Pickleball apparel CEO, dubbed sport's 'ultimate ambassador,' accused of Ponzi scheme

As a new game mixing elements of tennis, ping pong and badminton exploded into America's fastest-growing sport, southern Indiana entrepreneur Rodney "Rocket" Grubbs rode the wave to build an apparel and equipment company he launched by selling T-shirts proclaiming "Pickleball Rocks."

The charismatic Brookville man quickly ascended to a role one fan-site described as "pickleball's ultimate ambassador," traveling the world to play in tournaments while promoting the business that shared its name with the slogan he trademarked in 2009.

Pickleball Rocks revenue was projected to top $1 million in 2022, but to meet the goal Grubbs needed capital — and to get it he turned to his well-heeled friends in the sport, pitching a limited number of investment opportunities promising quick and hefty returns. While the total remains unknown, one investor told IndyStar she estimated 120 people from the U.S., Canada and Portugal jumped at the offer, handing over several million dollars to Grubbs in exchange for promissory notes.

But last month, the Indiana Secretary of State's securities division issued a cease and desist order calling the solicitations an "alleged fraudulent investment scheme." The action came amid growing investors' complaints about Grubbs missing repayment deadlines and avoiding their calls and demands. Officials said Grubbs is not registered in Indiana to offer promissory notes.

Now, some of the friends and pickleball associates who eagerly loaned Grubbs money fear their investments have been lost. Some are angry.

"He traveled around and used his good reputation, and also the reputation of others that he surrounded himself with, in order to take advantage of good people,” said Teri Siewert, an investor who lives in Florida. “None of them were stupid. They were doctors. They were lawyers. They were professors. One was a financial consultant. She really feels terrible. That's how trusted he was in the pickleball community."

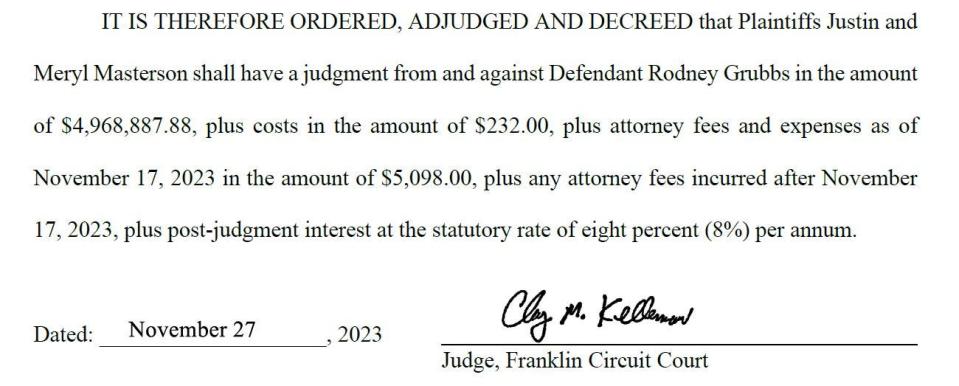

Grubbs already facing more than $9 million in judgments

Grubbs — who has not been charged with any crime or securities violations — could not be reached for comment. He has no attorney of record on file for recent lawsuits. A Brookville telephone number listed for him, and working the day in January the state issued its warning, now appears to be disconnected.

Court records show Grubbs already is facing judgments and penalties of more than $9 million in three investor lawsuits from 2023.

In a separate lawsuit filed in December, several other investors asked a federal judge to force Grubbs into Chapter 7 bankruptcy. The move would require him to sell assets to repay their loans. In a written response to the judge filed Jan. 23, Grubbs said he cannot afford an attorney. He said his only eligible assets are 11 low-income rental properties valued at about $800,000 and an estimated $150,000 in equipment and apparel from Pickleball Rocks.

Grubbs told the judge that will not be nearly enough to satisfy the "no less than 250 outstanding lenders" he would expect to make claims if he files for bankruptcy. Instead, he pleaded for the judge "to consider any option that would allow the petitioners and all future creditors to recoup money with the one asset that had the ability to continue to produce income" — his business.

Grubbs said the name Pickleball Rocks has intellectual property value, even though it "has been greatly diminished" by gossip and what he called "coordinated" social media attacks by investors. But he remains optimistic about its future and offered to "relinquish all ownership/management/profit rights" from Pickleball Rocks to his creditors.

"With a good management team, Pickleball Rocks will continue to grow," he told the judge, citing the "millions of new players coming into the sport ... (who) do not use social media, and will not be impacted by any of the current news."

"Those new players," Grubbs said, "will shop and buy."

Investor on Grubbs: Like talking to an old friend

IndyStar spoke with several of Grubb's investors — retirees living in five different states — who shared similar stories of meeting Grubbs at pickleball tournaments.

They described Grubbs as friendly, outgoing, and credible. He came off slightly religious, they said, and didn't appear to lead a lavish lifestyle. Speaking with Grubbs was like talking to an old friend, said Ron Ponder, a pickleball referee from Oklahoma who invested $65,000 in All About Pickleball LLC, the Indiana corporation registered to do business as Pickleball Rocks.

“He's very well known within the pickleball community. He's the same way with everyone,” Ponder said. “He’s happy to see you, and he can't wait to tell you about stuff.”

Pickleball isn't the only passion Grubbs parlayed into a business. Before he was the "Rocket," Grubbs was a self-proclaimed certified professional consultant, according to his website and the Indiana Secretary of State. Online, the bespectacled businessman, who is in his late 60s, described himself as a life coach, author, speaker and entrepreneur who specializes in marriage, business and financial consulting.

"My vision is to have an army of individuals and married couples worldwide, who as small business owners, are living happy, prosperous lives, and by their example and by their actions will teach others to do the same," his website says.

It all appeared to add up to an image of a man who can be trusted.

Several of the friends Grubbs made through pickleball bought into the image — and his short-term, high-return investment offers. The five investors who talked with IndyStar said they wired a total of roughly $300,000 to Grubbs over the course of several years. They said the money came from their retirement and savings accounts.

At least two investors did get their money back, but many others are still waiting long after the loans came due.

Investors told they were part of a small, select group

The investment pitch Grubbs used is detailed a 19-page complaint from the Indiana Secretary of State. It says he told prospects a $25,000 investment would get the last slot available amongst a small circle of investors. He explained the money would allow Pickleball Rocks to grow or fulfill large, new contracts.

Grubbs guaranteed a 12% interest rate compounded monthly, and a lump sum repayment after 18 months. The promissory note also said investors would receive an increased interest rate of 18% if he defaulted.

Robert Smutka, an investor from Minnesota, told IndyStar that Grubbs routinely rolled over his loan into new contracts instead of paying him when they came due. Smutka agreed to moving his money into new promissory notes, not wanting to hurt the company.

A recent widower who invested money from his retirement account, Smutka said he's not comfortable with publicly disclosing how much he gave Grubbs.

Buying into the pitch

Teri and Scott Siewert believed they made a good investment with the man they thought they knew well.

Ardent pickleball players, Scott had shared a court with Grubbs, playing as both a partner and an opponent. They crossed paths at many tournaments. Grubbs spent a year soliciting the couple to invest in Pickleball Rocks, Teri said. They initially held off.

But when Grubbs told them he'd landed a contract to sell apparel and that an opportunity to invest remained available, they reconsidered. In early 2019, the White Springs, Florida, couple transferred $25,000 from their bank account to Grubbs.

“He said that he had six $25,000 investment slots that would buy him $150,000 worth of apparel so he could meet the needs of this big contract,” Teri said. Another investor was cashing out, creating an opening for them.

When the couple agreed to the 18-month loan, they offered to accept a lower interest rate to help Grubb expand his business. Teri said Grubbs declined, saying his business model would support a higher interest rate.

Like many others who invested with Grubbs, they agreed to keep the loan confidential. But when it came due in September of 2020, the Siewerts asked for their money to help buy a new home. Grubbs said he couldn’t repay them, they claim.

Grubbs also didn’t pay the following year — or in 2022 and 2023. Teri said they requested payment numerous times, and even tried to renegotiate with Grubbs. Teri had her daughter, an attorney, send a demand letter offering to settle the debt for $30,000 — far less than the more than $50,000 owed to them in principal and interest. She got the idea after a friend told her about a Texas couple that made a similar offer and got their money back from Grubbs.

He still didn't come up with the money. So when Teri saw that Grubbs and his wife, Karen, had two vendor booths at a 1,000-plus person pickleball tournament outside Dayton last year, it took everything in her not to confront him immediately. She stressed about it the first day. On the second day, she sat and dwelled on the situation — that was until she turned and saw an acquaintance about five courts down.

"It was like a magnet just drew me to her," Teri said. So she asked the acquaintance if anyone in the pickleball industry had ever approached her about a loan.

"Her eyes got big and she goes, 'Rocket! You too?'" Teri recalled. "I said yes and we were just like hugging each other — like 'Oh my God, I'm so sorry, so sorry.' I just felt like I'm not alone."

'The phone didn't stop ringing'

Something else happened at the tournament in Dayton. Teri Siewert said she confronted Grubbs after overhearing him make an investment pitch to another woman.

"I had just caught him soliciting somebody (and) stepped in between him and the lady and said to her, ‘Please don't do it. We've been trying to get our money for three years,’ and he starts laughing out loud behind me," she said.

Grubbs continued to ignore the couple's demand to return their money. Finally, in early December, they went public with their complaints. They posted about their experience on Facebook, internet forums and sent their stories to pickleball clubs.

"I was seeking other investors to see if what I suspected was true and to see just how deep and wide this might go," Teri said." The phone didn't stop ringing."

By the end of the weekend, she had more than 20 names. She also learned about the lawsuits filed against Grubbs in Indiana and reached out to Matthew Foster, an Indianapolis attorney representing investors in those cases.

Not long after that, something unexpected happened: "Rodney pays us $56,000," Teri said, "to make us shut up and go away."

By that point, she wasn't ready to go away or shut up. Instead, she encouraged other unhappy investors to speak up about Grubbs. Rick Griffith of North Carolina was one of the people who saw one of Siewert's online posts. At first, he thought it was odd — then his eyes scanned it and saw the names Rodney Grubbs and Pickleball Rocks.

“Shit! I’m in this too,” he said, realizing for the first time there were other investors.

“Most of us thought we were alone. You know, we took this last spot, or, replaced somebody,” Griffith said. “There’s a lot of people out there.”

Griffith had met Grubbs like everyone else. He'd purchased a Pickleball Rocks shirt at a Myrtle Beach tournament in 2021 and the next year saw Grubbs in Hilton Head. Griffith said Grubbs spotted his shirt. They chatted, and Grubbs gave him trinkets.

Griffith was playing in the diamond championships in Daytona Beach, Florida, in 2022 when he saw the Pickleball Rocks booth and struck up a conversation. “He mentioned a $50,000 investment, and I said 'well I'm definitely not interested. It's too much,'” Griffith recalled.

So Grubbs offered to cut the buy-in to $25,000. They traded messages for several weeks until Griffith felt confident about the deal. On Jan. 26, 2023, he wired $25,000 to Grubbs. The loan comes due July 26. He had planned to roll it over and just take interest, but now he’s worried he won’t get paid at all.

“Everything's kind of gone to the toilet,” said Griffith.

'There was more risk than normal'

About 18 months ago Ron Ponder, the pickleball referee from Oklahoma, got a text message out of the blue. Grubbs wrote he was expanding the Pickleball Rocks brand to include nets, balls and paddles. The company had also made a major hire, bringing in a former Reebok executive.

Grubbs said the changes would allow Pickleball Rocks to target schools and colleges, but he needed operating funds and pitched Ponder the opportunity to invest $25,000 for 18 months, earning 12% each month on his investment.

“On my other money, I was making 8% anyway so it wasn't, you know, crazy. It wasn't, 'Hey, I'm gonna pay you 30%.' It was better than normal, but there was more risk than normal,” Ponder said.

“I had the money lying around so I said 'yeah I can do that' because it was a good brand. Rodney's in charge of it. What could go wrong?”

Ponder wired Grubbs $25,000.

About six months later, Grubbs was back with another offer. He had a small group of investors and one slot was available. The terms remained the same. Ponder wired another $25,000. A few months later Grubbs made a third offer to Ponder. He said Grubbs told him about a lucrative opportunity to buy nets that he could quickly sell. He only needed $15,000 for four months.

Ponder sent the money using Venmo and PayPal. By then, though, he'd started to wonder about his money.

“I'm like, ‘Wow, I've got $65,000 with this guy,' and I trust him because it's Rodney," he recalled thinking, "but on the other hand, I really don't know that much about him.”

When his first loan came due, Ponder didn’t hear from Grubbs. He gave it a week and reached out. Ponder told IndyStar Grubbs asked for more time and said he’d pay the money back at Christmas. A week later, Ponder saw the Siewerts' post on Facebook.

“I went straight from suspicious to pissed off,” Ponder said, adding that Grubbs dismissed the Siewerts as an angry couple. Then Ponder learned about the lawsuits and the other jilted investors.

“Losing that won't affect me. I won’t notice that it’s gone, but he’s got people's life savings,” Ponder said. “Someone said to me 'You're a fool.' No, I'm not a fool. I trusted a friend. I trusted someone who I like, and so that's not on me. That's on him.”

Contact IndyStar investigative reporter Alexandria Burris at aburris@gannett.com. Follow her on X, formerly Twitter, at @allyburris.

This article originally appeared on Indianapolis Star: Investors fear Indiana-based pickleball apparel CEO ran Ponzi scheme