The Plastiques du Val de Loire (EPA:PVL) Share Price Is Up 87% And Shareholders Are Holding On

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Plastiques du Val de Loire share price has climbed 87% in five years, easily topping the market return of 47% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 3.8% in the last year , including dividends .

Check out our latest analysis for Plastiques du Val de Loire

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

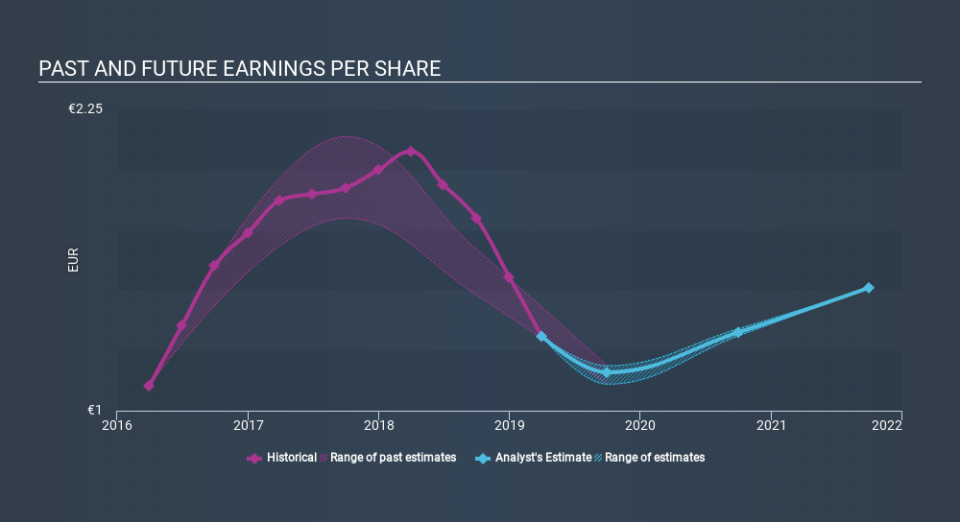

During five years of share price growth, Plastiques du Val de Loire achieved compound earnings per share (EPS) growth of 31% per year. This EPS growth is higher than the 13% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. This cautious sentiment is reflected in its (fairly low) P/E ratio of 6.21.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Plastiques du Val de Loire's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Plastiques du Val de Loire the TSR over the last 5 years was 106%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Plastiques du Val de Loire provided a TSR of 3.8% over the last twelve months. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 16% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. Before forming an opinion on Plastiques du Val de Loire you might want to consider these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.