Pinterest Options Popping on Pre-Earnings Analyst Note

Pinterest Inc (NYSE:PINS) will report third-quarter earnings next Thursday, Oct. 31. Ahead of the event, PINS stock got a boost of confidence from RBC, which upgraded the equity to "outperform" from "sector perform." The analyst also hiked its price target on the shares to $35 from $30, representing expected upside of more than 38% from Friday's close of $25.31. The brokerage firm waxed optimistic on Pinterest's new ad strategies and monetization opportunities, and said its analysis shows "performance improving" after lockup periods expire, looking at data on tech initial public offerings (IPOs) since 2017. As such, PINS options volume is popping today.

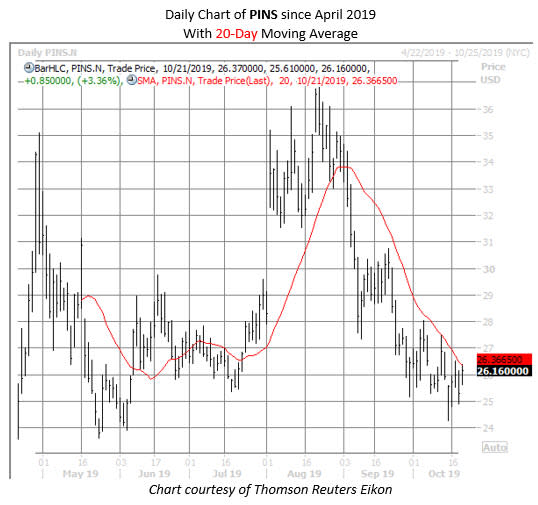

Pinterest stock is up 3.4% at $26.16, at last check, but upside has been limited around its 20-day moving average. This trendline hasn't been toppled on a daily closing basis since late August, just after PINS stock touched an all-time high of $36.83 -- nearly double its IPO price of $19. Since that peak, the equity has dropped close to 30%, but found support in the $25 area -- around its Day One close.

The shares enjoyed a major bull gap after the e-commerce concern's early August earnings report, jumping 18.6% in one day. The firm has reported just two quarterly earnings since going public, dropping 13.5% after its debut report in mid-May. This time around, the options market is pricing in a 16.2% swing for PINS shares, regardless of direction -- in line with the stock's average one-day post-earnings move.

As alluded to earlier, today's upbeat analyst attention has triggered unusually high options volume on Pinterest. Specifically, about 7,200 calls and 4,900 puts have changed hands -- double the average intraday volume. Most active is the November 24 put, where nearly 1,900 contracts have crossed the tape -- primarily in a single block around the ask price. Assuming the puts were bought to open, the trader is betting on -- or hedging against -- a decline south of $24 before the options expire on Friday, Nov. 15. Currently, PINS' all-time low stands at $23.05.

Bulls, meanwhile, are circling the weekly 11/1 26-strike call -- the second-most active option today. Buyers of the calls expect PINS to climb back atop the $26 level before the close on Friday, Nov. 1, when the options expire -- just one day after Pinterest reports earnings.

Elsewhere, short sellers have been circling the security since its recent decline. During the past two reporting periods, short interest grew 21.4%, and now represents a hefty 20.6% of PINS' total available float. Should the company once again top earnings expectations next week, a short squeeze could help fuel a rebound.