What people, Purdue are saying about controversial Back a Boiler income share agreement

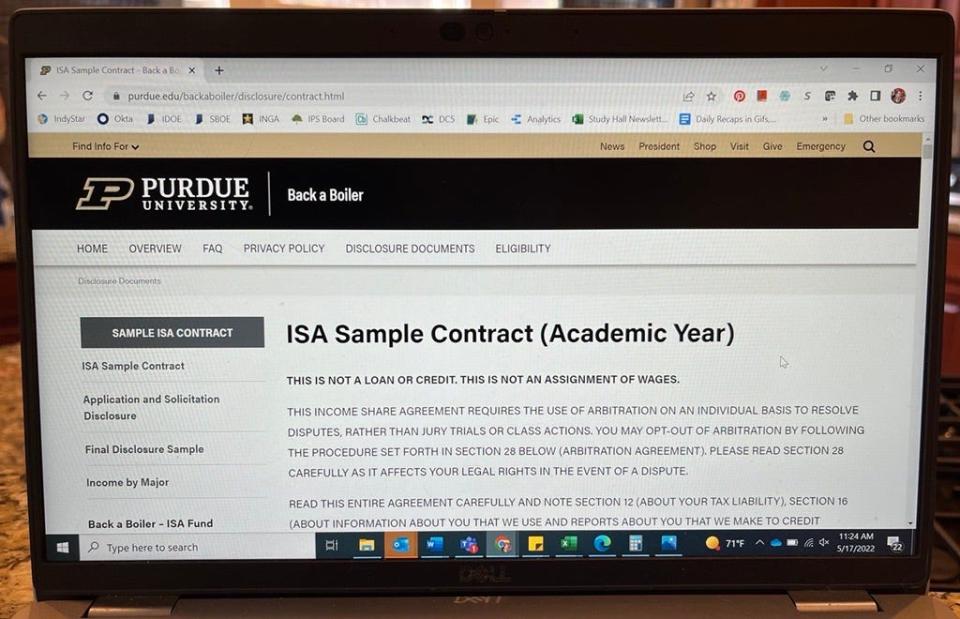

For years, Purdue University has touted its Back a Boiler program as an innovative alternative to student loans but a watchdog group says the way Purdue is running and marketing the program may be illegal.

In March, the Student Borrower Protection Center sent a letter to the U.S. Department of Education, asking it to investigate the program and immediately put a stop what it called an "illegal lending scheme" and make whole the borrowers harmed by it. Purdue has denied allegations of wrongdoing.

To date, more than 1,600 Back a Boiler contracts have been signed by Purdue students. IndyStar spoke with five of them who say they feel taken advantage of and misled.

Back a Boiler: Students feel duped by Purdue's loan program. Could it be illegal?

What is the Back a Boiler program?

Back a Boiler is an income-share agreement launched by Purdue University in 2016. Starting in their sophomore year, students may apply to the program to help cover the cost of attending Purdue.

Students sign a contract that promises a share of their future earnings in exchange for the loan, which is paid by one of two limited liability corporations. The LLCs are funded by a variety of investors – institutional investors like hedge funds and private individuals.

Funding levels start at $5,000 for a semester or $2,500 for a summer session. Terms on the agreements vary based on major and amount requested but they typically last for eight to 10 years and require students contribute around 5% of their income. The program maxes out when a student commits 15% of their future earnings.

What is an income share agreement?

Purdue isn’t the only school offerings ISAs. The concept has been around for decades but, in the modern era, they’ve been more common at for-profit and non-degree-granting entities, such as computer coding bootcamps.

Income share agreements are when a student commits a future share of their income in exchange for a portion of their educational costs.

Typically, the contract lasts for a set number of monthly payments or a maximum payment amount. While some programs ensure students don’t pay back more than they borrowed, most do cap payments above the original ISA contract amount. In Purdue’s case, the contracts typically max out at 2.5 times the amount borrowed.

So, a student that borrows $10,000 would pay the agreed upon share of their income for the set number of months or until they pay back $25,000 – whichever comes first. At the end of the contract length, a student’s obligation is met, whether they’ve paid back the money they borrowed or not.

Are ISAs loans?

Yes. While ISAs are often marketed as an alternative to loans, the Consumer Financial Protection Bureau has said that ISAs are private loans.

How are ISAs different than traditional loans?

Traditionally, loan terms include a principle amount borrowed and an interest rate. Borrowers pay back the loan with interest until the balance is paid off. With an income-share agreement, payments are based on a percent of the borrower’s future income and made for a set period of time, which means they may pay back more or less than they originally borrowed.

In cases where students struggle to find work, or start out with a low-paying job, the ISA could be beneficial because payments can be put on hold when students are out of work or making too little. For students who’d like to pay off their loans early, though, ISAs like Back a Boiler come with what amounts to a large pre-payment penalty because they can only end the agreement early by paying off the maximum payment cap.

What are people saying about the Back a Boiler program?

The Student Borrower Protection Center, a watchdog group, says that the way the program is run and marketed is illegal. The nonprofit has asked the U.S. Department of Education and Consumer Financial Protection Bureau to get involved.

IndyStar spoke with five students and their families who say they feel duped by the marketing of the program and now feel taken advantage of by the university and terms some called predatory.

Several families said they wish they’d taken out private student loans instead because they would have been able to pay off the borrowed amount, plus interest, faster and at a much lower cost.

One student called it a “rip off” and another said she feels stuck.

One student IndyStar spoke with said she was happy with her Back a Boiler ISA because she liked knowing she’d be done paying it off in 10 years and expects to pay on other private student loans for longer.

What does Purdue say about it?

Purdue denies the allegations about wrongdoings with the Back a Boiler program. In its response to IndyStar, Purdue said "transparency and ISA literacy are the hallmarks of Purdue’s Back a Boiler program" and the process is designed to ensure students make an informed decision. Participants must also successfully complete a quiz prior to entering into an ISA contract to check understanding.

Call IndyStar education reporter Arika Herron at 317-201-5620 or email her at Arika.Herron@indystar.com. Follow her on Twitter: @ArikaHerron.

This article originally appeared on Indianapolis Star: Back a Boiler: What people, Purdue say about controversial program