Pinterest, Inc. (NYSE:PINS) is in the Green on Cash Flows and Profit - Here is how we Value the Company

This article was originally published on Simply Wall St News

Pinterest, Inc. (NYSE:PINS), is a testament to how hard it is for investors to enter a stock when it is in a downward trend. For Pinterest, the fundamentals paint a very profitable future at an acceptable price, which is what we will explore in this article.

Pinterest is a platform that connects customers to online merchants. The company has been rapidly improving its business model and service, which is why many investors may not be up-to-date on the functioning of the platform. We encourage investors to visit www.pinterest.com in order to evaluate the service, and experience the improvements in search relevancy and connection to merchants.

Pinterest has 444m monthly active users, and brought US$633m in revenue for Q3 2021. The platform seems to be stagnating in user growth, but is increasing in both revenues and earnings quality. Management seems to be shifting the focus from raw user acquisition to monetization, and we expect to see increased profitability in the near future. In fact, the current profit margin is 14.3%, but the free cash flows indicate that profitability is understated.

Check out our latest analysis for Pinterest

Looking at the value of the company, it seems that the market capitalization has dropped to US$18.6b, and our intrinsic value model estimates the value of the future cash flows to be worth US$45.8b or US$70 per share, which is a whopping 59% difference from market cap to fair value.

Click HERE to see the intrinsic value model for Pinterest.

Future Estimates

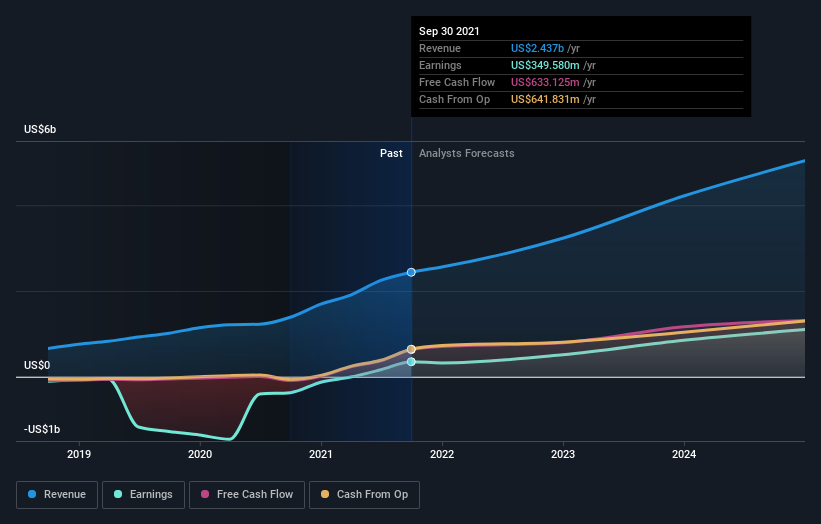

While looking at the fundamentals, it is sometimes better to look at their trailing twelve-month trend, in order to get a better feeling for the direction of the company. Conversely, earnings may not always denote the true financial position of the company, which is why we also look at the free cash flows. In a company where the earnings differ from the cash flows, we tend to use the cash flows as a better representation of profitability.

In the chart below, we can see both the historical financials, and the average future estimates from analysts. This helps us better understand the future trends of the company.

Taking into account the latest results, the most recent consensus for Pinterest from 28 analysts is for revenues of US$3.23b in 2022 which, if met, would be a major 33% increase on its sales over the past 12 months. Per-share earnings are expected to surge 41% to US$0.76.

The analysts reconfirmed their price target of US$50.57, showing that the business is executing well and in line with expectations. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Pinterest, with the most bullish analyst valuing it at US$83.00 and the most bearish at US$22.00 per share. Such a wide range in price targets is common among young growth companies. The cash flows are always hard to predict, but it seems that Pinterest is validating its business model, which gives investors confidence on the upside in the company.

Another way to look at these forecasts is to place them into context against historical growth and the industry itself.

As the company grows, it becomes clear that there is an expectation that revenue growth will slow down, with revenues to the end of 2022 expected to display 25% growth on an annualized basis, which is less than the historical growth rate of 42% over the past three years. On the other hand, companies in this industry with analyst coverage are forecast to grow their revenue at 14% annually. So it's pretty clear that, while Pinterest's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

Pinterest is a rising company which started demonstrating the first signs of profitability for investors. This gives us a better idea for the earnings power of the company and makes it easier to valuate the free cash flows.

While investors are struggling with the current macroeconomic landscape, it might be worth diving deeper into Pinterest, as it can be a future high margin business which is trading at a relatively low price.

That said, it's still necessary to consider the ever-present spectrum of investment risk. We've identified 3 warning signs with Pinterest , and understanding them should be part of your investment process.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.