Personal credit scores went up during COVID-19, Idahoans led the way. Here’s how and why

The COVID-19 pandemic was a time unlike any other for millions of Americans nationwide, particularly when it came to balancing your pocketbook.

In the early days of the pandemic, the unemployment rate nationwide peaked at 14.8% in April 2020. During that same month, Idaho’s unemployment spiked to 11.6%. Such hardships made it difficult for many Idahoans to do once-simple things, like paying off mortgages, loans and credit cards. Many people were left struggling to put food on the table or pay rent.

But as it turns out, Idahoans did a better job than anyone else in the nation paying off their bills and outstanding loans on time, according to a new study from travel assistance website Upgraded Points.

Between 2019 and 2022, Idahoans saw an average increase of 16 points in their credit score. Idaho’s average credit score before the pandemic was 711, while the average score by the end of 2022 was 727, which is a 2.3% increase.

Three other states — Alaska, Arizona and Nevada — also saw a 2.3% increase in their average credit score, but none had a credit score as high as Idaho by the end of 2022.

Why did credit scores increase?

Many state and federal agencies jumped into action at the start of the pandemic to ease the financial burdens of Americans with a variety of fixes.

The Department of Education’s student loan forbearance program ends in October, after three interest-free years. Many auto loans also offered deferments on car payments in the early days of the pandemic, providing borrowers further relief.

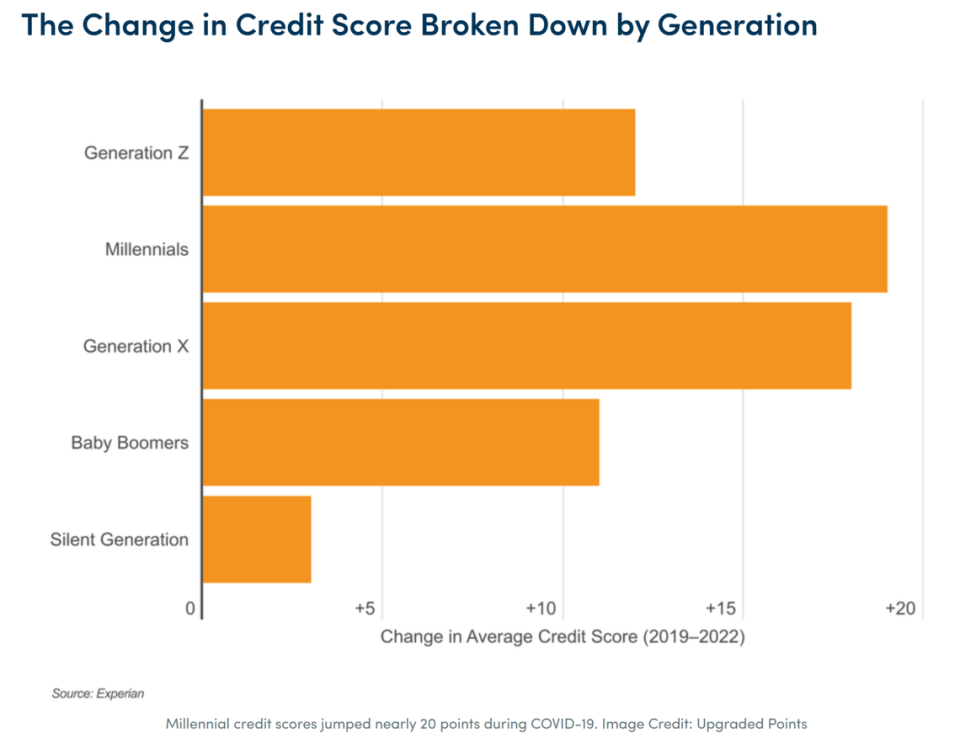

No demographic benefited more from pandemic-era relief of this type than millennials, who nationwide raised their score by an average of 19 points during the study. Millennials are born between 1981 and 1996, according to the Pew Research Center, putting them between the ages of 26 and 42 and, therefore, most likely to be paying off higher education loans.

Generation X — born between 1965 and 1980 — had the second-highest increase in the U.S. of 18 points, while the Silent Generation — born between 1928 and 1945 — was last with a 3-point gain.

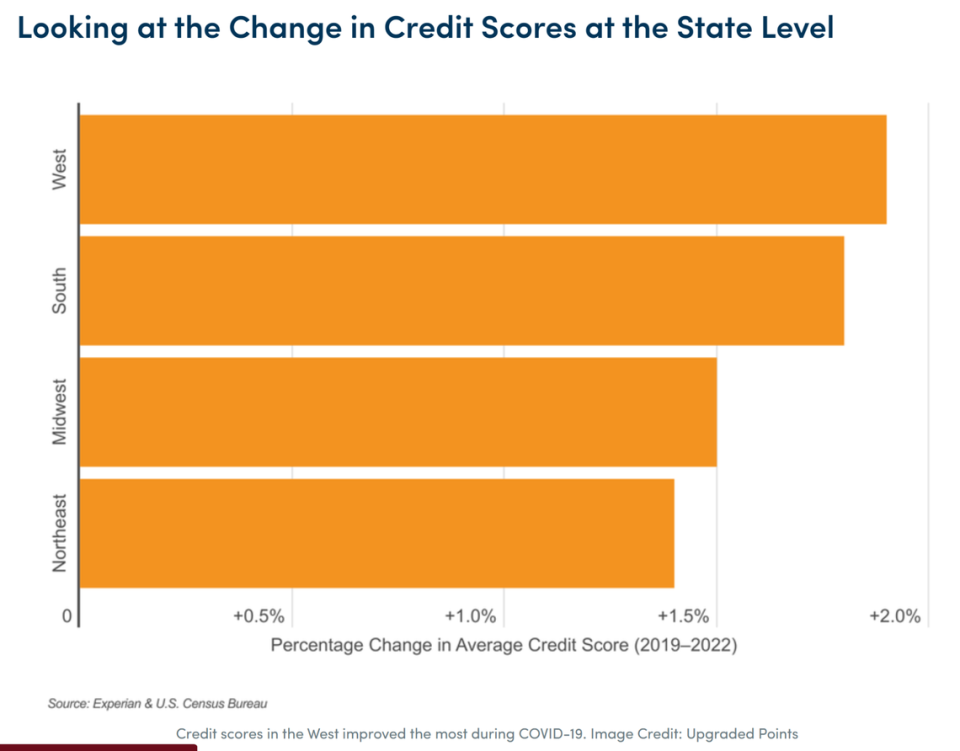

The Upgraded Points study also broke down the credit score increase by geographic location. The west — which includes states that are west of the Rocky Mountains, such as Idaho, Arizona and Oregon — saw the highest increase in credit score at 1.9%. The northeast had the lowest increase at 1.4%.

The study attributes the difference by region to the speed at which pandemic restrictions were lifted — in the west, they tended to be lifted more quickly in comparison to the northeast.

How to increase your credit score

There are multiple ways to improve your credit score, namely methodically paying your bills on time and not carrying a balance on credit cards. When there is a credit card balance before payment, it should ideally not exceed 30% of the credit card limit.

The Idaho Department of Education runs the Next Steps Idaho program, which helps teach incoming college students life lessons, including managing a credit score. According to Next Steps Idaho, in collaboration with CapEd Credit Union, here are the best ways to increase your credit score:

Pay your bills and statement balance in full monthly — those costs aren’t going anywhere.

Start small — your credit score increases on the ability to pay off costs consistently, so apply for one credit card to start and make small purchases you can pay off quickly, such as gas or a cell phone bill.

Use just a small portion of your available credit — a low utilization shows that you don’t rely on your credit card.

Limit new credit by avoiding acquiring numerous credit cards in a short period of time.

Mix things up — have and pay multiple bills, such as a mix of credit cards, utility bills and installment loans.

Avoid carrying a balance and pay off the complete balance before the end of every month. This is easier when paying for smaller gas or grocery bills.

Monitor your credit — Checking your score helps raise it. You can use free sites to find your approximate credit score, such as Experian, or Credit Karma, which also gives you regular reminders and tips to improve your score.

What other states increased credit scores?

According to the Upgraded Points study, here are the other states in which its residents performed exceptionally well in raising their credit scores:

Idaho: 711 to 726 (2.3%)

Alaska: 707 to 723 (2.3%)

Arizona: 696 to 712 (2.3%)

Nevada: 686 to 702 (2.3%)

South Carolina: 681 to 696 (2.2%)

Utah: 716 to 730 (2%)

Oregon: 718 to 732 (1.9%)

Delaware: 701 to 714 (1.9%)

Indiana: 699 to 712 (1.9%)

Florida: 694 to 707 (1.9%)