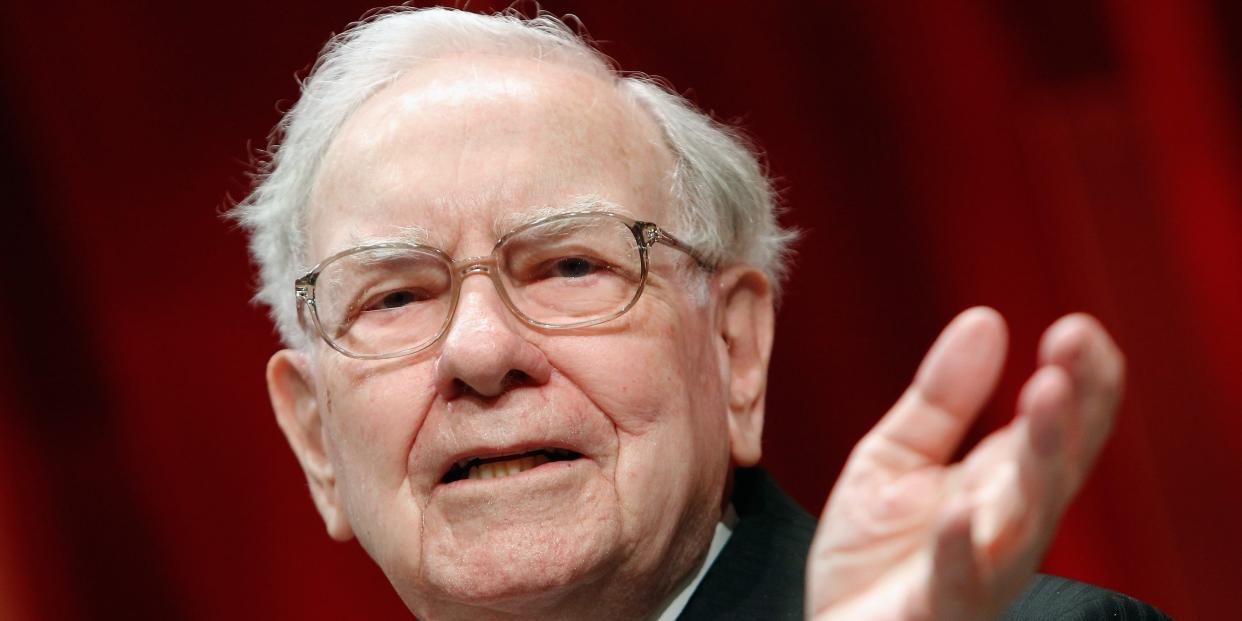

Peter Thiel calls Warren Buffett an enemy of bitcoin — and says the investor's criticism of crypto is weighing on its price

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Peter Thiel singled out Warren Buffett as a major obstacle to bitcoin's wider adoption.

Crypto fans must battle opposition from Buffett and others to supercharge bitcoin's price, he said.

Buffett has called bitcoin "rat poison squared", and dismissed it as a worthless delusion.

Peter Thiel took aim at Warren Buffett during his keynote speech at the Bitcoin 2022 conference in Miami this week, asserting the investor's scathing criticism of the leading cryptocurrency has slowed its wider adoption and weighed on its price.

The billionaire cofounder of PayPal and Palantir labeled the Berkshire Hathaway CEO as "enemy No. 1" for bitcoin fans, and slammed him as a "sociopathic grandpa from Omaha."

Thiel also called out JPMorgan CEO Jamie Dimon and BlackRock CEO Larry Fink as two other members of a "finance gerontocracy" that stands in opposition to the "revolutionary youth movement" behind bitcoin.

"This is what we have to fight for bitcoin to go 10x or 100x from here," said Thiel, who has invested in the coin personally and via his Founders Fund. The price of bitcoin has more than quintupled since the start of 2020, from below $8,000 to around $44,000 today.

Berkshire and Palantir didn't immediately respond to requests for comment. JPMorgan declined to comment. BlackRock pointed Insider to Fink's latest letter to shareholders, in which he wrote: "A global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of money laundering and corruption. Digital currencies can also help bring down costs of cross-border payments."

Thiel targeted Buffett because the investor has been notoriously blunt in his dismissal of bitcoin and other crypto assets.

The Berkshire chief has called bitcoin a worthless delusion and "rat poison squared", compared the crypto boom to the Dutch tulip bubble, and predicted it would end badly. He has also vowed that Berkshire would never own crypto.

It's worth noting that Buffett hasn't criticized the asset class for a couple years now, as he's grown wary of angering its large and passionate following.

Thiel, during his speech this week, accused Buffett and other financiers of bashing the digital coin because they have vested interests in the fiat-currency system. They want to pretend investing is more complicated than buying bitcoin, or their services won't be needed anymore, he said.

The early Facebook investor and proud libertarian argued that institutional investors are making a "deeply political choice" by not holding bitcoin.

Thiel railed against environmental, social, and governance (ESG) criteria, saying they favor "woke companies" and function as a "hate factory" that names and shames businesses. He was likely referring to funds that have refused to own bitcoin due to the environmental costs of mining new coins.

The serial entrepreneur panned Buffett's investing approach as "problematic" and "very fake" in a 2013 documentary. He argued the Berkshire chief's avoidance of technology companies, in favor of owning staid businesses with strong brands and simple products, doesn't foster innovation or push society forward.

"Would you rather invest in a spaceship company that goes to Mars, or would you rather invest in a Mars candy bar?" Thiel asked.

He suggested that Buffett would respond that spaceship companies come and go, whereas people will always want Mars bars, even if humanity relocates to Mars.

"Even if he personally can do it, you can't have a country in which everybody's Warren Buffett," Thiel said.

Read the original article on Business Insider