Pinterest IPO: 4 Key Points From the Company's Financials

At the end of last week, Pinterest filed its S-1 form with the Securities and Exchange Commission, providing financial documentation needed to initiate the selling of company shares on a publicly traded market. Pinterest, which describes itself as a "visual discovery" company, allows users to find everything from recipes to home decor ideas to fashion images.

The company hasn't disclosed what it will price its shares at or how much it wants to raise from the offering, but did say that its shares will be listed on the New York Stock Exchange with the ticker PINS. The latest estimates, based on Pinterest's multiple rounds of funding, put the company's valuation at around $12 billion.

Pinterest had previously been targeting an IPO date for later in 2019, but the S-1 filing means that the company has likely pushed up that timeline significantly. For investors considering buying shares when the stock does trade, here are four key facts the company highlighted in its S-1 disclosure.

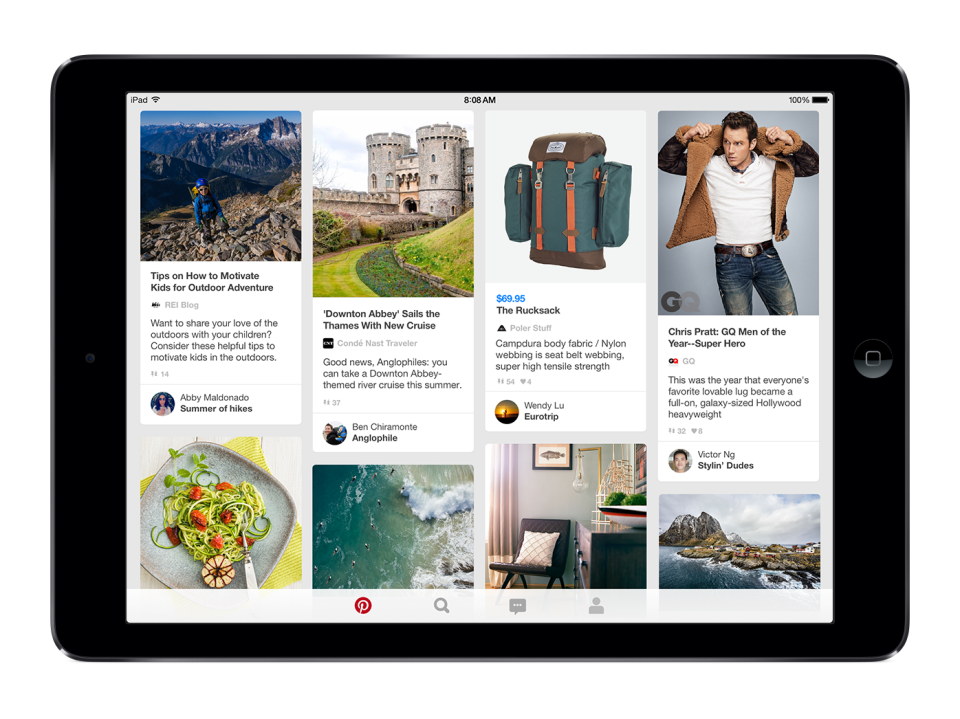

Image source: Pinterest.

1. Sales reached $756 million in 2018

At the end of last year, the company generated $756 million in sales, an increase of 60% from 2017. And from 2017 to 2018, the company's revenues increased by 58%. That's not meteoric growth, and it's certainly not the percentage growth that many investors expect from companies that are about to go public.

Investors should take a look at how Pinterest is growing its revenue per user as well. The company's global average revenue per user reached $3.14 in 2018, a 25% jump from the previous year. And in the U.S., the average revenue per user was $9.04 last year, up 47% year over year. When the U.S. revenue per user is backed out of the global figure, international revenue per user was $0.25 last year, up 22% year over year.

The company wrote in its filing that, "Due to our decision to focus our earliest monetization efforts in the United States, we have less experience monetizing international markets and therefore may experience challenges scaling and monetizing these markets due to differences in Pinners' taste and interests and advertisers' expectations."

That doesn't mean the international market won't be a huge growth area for Pinterest, but only that investors should expect that building out its international sales won't be as easy as bringing in ad sales in the U.S.

2. Losses narrowed to $63 million last year

Pinterest isn't profitable, but has made huge progress toward that goal. At the end of 2018, the company lost about $63 million, which is far less than the $130 million loss at the end of 2017.

The increase in sales from 2017 to 2018 certainly helped the company close the gap between sales and profitability, and it's worth pointing out that Pinterest managed to narrow its losses even as the company's costs of revenue increased.

In 2017, Pinterest's costs of revenue -- expenses for things like its web hosting services, mobile app costs, salaries, etc. -- was $178.6 million. Those costs increased to $241.5 million in 2018, but because Pinterest also increased its sales in 2018, those rising costs of revenue didn't cause the company to post a larger year-over-year loss.

The company acknowledged in its S-1 that, "We are in the early stages of our monetization efforts." All of which means that, as the company goes public, investors should keep a close on eye on whether or not Pinterest continues to narrow its losses.

3. Pinterest has 265 million monthly active users

Pinterest ended 2018 with 265 million monthly active users (MAUs) in the fourth quarter. The company measures a MAU as a logged-in Pinterest user who visits the company's website or opens its mobile app at least once during the month.

The company says two-thirds of its users are women and its total audience includes 43% of internet users. The S-1 noted that eight out of 10 women ages 18 to 64 who have children are on its platform, and that more than half of U.S. millennials use its service.

Pinterest talks a lot about its female users and their influence in making money decisions in their households. The company calls these users "deciders" and says that its core female users "are often the primary decision makers when it comes to buying products and services for their household ..." That's important for the company to point out as it tries to woo more advertisers to its platform.

Investors should know that, at the end of 2018, Pinterest's largest group of MAUs came from outside the U.S., with about 184 million (compared with 82 million in the U.S.). As noted earlier, U.S. users generate far more revenue for the company. But Pinterest is likely to focus an increasing amount of attention on monetizing international users, considering how large of a percentage of total users they make up.

Image source: Pinterest.

4. Risks the company faces

Pinterest highlighted a few key risk factors facing the company, including "significant competition" from internet and social media companies. While the company doesn't consider itself a social media platform, it knows that it's fighting Facebook, Instagram, Twitter, Snap, and others for advertising dollars.

In its S-1 filing, the company wrote: "We primarily compete with consumer internet companies that are either tools (search, e-commerce) or media (newsfeeds, video, social networks). We also compete for advertising revenue across a variety of formats. Some of our competitors have greater financial resources and substantially larger user bases."

Compared with Facebook and Twitter, Pinterest is a much smaller player. Facebook boasts 2.3 billion monthly active users, while Twitter has 321 million. For that reason, the company tries to focus investors' attention on how it's a better advertising company than its competitors. Pinterest mentioned that independent research from Cowen and Company found that "more people use Pinterest to find or shop for products than on social networks."

Aside from convincing advertisers to sell on its platform instead of with its competitors, Pinterest also said that some of its user growth was "negatively impacted" in mid-2018 after Facebook changed its log-in authentification system, which some on Pinterest use to access the platform.

Another risk factor comes from trying to expand its international sales. The company said in its filing that, "We plan to enter new international markets where we have limited or no experience in deploying our service or selling advertisements."

That could be particularly problematic for Pinterest as it tries to appeal to international users and their specific online content needs -- and then tries to convince advertisers that it can reach relevant buyers. The company said that to expand successfully in the international market, it will require "significant investment of time and resources."

Lastly, another risk factor for the company comes from Alphabet's Google and its massive influence over the internet. Pinterest said that it had seen declines in its traffic and user growth as a result of changes to Google's search algorithms. "For example, in the first quarter of 2018, Google de-indexed our keyword landing pages, which negatively impacted traffic and user growth in the quarters that followed," the company said in its filing. Pinterest admitted that it has "limited" ability to appeal any changes and that it may not be able to revise its search engine optimization strategy to bounce back from future changes.

Keep this in mind before buying Pinterest shares

As with any company that's just going public, there are both huge opportunities for growth and substantial risks. Those wondering whether or not Pinterest is a good investment should consider all the above, and factor in that most IPOs tend to underperform the market for several years.

Pinterest is doing a good job stemming its losses and generating solid revenue growth, but it's generally a wise move to wait for at least several quarters of earnings reports to be released as a publicly traded company before investors buy shares of a stock. This gives an even better picture of the company's financials and user growth, and helps avoid any emotional hype that can be drummed up during an IPO.

Pinterest could prove to be a significant long-term investment. But keep in mind that in order to benefit, it's not necessary to buy shares right when the company goes public.

More From The Motley Fool

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. Chris Neiger has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Facebook, and Twitter. The Motley Fool has a disclosure policy.