Some Perennial International (HKG:725) Shareholders Have Copped A Big 63% Share Price Drop

While not a mind-blowing move, it is good to see that the Perennial International Limited (HKG:725) share price has gained 10% in the last three months. Meanwhile over the last three years the stock has dropped hard. In that time, the share price dropped 63%. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

View our latest analysis for Perennial International

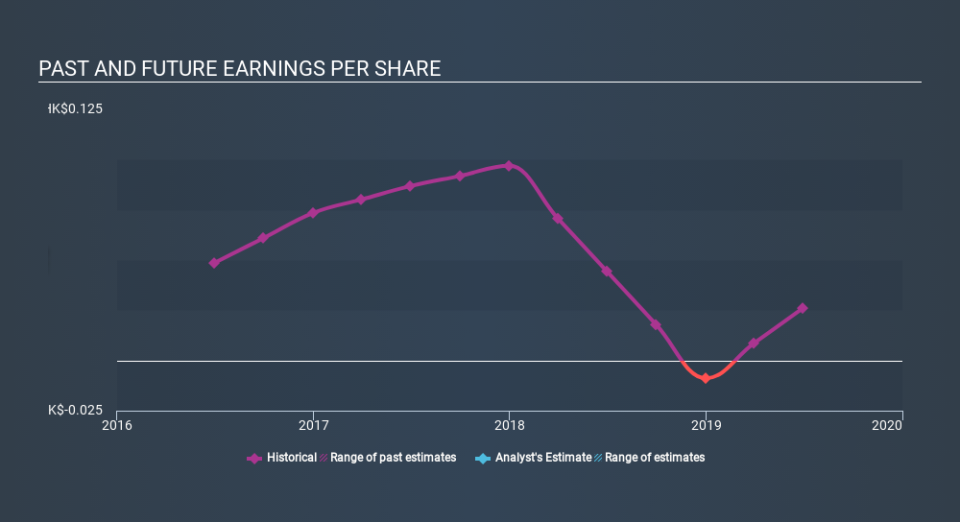

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years that the share price fell, Perennial International's earnings per share (EPS) dropped by 19% each year. This reduction in EPS is slower than the 28% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Perennial International shareholders are down 33% for the year, but the market itself is up 3.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Perennial International better, we need to consider many other factors. For example, we've discovered 4 warning signs for Perennial International (1 is a bit concerning!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.