PepsiCo Declares Quarterly Dividend

- By Alberto Abaterusso

PepsiCo Inc. (PEP) announced on Thursday the quarterly dividend for the final three months of fiscal 2018.

The U.S. snack and beverage giant is expected to pay 92.75 cents per ordinary share on Jan. 7 to shareholders of record as of Dec. 7. The ex-dividend date is scheduled for Dec. 6. The payment is on par with the previous dividend and represents a 15.2% increase from the fourth quarter of 2017.

Warning! GuruFocus has detected 1 Warning Sign with EXTN. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

If the payment is maintained for the next four quarters, the recurring distribution will lead to a forward dividend of $3.71, granting 3.18% according to PepsiCo's share price of $116.8 at market close on Thursday. The stock is offering a higher return than most of its peers as well as the S&P 500 index. The industry has a median yield of 2.21% and the S&P 500 index has a dividend yield of 1.92% as of Nov. 15.

The payout ratio is 100%, versus an industry median of 38%.

The company distributed approximately $4.77 billion in dividends over the last four quarters, representing roughly 55.2% of the trailing 12-month operating cash flow of $8.64 billion. The amount of free cash flow net of debts paid over the same period accounted for $5.98 billion.

PepsiCo is able to sustain its dividend through a strong portfolio of products. These products, which are known in every corner of the world, include Pepsi-Cola, Frito-Lay, Quaker, Gatorade, Doritos and Tropicana.

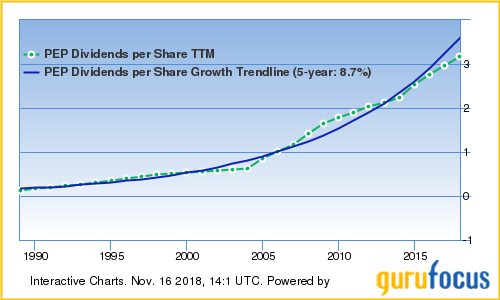

Thanks to this portfolio of products, PepsiCo has been able to distribute dividends to its shareholders for more than 46 years. The annual distribution has progressively grown over time at an annual average rate of 8.7% over the last five years, as illustrated in the chart below.

Over the last five years, the dividend per share has been underpinned by a 5.2% yearly average growth in earnings per share.

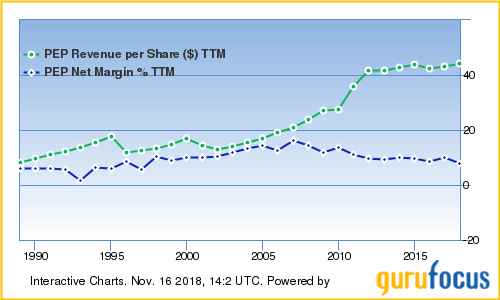

Revenues and net margins have progressively increased over time as well, with the top line growing more rapidly than profit. PepsiCo has a net profit margin of 7.66% compared to an industry median of 5.54%.

GuruFocus has assigned a profitability and growth rating of 7 out of 10 and a financial strength rating of 6 out of 10.

A solid balance sheet combined with a nearly 7% annual estimated growth in net earnings for the next five years will allow PepsiCo to sustain subsequent hikes in the dividend.

The company's balance sheet is one of the most leveraged in the industry. The debt-to-equity ratio is 341% versus an industry median of 37%. Regardless, the company doesn't have issues paying interest expenses on the outstanding debt due to an interest coverage ratio of 8.26, which is above the threshold.

There isn't any doubt PepsiCo is a good investment. However, I would wait for any significant weakness before increasing a position as the stock appears to be a bit expensive based on the closing share price on Thursday.

As illustrated in the chart below, the stock is trading above the 200-, 100- and 50-day simple moving average lines following a 2% appreciation for the 52 weeks through Nov. 15.

The closing share price on Thursday was also above the midpoint of the 52-week range of $95.94 to $122.51 per share.

PepsiCo has a price-book ratio of 16.03 versus an industry median of 2.56, a price-sales ratio of 2.58 versus an industry median of 1.36 and a price-earnings ratio of 33.66 versus an industry median of 23.36. The forward price-earnings ratio is 19.46 versus an industry median of 21.05.

The Peter Lynch chart below also suggests the stock is not trading cheaply:

Disclosure: I have no positions in any securities mentioned in this article.

Read more here:

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with EXTN. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years