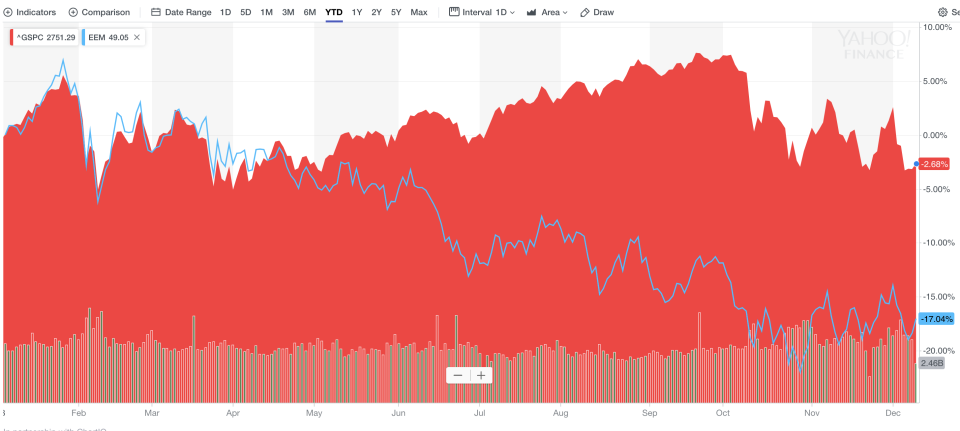

Emerging markets brought higher returns than U.S. equities in 2016 and 2017, but over the course of 2018 that trend has reversed strongly. The highly tracked MSCI emerging markets equity ETF EEM is down by more than 15% this year while the U.S. benchmark S&P 500 has been about flat.

These pension fund managers also increased their buys of emerging market debt, which has also proved a losing bet. The JP Morgan emerging markets global index has fallen around 10% in value for the year, while the U.S. benchmark Bloomberg-Barclays Aggregate fund is down just 3%.

The theme of chasing gains and coming up short has been consistent for U.S.-based pension fund managers. Over the last decade, fund managers who oversee the pensions of the nation’s teachers, firefighters, police and other government workers have bet on investment strategies that have cost U.S. taxpayers at least $600 billion, possibly more than $1 trillion, in underperformance and fees, investment data and calculations by Yahoo Finance found.

Emerging market funds invest in securities from less-developed markets like China, Argentina, Turkey and South Africa, which have been hurt this year by the strong U.S. dollar and global trade tensions as well as individual country turmoil.

Historically, because public pensions are guaranteed, the underperformance of funds doesn’t hurt retiring pensioners but instead hits taxpayers in the form of budget cuts for schools, hospitals and libraries and decreased spending on infrastructure, health care and other public projects.

“Any time a part of the portfolio drops and it impacts returns, the longer-term consequences for the state is they’ve either got to increase taxpayer contribution for the funds or decrease benefits or make the employees pay in it more,” said Jeff Hooke, a lecturer at Johns Hopkins University who studies pension fund investment.

Over the last decade the money-losing strategy has been investment in so-called alternative investments such as hedge funds, private equity, real estate or commodities, that performed well during the 2007-2009 financial crisis, but have badly lagged returns for the S&P 500 and simple stock and bond index funds.

Investors have continued to bet on alternatives and are now also chasing emerging markets for much the same reason – their pitches to state pension boards have unrealistic return assumptions that force them to take more risk in an attempt to keep up with with growing liabilities. Studies show U.S. pensions are grossly underfunded to the tune of trillions of dollars.

“The reality is that when you think about these public plans, many of them have long-term return assumptions on their portfolios that are around 7-7.5%, and in some cases still even higher than that,” said Goldman Sachs Asset Management (GSAM) Chief Pension Strategist Mike Moran. “When you look at long-term return forecasts across a wide variety of asset classes it’s hard to get to that number just in developed markets equities, developed market fixed income.”

It’s too early to say it was as bad bet

But, Moran points out, the long-term time horizon afforded to pension fund investors may mean that EM is a good bet. Emerging markets are generally countries with economies that are growing faster than developed countries like the United States, Japan and Western Europe. As the countries grow many investors and market analysts expect that their stocks and bonds will provide better returns.

Emerging markets have staged a bit of a rally late in the year, with EEM outperforming the S&P over the past month. EEM had been down as much as 34% at its 2018 low. The same has not been true for bonds, however, as the JPMorgan EMBI has continued to underperform the Bloomberg-Barclays Aggregate.

Additionally, Moran notes that most pension plans’ allocation to emerging markets is small, typically representing less than 10% of overall holdings, and that public pension plans are still typically receiving contributions and don’t need to immediately generate income.

“Yes, there’s going to be more volatility in EM, but I’d say these plans … have very long-term time horizons and they’re willing to ride out some volatility in the short term in order to reap the benefits of the long-term asset class returns,” Moran said.

Still, this year’s poor returns for emerging markets could pose a real problem for fund managers who are already lagging their return goals. Pensions and Medicaid spending are already grossly underfunded to the point that many cities and states have attempted to cut them, often unsuccessfully, meaning they have to cut back on other things. School funding has been hit especially hard over the past decade.

Estimates vary on just how much less pension funds have in assets than what they owe, but calculations range from $1 trillion to $6 trillion, an amount that is more than the gross domestic product of Japan, the world’s third-largest economy.

The problem was worsening even before this year’s debacle in emerging markets. A study by the American Legislative Exchange Council (ALEC) found that the unfunded liabilities of state and local government pension plans rose by $433 billion in 2017 – meaning an increase of $50,000 for every American household.

ALEC suggests that even their $6 trillion estimate is likely too low because “states have found ways to work around … requirements and paint an unrealistically rosy picture of their pension funding status.”

The allocation to emerging markets may help dig investors out of the massive pension hole they’ve put American taxpayers in if the asset class does rebound and investors stick with it, but if investors are wrong it will further exacerbate an already unsustainable problem with no solution in sight. Emerging markets are generally considered riskier than developed market assets.

“Riskier assets tend to take bigger losses during market downturns and can cause pension investment returns to fall far below the assumed rate of return,” said Skip Estes, research analyst at the ALEC Center for State Fiscal Reform. “Consequently, every pension contribution is insufficient to fund the pension and legislatures never contribute enough to close the gap.”

Estes’ research focuses largely on alternative investments, but emerging markets can present some of the same problems.

—

See also:

The emerging markets feel-good story of the decade has imploded

It’s the end of the world as we know it, and investors feel bullish

Global debt jumped by $8 trillion in Q1, rising to record $247 trillion

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.